For almost three years now, low crude prices have been dragging down the economies of petrostates like Venezuela and Saudi Arabia. But on November 30 of last year, OPEC member states put aside their differences and agreed on a production slowdown deal.

An agreement is all well and good, but it’s no guarantee that rival OPEC members will follow through with cutting production. Now that we’re a couple months in, investors are wondering...

How many member states are honoring the deal? How many are ignoring it? And what effect has the deal had on financial markets?

We’ll answer all of these questions below.

Signs of Strength

One good omen for the OPEC deal is Saudi Arabia’s fidelity. The kingdom is the world’s largest oil exporter and the de facto ringleader of OPEC. The state-owned Saudi Aramco oil company has allegedly cut output by almost 500,000 barrels per day. That’s a substantial chunk of OPEC’s goal of 1.2 million barrels per day.

Kuwait has also cut its output by 130,000 barrels a day, according to the CEO of its state oil company. Between the faithful participation of Saudi Arabia and Kuwait, the oil cartel is already more than halfway to reaching its slowdown target.

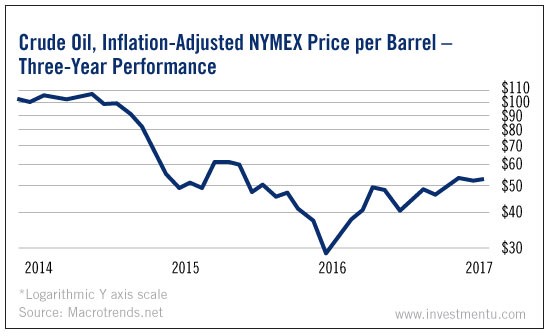

The price of oil has already rebounded to the mid-50s range on news of the cuts. And adding to this optimism, most of the other 11 OPEC members are also reducing production.

But notice that I said most and not all.

Fault Lines

Three of the biggest OPEC states are exempted from the slowdown deal: Iran, Nigeria and Libya. And there are some good reasons for these allowances.

Libya is in the middle of a civil war. Nigeria is in a deep recession, and it’s still busy fighting Boko Haram. (It’s not easy to retool your budget and oil production process with jihadists running around.)

Iran has a slightly less sympathetic reason for not cutting production. It just really doesn’t want to. The country was under U.S. sanctions between its 1979 revolution and the 2016 nuclear disarmament deal. During that time, it was forced to stop exporting crude and became economically isolated.

But now that the sanctions have been lifted, Iran’s government has insisted that it be exempted from the OPEC slowdown. It wants a chance to “recapture lost market share,” according to the country’s oil minister.

Then there are states that don’t have an exemption to the deal - but seem to be blowing it off anyway. For example, rumors from Iraqi oil traders imply that their country plans to increase oil exports in future months, which is in violation of the slowdown.

It’s a bit too early to rule on the fate of the OPEC deal. The situation will become clearer as actual production reports are released throughout 2017.

For now anyway, the market seems cautiously optimistic about the deal’s prospects. Crude is stably above $50 per barrel. And with many oil companies now leaner and meaner than ever, even this modest increase in prices should be good for bottom lines.