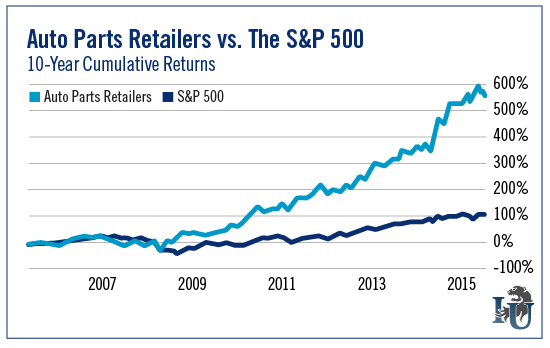

This week’s chart highlights an industry that’s, simply, crushing it.

Over the last 10 years, the auto parts retail industry has produced a return of 560%. Compare that to the broader market’s respectable, but less inspiring, return of 103%.

So what’s driving this growth?

The recent drop in oil and gas prices is certainly playing its part. With cheaper gas, people are inclined to drive more. (This is also true for air travel, as my fellow researcher Bob Creed reported a few weeks back.)

And with more driving comes more wear and tear. This is creating greater demand for auto parts and maintenance services.

Drivers are also keeping their cars longer. According to industry research firm IHS Automotive, the average age of lightweight vehicles has risen to 11.5 years.

Naturally, the older the car the more likely it will need repairs.

And unlike other retailers, auto parts stores are hardly affected by the e-commerce boom. Most of us still rely on mechanics to repair and maintain our vehicles. That’s unlikely to change anytime soon.

Another factor supporting this trend? Driving services like Uber and Lyft.

A growing number of drivers are staying on the roads longer to earn supplemental income. And as I said, more driving means more repair and maintenance needs.

That’s why Uber and Lyft offer discount incentives to their drivers. These discounts are available at retailers such as Jiffy Lube, Meineke, Midas Gold Corp. (TO:MAX), Firestone Ventures Inc. (TO:FV), Advance Auto Parts Inc (N:AAP) and AutoZone (NYSE: N:AZO).

In effect, Uber and Lyft are driving traffic to some of the industry’s most recognized companies. And if you’re an auto parts retailer, this is music to your ears.

Take AutoZone, for example. It has seen consistent year-over-year sales growth for the past 25 years.

The first quarter of fiscal 2016 saw a 14% rise in earnings per share to $8.29. That’s on a 5.6% boost in sales. It’s also the 37th consecutive quarter of double-digit earnings per share growth.

And the stock price? It’s up a solid 21.5% for the year.

Or how about OReilly Automotive Inc (O:ORLY)? As with its industry peer, annual sales have grown without interruption since the early ‘90s. Its earnings per share bumped up 28% in the most recent quarter as sales grew 10.8%.

So far this year, the company’s stock price has surged an even more impressive 33.4%.

Both companies have made efforts to increase shareholder value through share buyback programs. O’Reilly has repurchased over $5 billion of its shares since 2011. And in 2014 alone, AutoZone repurchased $1.1 billion worth of its shares.

Lastly, both are investing in their commercial sales.

In the past, AutoZone and O’Reilly have largely focused on the do-it-yourself market, emphasizing parts retail over maintenance services. But that’s changing as these companies ramp up their “do it for me” commercial sales and seek to open additional stores nationwide.

Either company is worth a closer look by investors. You don’t want to miss the chance to ride this uptrend.