The major trading territories of the US and UK have had a good Q3 and healthy year-end exit rates should pave the way for more progress in FY14. Market declines in Europe and Canada have slowed and are also set for an improved performance next year. The combination of reduced market risk and visible growth drivers – including Truth Hardware – is appealing and we expect this to translate to further share price progress.

Largest territories lead the way

The 13 November IMS echoed comments made with H1 results; positive trading trends in the US and UK continue and weaker markets appear to be at their lows, with more positive outlooks. More specifically, for Amesbury, US demand has remained healthy with no discernible impact on sentiment from government budget wrangling, RMI activity gradually rising and an order position supporting good sales activity deep into Q4. More detail on the integration of Truth will emerge with the FY13 results; we currently factor in c £5m acquisition-related exceptional costs in H213, followed by c £3.1m (c $5m) annualised profit benefit by FY16. In the UK, grouphomesafe has seen share gains from the return to market growth in Q2 continuing in H2 to date. This is particularly the case in hardware, where both existing and acquired operations (ERA and Fab & Fix respectively) are ahead y-o-y and should increasingly benefit from a co-ordinated sales strategy. Schlegel International’s better markets (ie Italy, Brazil and Australia) have sustained activity levels in H2, while the weaker European ones appear to be more stable at current levels, consistent with macroeconomic indicators. H2 trading should also see the benefit of restructuring actions taken in H1. Overall, we expect H2 margins above H1 in all three regions. Similarly, our estimates incorporate profit progress in all regions in FY14; this is most marked in North America, reflecting annualised Truth effects, although we also anticipate underlying progress across the board.

Valuation: Unambiguous growth picture

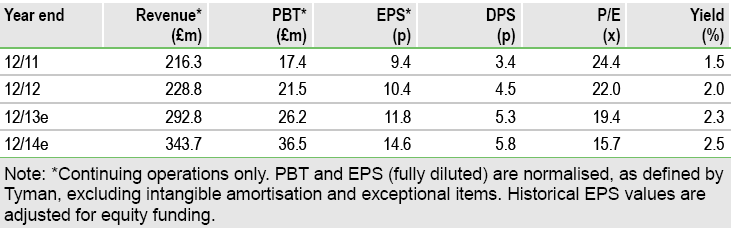

As stated in our recent note, we believe our estimates are at the lower end of published consensus, providing scope for a more positive FY13 outturn. For FY14 and beyond, a focus on sustained market recovery and integration benefits for the enlarged group represents an unambiguous growth picture and supports our existing three-year CAGR of 17% (FY13-15). Current valuation metrics are broadly as we outlined previously (closing year P/E ratio of 19.4x or 15.7x one year out).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Tyman Positives Accentuated, Negatives Receding

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.