Dollar has been a major market mover over the last 6 months

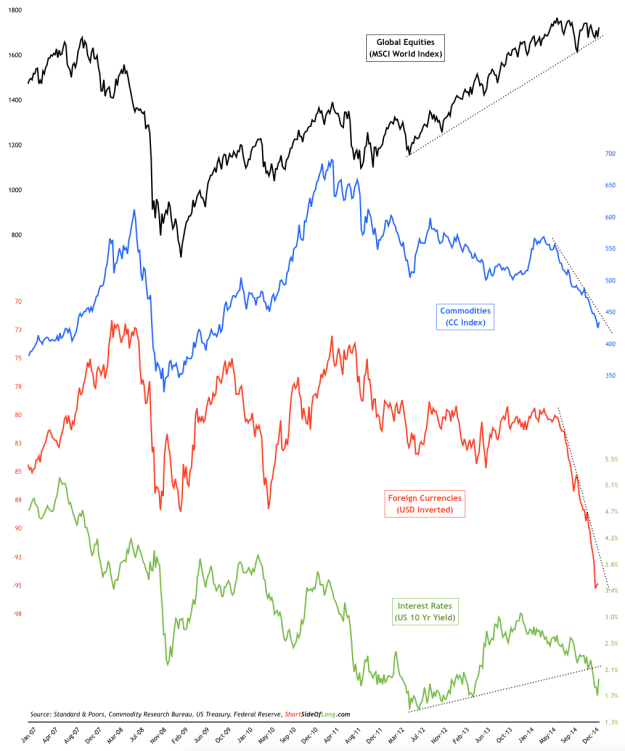

The chart above shows the performance of major asset classes since January 2007 (prior to the Global Financial Crisis). All assets are priced in US Dollars and include the global stock market index, equal weighted commodity index, US Dollar index and the U.S.10-Year interest rate note yield.

Let us remember that the US equity market holds the largest weighting in the MSCI World Index, so due to its strong outperformance, the overall global index is giving an appearance of a consolidation. But the truth is, European and Emerging Market stocks have been under strong selling pressure in recent months, holding a lot of similarities to the commodity sell off.

US equities and bonds have outperformed all other major assets

Really, it is only the US assets that continue to push towards 52 week highs. US bonds and the US Dollar have also been gifting investors above average returns. In recent weeks, US interest rates have approached levels not since since the eurozone Crisis in middle of 2012 (bonds have rallied), while the US Dollar Index is trading at levels not seen since 2003.

Now, I understand that most investors don't play commodities due to the contango effect and usually don't invest (but only trade) currencies as returns tend to be small, unless major leverage is applied. Therefore, if we focus on the global macro asset classes by tracking the total return of the most popular ETFs, we still come to the same conclusion, that by and large US assets are outperforming the rest of the world.

The question now is... how long does this outperformance last? The basic answer is, as long as the Dollar keeps rallying, similar to the period between mid 1990s and into early 2000s. Federal Reserve seems determined to rise rates from the zero bound level.