Tyson Foods, Inc. (NYSE:TSN) posted fourth-quarter fiscal 2016 results, wherein both earnings and revenues missed the Zacks Consensus Estimate.

In fiscal fourth-quarter, adjusted earnings of 96 cents per share missed the Zacks Consensus Estimate of $1.24 by 22.6% but improved 16% from the year-ago tally of 83 cents on higher margins.

Revenues and Margins

Net sales slipped 6.1% to $9.156 billion due to lower sales across most of the segments like chicken, beef, pork and prepared foods. Sales missed our expectation of $9.31 billion by 1.6%. Sales volume dipped 8.2%, while average sales price (ASP) went down 5.1%.

Tyson's adjusted operating income gained 3.2% to $586 million due to lower feed costs. Adjusted operating margin inflated 60 basis points (bps) to 6.4%.

Segment Details

Chicken: Sales at this segment remained almost flat year over year at $2.811 billion as a 3.2% dip in sales volume was offset by a 3.5% gain in average price. Sales volume declined due to the company’s strategy of optimizing its mix. Average sales price increased in third-quarter on positive mix.

Beef: Sales at this segment declined 15.1% year over year to $3.477 billion, due to 0.3% dip in sales volume along with a 14.9% decrease in ASP. ASP declined due to higher domestic availability of fed cattle supplies, while sales volume was hurt by reduction in live cattle processed.

Pork: Pork segment sales were up 1.4% year over year to $1.235 billion driven by a 0.4% increase in sales volume and a 1% rise in average price.

Prepared Foods: Sales at Prepared Foods slipped 1.5% year over year at $1.837 billion as 2.6% gain in volume was offset by 3.9% decline in ASP. Adjusted sales volume grew on higher demand.

Other: In the fiscal first quarter, the company’s International segment was shifted under ‘Other’ following the sale of Mexico and Brazil chicken operations in fiscal 2015. The Other segment also includes the foreign operations related to raising and processing live chickens in China and India as well as a third-party merger and integration costs.

Sales decreased to $96 million from $111 million in the year-ago quarter.

Fiscal Results

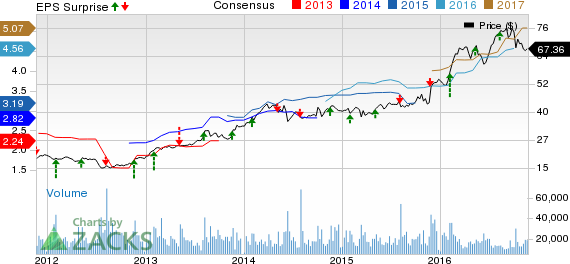

In fiscal 2016, adjusted earnings of $4.39 per share missed the Zacks Consensus Estimate of $4.66 and improved 39% from the year-ago tally of $3.15 on higher margins.

Net sales slipped 10.85% to $36.881 billion and missed our expectation of $37.05 billion.

Fiscal 2017 Guidance

The company issued fiscal 2017 guidance in concurrence with the earnings call. The company anticipates earnings to remain in the range of $4.7 to $4.85, up 7% to 10% year over year.

Zacks Rank

Tyson carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader consumer staple sector include Sanderson Farms Inc. (NASDAQ:SAFM) , Hormel Foods Corp. (NYSE:HRL) and Sysco Corp. (NYSE:SYY) .

Sanderson Farms sports a Zacks Rank #1 (Strong Buy) and has an expected earnings growth rate of 5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hormel Foods carries a Zacks Rank #2 (Buy) and has an expected earnings growth rate of 9.6%.

Sysco also carries a Zacks Rank #2 and has an expected long-term earnings growth rate of 8.76%.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks' private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access. Click here for Zacks' private trades >>

SYSCO CORP (SYY): Free Stock Analysis Report

TYSON FOODS A (TSN): Free Stock Analysis Report

HORMEL FOODS CP (HRL): Free Stock Analysis Report

SANDERSON FARMS (SAFM): Free Stock Analysis Report

Original post

Zacks Investment Research