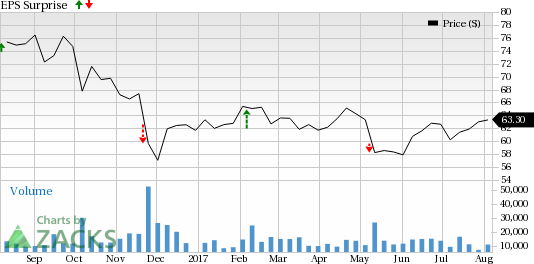

Tyson Foods, Inc. (NYSE:TSN) came out with third-quarter fiscal 2017 results, wherein adjusted earnings of $1.28 per share came a penny ahead of the Zacks Consensus Estimate, and increased 6% year-over-year.

The company now expects adjusted earnings for fiscal 2017 in a range of $4.95-$5.05 per share, reflecting a 13% growth year-over-year.

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2017 has trended upward over the past 30 days. Further, if we look at Tyson’s performance in the trailing four quarters (excluding the quarter under review), the company has outperformed the Zacks Consensus Estimate by an average of 2.8%.

Revenues: Tyson generated net sales of $9,850 million that advanced 4.8% year over year and also topped the Zacks Consensus Estimate of $9,479 million. Sales were driven by volume growth in each segment. Further, performance at the Beef and Pork segments remained particularly strong in the quarter. The company expects fiscal 2017 sales to be more than $38 billion, on the back of higher sales volume at each segment.

Key Events: Tyson Foods concluded the buyout of AdvancePierre in June, and is well on track with its integration. Based on the solid progress with the integration, management expects cumulative net synergies to exceed $200 million within three years.

Zacks Rank: Currently, Tyson carries a Zacks Rank #3 (Hold) which is subject to change following the just released earnings results.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Check back later for our full write up on Tyson Foods’ earnings report!

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Original post