"The successful warrior is the average man, with laser-like focus." --Bruce Lee

We kicked the week off on a bit of a weak note but then support levels held well and we began to bounce back.

We’ve got nice gains in all our positions so my stops are a bit loose since I’m trying to let them work higher if all goes well.

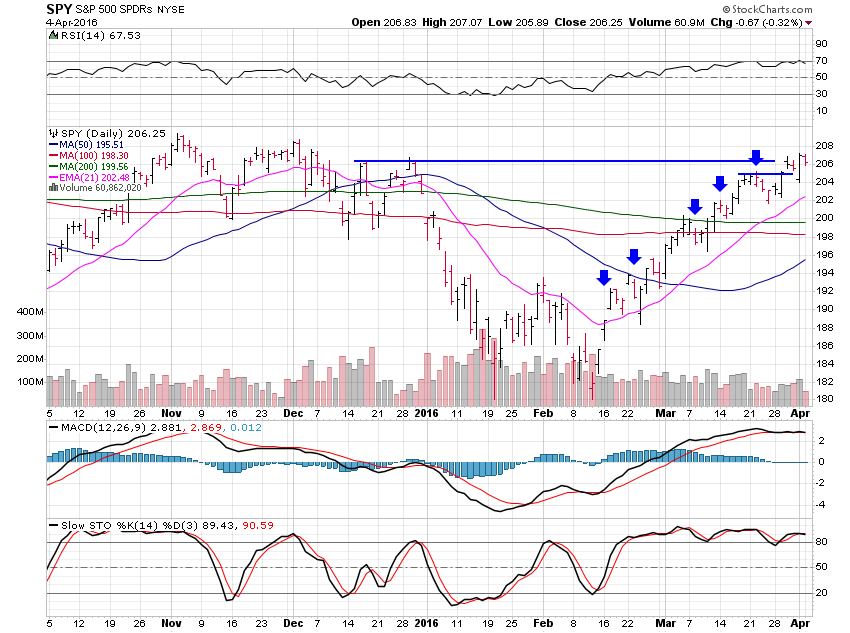

If you take a look at the following SPDR S&P 500 (NYSE:SPY) chart you can see most of the weeks have started weak but ended strong since mid-February, so as far as I can see, this week is playing out the same way.

Fine action from SPY who could base here for another week before we breakout into new highs if things work out as they appear to be set to do.

I’d love to see a nice run into May and then perhaps the proverbial “sell in May and go away”.

Last summer there wasn’t a lot of trading to do and while I love to trade, summers are short and taking some time away is always refreshing so fingers crossed!