Strong Q2 trading

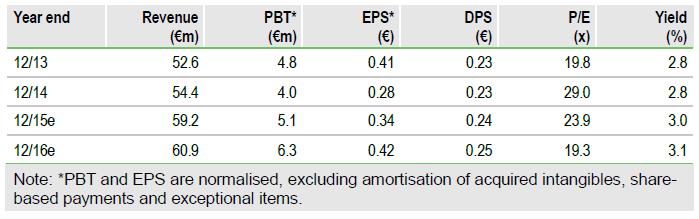

Since incorporation in Q2, TXT Perform's (MILAN:TXTS) Asia Pacific subsidiary has won its first major contract, worth more than €1m. Combined with strong underlying performance in both divisions, this should result in group revenue growth of c 20% for Q215, ahead of our 8.5% forecast. This should also drive stronger than forecast EBITDA. We leave our estimates unchanged pending full H115 results on 4 August, but highlight that there is likely to be upward pressure on forecasts.

TXT expects to report Q215 revenues of c €16.3m, significantly higher than our €14.6m forecast, boosted by a contract win in TXT Perform’s new Asia Pacific subsidiary. This was a licence deal worth more than €1m to manage more than 40 Duty Free and Galleria stores in airport hubs and tourist locations worldwide. TXT Perform saw revenue growth of 27% y-o-y (vs flat growth in Q115) and TXT Next grew 11% y-o-y (vs 13.6% in Q115). H115 software revenues of €8.3m were 35% higher than a year ago. The company expects Q215 and H115 EBITDA to grow in line with revenue growth, with EBITDA margins in line with the previous period. For Q215, this implies a margin of c 10.4% or €1.6m (compared to our €1.3m forecast). The company ended the period with net cash of €9.5m, down from the €12.1m reported at the end of Q115, reflecting payment of annual bonuses and the dividend in Q215.

To Read the Entire Report Please Click on the pdf File Below