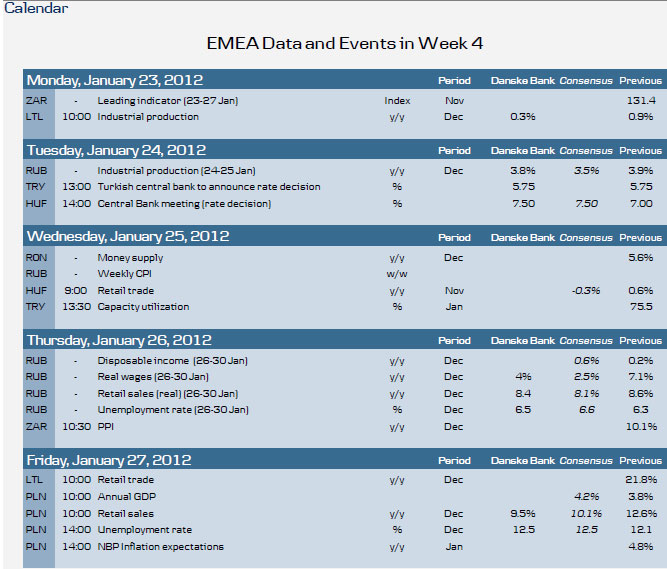

Two rate decisions – both on Tuesday – will dominate the EMEA agenda next week. Most interest will undoubtedly be on the Hungarian rate decision after the recent spike in volatility in the Hungarian markets on the back of the Hungarian government’s decision to pass a new central bank law. The law has been heavily criticized by the European Commission as, according to the EU, it is in breach of EU rules and limits the independence of the central bank.

This week, the Commission said it has initiated legal action against the Hungarian government regarding the central bank law. There will likely be more focus on these issues rather than on actual monetary issues at the press conference following next week’s rate decision. We expect Hungarian central bank governor Simor to continue to fight for and defend the independence of the Hungarian central bank (MNB). However, he will also be cautious about upsetting the markets. So far, the MNB has shown considerably more calm than the Hungarian government, in our view.

The MNB has hiked its key policy by a total of 100bp over the last two Monetary Council meetings, despite the complete lack of growth momentum in the Hungarian economy. However, inflation also remains above the MNB’s 3%-inflation target and there is no doubt that the recent sharp sell-off in the forint is a key driver for the MNB’s hawkishness. With the MNB’s independence under attack, political uncertainty remains elevated. Therefore, we remain in line with the consensus expectation expect a 50bp rate hike to 7.50%.

The rate decision should be somewhat less interesting than the Hungarian rate decision. That said, over the past year the Turkish central bank’s communication and policy actions have been somewhat erratic so every Turkish rate decision is drawing a lot of attention and uncertainty about the outcome of the decision is much higher than it needed to be.

Turkish inflationary readings remain volatile and elevated, with the December headline reading hitting a 2011 high of 10.45% y/y, up from 9.48% y/y a month previously and averaging around 6.5% for 2011. Our latest forecasts see CPI averaging 8.4% in 2012E, but the risks are skewed for higher readings despite the central bank’s determined, inflation hawkish stance.

Since cutting policy rates at the interim rate setting meeting in August by 50bp to 5.75% to shore up against slowing growth and as a pre-emptive measure against the deteriorating external conditions, the TCMB has taken an almost 180 degree turn and adopted a rather hawkish stance in the face of accelerating inflation and the depreciation of the lira, which it regards as excessive. Following the last inflation report, the TCMB launched a lira supportive new policy approach that utilises a rate corridor of 5.75% to 12.5% on the o/n lending rates and effectively re-sets lending rates on a daily basis. However, in terms of the actual policy rates, we see no changes in either direction in the near term, as attention remains on the o/n lending rates and a host of other unorthodox measures. We therefore expect unchanged rates from TCMB at next week’s meeting. That is also the consensus expectation.

