You don’t have to get fancy with investing. Simple trades are often the best trades.

And today’s chart highlights a very simple “no brainer” trend that should grab your attention.

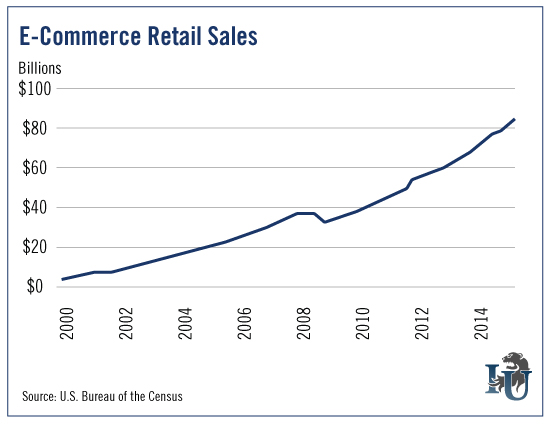

As you can see, e-commerce retail sales have grown more than 1,283% since the turn of the century. This is a trend you should already be aware of. After all...

Every year, more consumers are choosing to shop online versus visiting a brick-and-mortar store. In 2000, less than 1% of retail sales came from e-commerce. Today, it’s clocking in at over 7% and growing.

(A 7% piece of the pie might seem small, but you have to consider that there are many retail items you probably wouldn’t buy online. Cars... gasoline... and restaurant meals, for example. These take up a big chunk of retail.)

Now, with the holiday shopping season upon us, e-commerce sites are salivating...

A Record Year on the Horizon

Yesterday, Black Friday kicked off the holiday shopping season. This is the pivotal quarter when retailers pocket the largest amount of sales for the year.

In 2015, total retail holiday sales are projected to hit $885 billion. That is a 5.7% increase over last year and the biggest jump since 2011.

No surprise, e-commerce sales are set to make up a bigger piece of the pie than ever... a whopping 9% of all holiday retail sales.

That should add up to more than $83 billion in online sales, an 11% increase over last year.

Holiday shopping will likely account for 68% of total e-commerce sales for 2015. Cyber Monday alone is projected to haul in over $3 billion this year.

The trend is clear...

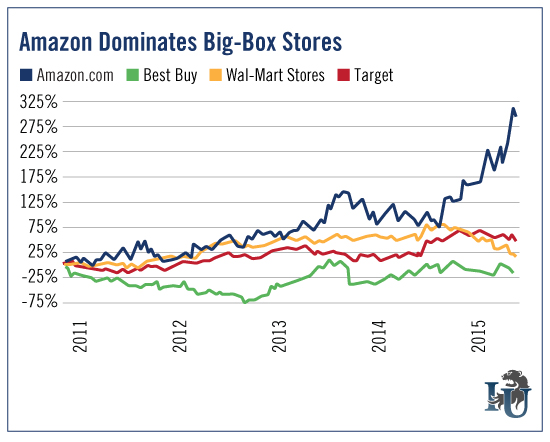

Online sales continue to gobble up retail market share. As a result, e-commerce sites like Amazon.com (Nasdaq: O:AMZN) are thriving while big-box stores are suffering.

As you can see in the chart, shares of Amazon are handily outperforming those of brick-and-mortar retailers.

In 2015 alone, Amazon has been one of the market’s top performers. The stock is up over 107% year to date. Meanwhile, Wal-Mart (NYSE: N:WMT) has been one of the worst performers in the Dow Jones 30. It is sitting on a 27.86% loss for the year.

Of course, even if you aren’t a “buy and hold” investor, there is a clear seasonal trade here.

Over the last five years, owning Amazon from the beginning of December to the end of May has handed investors average gains of 6.81%. During the same period, Wal-Mart has averaged just 1.56%.

As consumers grow increasingly tired of the long lines and crowds, Amazon’s share of overall holiday sales should only increase.