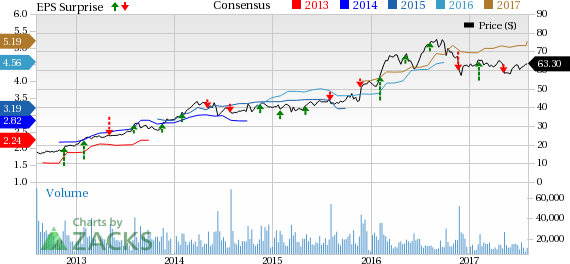

Tyson Foods, Inc. (NYSE:TSN) posted better-than-expected third-quarter fiscal 2017 results, wherein both earnings and sales surpassed the Zacks Consensus Estimate. The company reported adjusted earnings of $1.28 per share that came a penny ahead of the estimate and increased 6% year over year. The results mainly benefitted from the strong performance of its segments, primarily Beef and Chicken.

Following the results, Tyson Foods’ shares were up roughly 3% during pre-market trading hours. We note that in the past three months, the stock improved 6.4% compared with the industry’s growth of 3.8%. Notably, the industry is part of the top 4% of the Zacks Classified industries (10 out of the 256). The broader Consumer Staples sector is placed at the top 13% of the Zacks Classified sectors (2 out of 16).

Revenues and Margins

Net sales increased 4.8% to $9.85 billion primarily due to improvement across all its food segments and beat the Zacks Consensus Estimate of $9.48 billion. Sales volume increased 0.5%, while average sales price (ASP) inched up 4.2%.

Tyson Foods' adjusted operating income declined 1.4% to $756 million due to higher operating costs. Adjusted operating margin contracted 50 basis points (bps) to 7.7%.

Segment Details

Chicken: Sales for the segment came in at $2.9 billion. Sales volume increased 1.6% year over year owing to higher demand for chicken products. Average sales price for the quarter increased 2.9% due to change in sales mix. However, adjusted operating margin declined 350 bps to 10.4% due to higher operating costs.

Beef: Sales for the segment came in at $4 billion. Sales volume rose 0.4% year over year, owing to robust domestic demand for beef products, improved availability of cattle supply and higher exports.These factors positively impacted the average sales price, which increased 5.3%. Adjusted operating margin expanded 130 basis points to 3.7% on the back of favorable market conditions.

Pork: Sales for the segment came in at $1.3 billion. The segment’s sales volume grew 0.6% year over year driven by enhanced exports as well as strurdy demand for pork products. Average sales price increased 3.3%, while adjusted operating margin increased 70 bps to 10.3%, gaining from live hog markets.

Prepared Foods: Sales for the segment came in at $1.9 billion. Prepared Foods’ sales volume grew 2.4% due to incremental volumes arising from the buyout of AdvancePierre. These were partly offset by fall in food service. Average sales price was up 4.9% due to favorable product mix arising from the acquisition of AdvancePierre. Adjusted operating margin contracted 90 bps to 10% due to higher operating costs.

Other: Sales for the segment came in at $85 million, while volume declined 11.9%. The segment incurred operating loss of $20 million compared with the loss of $23 million in the year-ago period.

Other Financial Update

Tyson Foods, which carries a Zacks Rank #3 (Hold), ended the quarter with a cash and cash equivalent of $231 million, long-term debt of $9.8 billion and shareholders’ equity of $10.1 billion. Further, management projects capital expenditures to be approximately $1 billion for fiscal 2017.

Guidance

For fiscal 2017, Tyson anticipates sales to be over $38 billion, as the company is hopeful regarding improving volumes across all its segments. For Fiscal 2018, it anticipates sales to increase to $41 billion. Tyson Foods envisions fiscal 2017 earnings in the range of $4.95-$5.05 per share, reflecting an increase of 13% year over year. The Zacks Consensus Estimate for the fiscal year is currently pegged at $5.19.

For fiscal 2018, USDA expects overall domestic protein production (chicken, beef, pork and turkey) to increase roughly 3-4% year over year. The company expects to realize synergies of over $200 million by fiscal 2020 from the recent buyout of AdvancePierre (acquisition completed on Jun 7).

Do Consumer Staples Stocks Interest You? Check These

Investors may consider better-ranked stocks from the same sector such as Inter Parfums, Inc. (NASDAQ:IPAR) , Nu Skin Enterprises, Inc. (NYSE:NUS) and Constellation Brands, Inc. (NYSE:STZ) all carrying a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inter Parfums has an average positive earnings surprise of 15.6% over the past four quarters. It has a long-term earnings growth rate of 12.3%.

Nu Skin has an average positive earnings surprise of 10.8% % over the past four quarters. It has a long-term earnings growth rate of 8.7%.

Constellation Brands has an average positive earnings surprise of 11.7% over the past four quarters. It has a long-term earnings growth rate of 18.2%.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Constellation Brands Inc (STZ): Free Stock Analysis Report

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS): Free Stock Analysis Report

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Original post

Zacks Investment Research