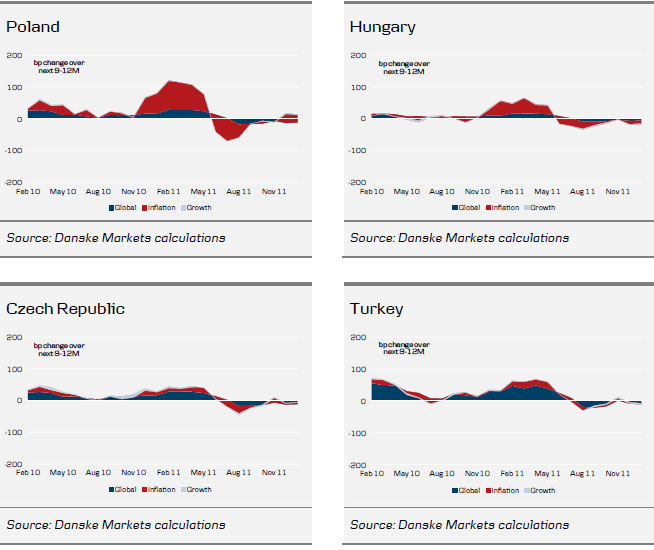

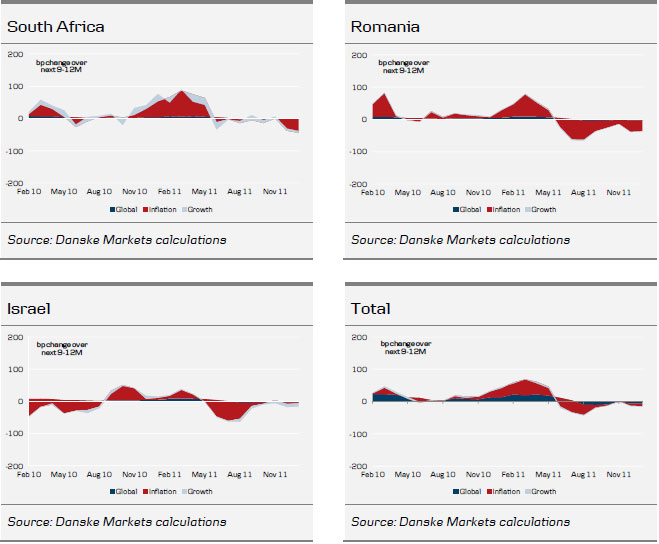

EMEA Monetary Policy Tracker

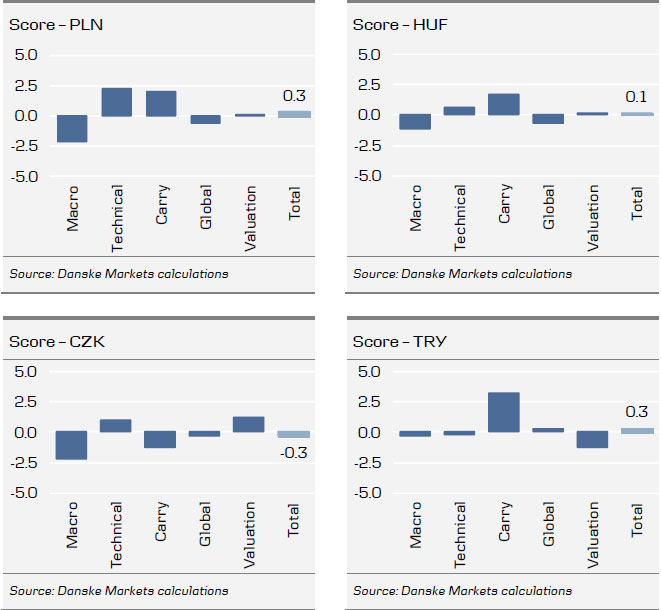

EMEA FX Scorecard Overview

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Two Rate Decisions to Dominate EMEA Agenda This Week

Published 01/23/2012, 11:37 AM

Updated 05/14/2017, 06:45 AM

Two Rate Decisions to Dominate EMEA Agenda This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.