Tyson Foods, Inc. (NYSE:TSN) posted weaker-than-expected second-quarter fiscal 2017 results, wherein both earnings and sales missed the Zacks Consensus Estimate. Despite strong chicken demand, results were hurt as a fire at two of its plants in the said period disrupted production.

In the second quarter, adjusted earnings of $1.01 per share missed the Zacks Consensus Estimate of $1.06 by 4.7% and declined 5.6% year over year from $1.07 per share due to lower sales volume and margin contraction.

Revenues and Margins

Net sales dipped 0.9% to $9.08 billion mainly due to declines in Beef and Prepared Foods segments. Sales also marginally missed estimates of $9.10 billion by 0.2%. Sales volume decreased 1.9%, while average sales price (ASP) inched up 0.9%.

Tyson's adjusted operating income declined 11.5% to $623 million due to lower sales and higher operating costs. Adjusted operating margin contracted 80 basis points (bps) to 6.9%.

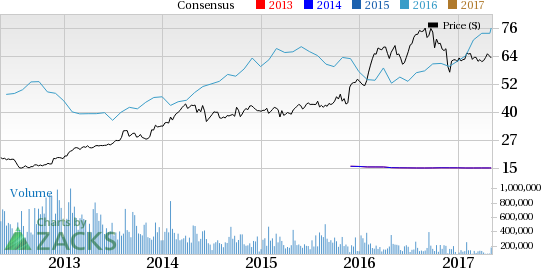

We note that Tyson Foods’ stock declined 8.9% in the past six months,wider than the Food-Meat Products industry’s decline of 1.8%. Notably, the industry is part of the top 5% of the Zacks Classified industries (12 out of the 265). The broader Consumer Staples sector is placed at bottom 19% of the Zacks Classified sectors (13 out of 16).

Segment Details

Chicken: Sales in this segment increased 2.2% year over year to $2.8 billion, as 2.0% decline in sales volume was offset by 4.3% higher pricing. Volume declined due to loss from fire at two of its plants, partially offset by higher demand for chicken products. On the other hand, sales price increased driven by favorable sales mix.

Operating income margin declined 440 bps to 8.3%, due to higher operating costs, which decreased $130 million during the quarter.

Beef: Sales in this segment declined 4.2% year over year to $3.5 billion, as both pricing and volume declined 3.1% and 1.1%, respectively. ASP declined due to higher domestic availability of fed cattle supplies and lower livestock costs, while sales volume was hurt by reduction in live cattle processed. However, operating margin expanded 230 basis points to 3.6% on the back of favorable market conditions.

Pork: Pork segment sales grew 9.4% year over year to $1.3 billion driven by 10.9% increase in pricing, offset by 1.3% decline in volumes. Average sales price increased as domestic availability of products decreased due to strong exports. However, volume declined as a result of change in customer demand, partially offset by increased exports. Adjusted operating margin, however, decreased 100 bps to 10.8%.

Prepared Foods: Prepared Foods’ sales declined 2.9% to $1.8 billion due to decline in both volumes and pricing of 2.1% and 0.8%, respectively. Lower sales volumes and lower ASP were attributed to decline in foodservices.

Adjusted operating margin contracted 300 bps to 7.9% due to higher operating costs at some of its facilities as well as increased marketing, advertising and promotion spending.

Other: Sales declined 4.7% to $82 million, as the 7.8% plunge in pricing overshadowed the volume growth of 3%.

Other Financial Update

Tyson exited the quarter with a cash and cash equivalent of $243 million, long-term debt of $5.9 billion and shareholders’ equity of $9.8 billion. During the quarter, the company repurchased 2.1 million shares for $133 million.

During the quarter, the company entered into a merger agreement to acquire all the outstanding shares of AdvancePierre Foods Holdings for approximately $3.2 billion, and assumed $1.1 billion of AdvancePierre's gross debt. The transaction is expected to close during third-quarter fiscal 2017.

The company also announced its intention to sell three non-protein businesses, Sara Lee Frozen Bakery, Kettle and Van’s, which are all a part of its Prepared Foods segment, as part of its strategic focus on protein-packed brands. The projected sales of these businesses total approximately $650 million for fiscal 2017.

Fiscal 2017 Guidance

For fiscal 2017, Tyson anticipates sales (excluding acquisition and sale of businesses) to be flat compared to fiscal 2016 as the company expects to grow sales volume across each segment, offset by the impact of lower beef prices.

The company expects overall domestic protein production (chicken, beef, pork and turkey) to increase roughly 3-4% year over year. The company expects Hillshire Brands synergy estimates for fiscal 2017 of around $675 million. The synergies will lead to higher investment in innovation, product launches as well as help in the strengthening of brands.

The company continues to expect fiscal 2017 earnings guidance of $4.90–$5.05, representing a 12% increase year over year.

Zacks Rank & Other Stocks to Consider

Tyson currently carries a Zacks Rank #2 (Buy).

Other top ranked stocks in the consumer staple sector include Darling Ingredients, Inc. (NYSE:DAR) , ConAgra Foods Inc. (NYSE:CAG) and Lamb Weston Holdings Inc. (NYSE:LW) . All the three stocks carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Darling Ingredients has posted a positive earnings surprise of 13.6% in its last quarter. While ConAgra Foods has a long-term earnings growth rate of 8%, Lamb Weston has a long-term earnings growth rate of 4.2%.

Zacks' 2017 IPO Watch List

Before looking into the stocks mentioned above, you may want to get a head start on potential tech IPOs that are popping up on Zacks' radar. Imagine being in the first wave of investors to jump on a company with almost unlimited growth potential? This Special Report gives you the current scoop on 5 that may go public at any time.

One has driven from 0 to a $68 billion valuation in 8 years. Four others are a little less obvious but already show jaw-dropping growth. Download this IPO Watch List today for free >>

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

ConAgra Foods Inc. (CAG): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Darling Ingredients Inc. (DAR): Free Stock Analysis Report

Original post

Zacks Investment Research