Tyman Plc (LON:TYMN): Slightly more subdued messaging from the US into the final quarter of FY17 but the effects should be temporary, in our view. The bigger picture footprint optimisation programme in North America is well founded and should provide longer-term competitive benefits. Fundamentally, the investment case remains attractive.

Commercial drivers behind lower guidance

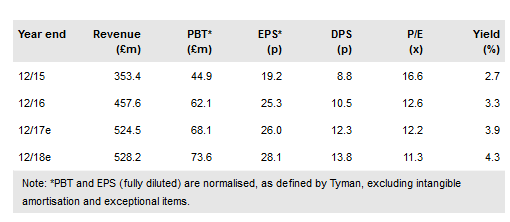

FY18 guidance has been trimmed due to the combined effect of higher input costs and challenges at AmesburyTruth’s (AT) Juarez site. In our view, AT sacrificed some margin in the light of direct cost overruns at Juarez as this expanded facility ramped up volumes. In other words, service disruption in key channels was minimised but at a cost and a secondary impact may have been felt among smaller customers where some share is understood to have been lost. Demand conditions generally have been in line with previous commentary and ERA and Schlegel International appear to have performed at least in line with their respective markets. Other regions also experienced higher input costs but may have been in a better position to absorb them. Overall, we have reduced underlying FY17 PBT estimates by c £3m (with a marginal reduction in FY18) with a further impact from updated FX assumptions (from US$1.25 in all years to US$1.27 in FY17 and US$1.30 in the following two years). Revisions are solely to our AT expectations.

To read the entire report Please click on the pdf File Below: