The market’s big multi-month rally may have you wondering if there are any oversold and undervalued dividend stocks left.The Basic Materials sector has lagged the other sectors over the past year, and is also next to last in appreciation year-to-date, but has shown more signs of life this past week.

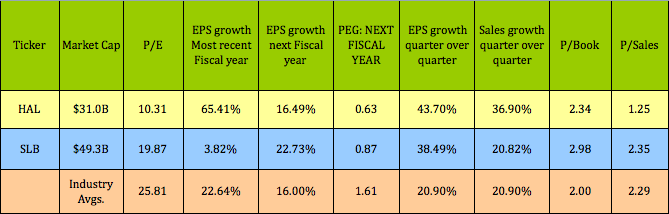

The Oil & Gas Equipment & Services industry within this sector has two dividend paying stocks that look oversold and mostly undervalued: Halliburton, (HAL), and Schlumberger, (SLB).Halliburton’s P/E of 10.31 is near the low end of its 5-year P/E range of 6.24 – 23.52, while SLB’s P/E of 19.87 is closer to the upper part of its 5-year range of 9.58 – 24.97.

As the 2 premier stocks within this industry, both of these stocks usually command a premium Price/Book, but they’re both undervalued on a PEG ratio basis. HAL had strong EPS growth in its most recent fiscal year and quarter, and is projected to have strong growth in its next fiscal year. SLB has a much higher P/E, but also had strong sales and EPS growth in its most recent quarter, and is forecast to have over 22% EPS growth in its next fiscal year:

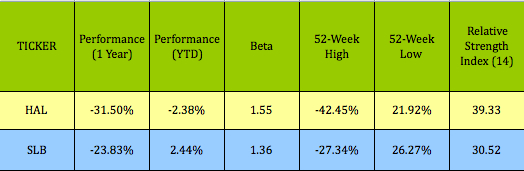

Share Performance: Like many other Basic Materials stocks, both of these stocks are down considerably over the past 12 months. They’re also way down from their 52-week highs, and have low Relative Strengths of below 40, indicating that they’re starting to enter the upper regions of oversold territory:

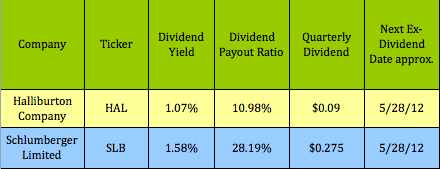

Dividends: Both firms managed to maintain their dividends during the 2008 crisis, and Schlumberger increased its quarterly dividend in 2012, to $.275/share, from $.25.

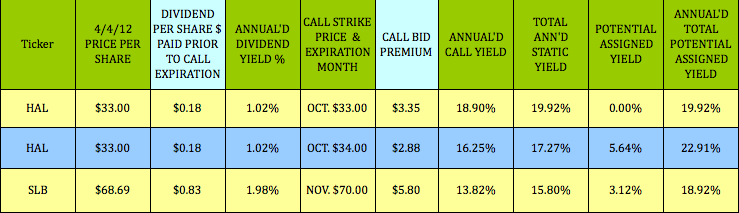

Covered Calls: Although these certainly aren’t high dividend stocks, they both have high options yields that dwarf their dividend yield. We’ve listed 2 different covered call options trades for HAL, to illustrate how you can tailor option trading strategies to meet your market bias, be it conservative or aggressive. When you sell covered call options at higher strike prices, you receive lower premiums, but you leave more room for potential price gains.

The first HAL call is more defensive: It has a strike price of $33.00, and its call bid premium of $3.35 is over 18 times HAL’s 2 dividend payouts during this 7-month term. However, since the call strike price and the stock price are equal, the $33.00 call options leave no room for potential assigned yield, (price appreciation).

The second HAL trade is more bullish: It has a $34.00 strike price, which leaves you the potential for a $1.00/share price gain, but its call bid premium is only $2.88, $.47/share less than the $33.00 call option.

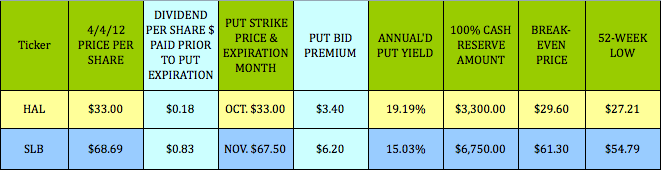

Cash Secured Puts: Experienced traders also sell cash secured put options as a way to earn a profit now from stocks that they want to accumulate.By selling a put, you’re obligating yourself to potentially have to buy a stock at a given put strike price by expiration, if the stock goes below that strike price. Like call options, you get paid a put premium within 3 days of making the trade, (often the same day), as opposed to waiting for quarterly dividends and possible price gains.

Generally, most stocks aren’t assigned or “put” to you until sometime near their expiration date. The reason for this is twofold:

1. Put option buyers will mostly end up selling their open puts, instead of exercising them. They may not want to allocate the cash needed to actually buy the shares and then sell/put them to a put seller.

2. Option buyers want to capitalize as much as possible on the potential price appreciation of the options.

The SLB trade listed below is more conservative than the HALtrade, in that its strike price is below SLB’s $68.69 price/share.This gives you a break-even that’s fairly close to SLB’s 52-week low of $54.79.SLB’s November $67.50 put options pay over 7 times what its dividends pay for the next 8 months.

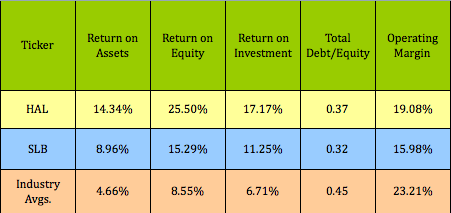

Financials: Both firms’ financial figures are superior to industry averages, except for operating margins, where the industry averages appear to be skewed higher, mostly by much smaller companies:

As the market starts to realize that these oil & gas service firms are able to quickly reallocate their resources to high demand areas, HAL and SLB may be two of the best stocks to buy for price gains.

Disclosure: Author is short Haliburton put options.

Disclaimer: This article is written for informational purposes only and isn’t intended as investment advice.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Two Oversold And Undervalued Blue Chip Energy Dividend Stocks

Published 04/08/2012, 04:26 AM

Updated 07/09/2023, 06:31 AM

Two Oversold And Undervalued Blue Chip Energy Dividend Stocks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.