Deeper and broader in North America

The Truth Hardware acquisition extends Tyman’s development as a pure building products play with a North American bias. UK profit momentum is also building, adding to progress seen in the US. Earnings growth (17% three-year CAGR, 2012-15) and additional US and UK housing upside should support further share price progress.

Truth Hardware accelerates North American growth

The US$200m purchase of Truth in July has extended Amesbury’s existing portfolio product range in window and door hardware and brings a meaningful presence in Canada for the first time. The fit is good and c US$5m estimated full run-rate synergies are identified vs Truth’s reported FY12 EBIT of US$18.6m (and Amesbury’s c US$18.3m). Given the ongoing recovery in the US housing market, the timing also looks favourable; consideration equates to an entry multiple of 8.3x EBITDA or sub 6x our FY15 estimate. Building a stronger North American platform also enhances Tyman’s potential to address other segments where representation is low. Tyman funded the deal with £73.4m of new equity (£65.5m net, via a firm placing and placing and open offer at 185p) and a new $100m debt facility. This resulted in a net debt to pro forma EBITDA of c 2.6x at the point of acquisition.

North America dominates, UK also progressing well

Amesbury was already the primary growth driver in our existing estimates. Truth enhances this and raises North America’s share of group operating profit to 70%+ on a full-year basis (2014e). Considerable progress has also been made in the UK, where grouphomesafe is delivering a strong profit uplift in FY13. Elsewhere, weak trading in Europe is not altogether surprising and takes some of the gloss off upgrades to other regions. Behind the positive acquisition effects (both Truth and Fab & Fix) our underlying US revenue growth and margin expansion expectations are set conservatively and there is potential for more growth as the housing cycle rebuilds. We currently model a flatter profile for other regions beyond FY13, but they may also broaden out and lengthen profit development in due course.

Valuation: Growth rating with more to come

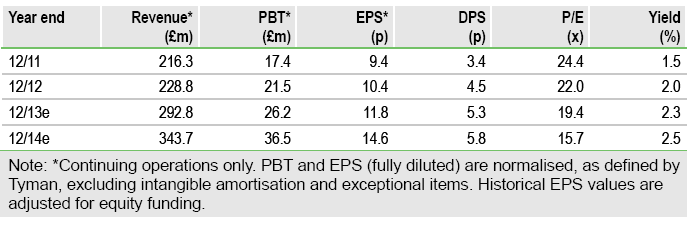

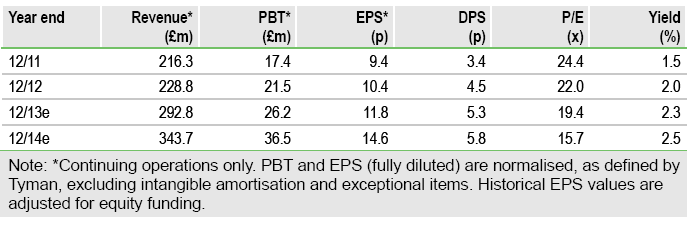

Our EPS estimates (as shown above) represent a three-year CAGR of 17% (PEG of 1.3x). A current year P/E ratio of 19.4x becomes 15.7x for FY14; we believe that housing aftermarket momentum in Tyman’s leading territories is highly likely to accelerate medium-term earnings growth, further increasing the attraction of the valuation.

To Read the Entire Report Please Click on the pdf File Below.

The Truth Hardware acquisition extends Tyman’s development as a pure building products play with a North American bias. UK profit momentum is also building, adding to progress seen in the US. Earnings growth (17% three-year CAGR, 2012-15) and additional US and UK housing upside should support further share price progress.

Truth Hardware accelerates North American growth

The US$200m purchase of Truth in July has extended Amesbury’s existing portfolio product range in window and door hardware and brings a meaningful presence in Canada for the first time. The fit is good and c US$5m estimated full run-rate synergies are identified vs Truth’s reported FY12 EBIT of US$18.6m (and Amesbury’s c US$18.3m). Given the ongoing recovery in the US housing market, the timing also looks favourable; consideration equates to an entry multiple of 8.3x EBITDA or sub 6x our FY15 estimate. Building a stronger North American platform also enhances Tyman’s potential to address other segments where representation is low. Tyman funded the deal with £73.4m of new equity (£65.5m net, via a firm placing and placing and open offer at 185p) and a new $100m debt facility. This resulted in a net debt to pro forma EBITDA of c 2.6x at the point of acquisition.

North America dominates, UK also progressing well

Amesbury was already the primary growth driver in our existing estimates. Truth enhances this and raises North America’s share of group operating profit to 70%+ on a full-year basis (2014e). Considerable progress has also been made in the UK, where grouphomesafe is delivering a strong profit uplift in FY13. Elsewhere, weak trading in Europe is not altogether surprising and takes some of the gloss off upgrades to other regions. Behind the positive acquisition effects (both Truth and Fab & Fix) our underlying US revenue growth and margin expansion expectations are set conservatively and there is potential for more growth as the housing cycle rebuilds. We currently model a flatter profile for other regions beyond FY13, but they may also broaden out and lengthen profit development in due course.

Valuation: Growth rating with more to come

Our EPS estimates (as shown above) represent a three-year CAGR of 17% (PEG of 1.3x). A current year P/E ratio of 19.4x becomes 15.7x for FY14; we believe that housing aftermarket momentum in Tyman’s leading territories is highly likely to accelerate medium-term earnings growth, further increasing the attraction of the valuation.

To Read the Entire Report Please Click on the pdf File Below.