In yesterday’s (August 28) Wagner Daily newsletter commentary, we said there were three ETFs on our “unofficial” watchlist that we were monitoring for potential buy entry in the near-term. They were: SPDR Gold Trust (GLD), iPath Grains ETN (JJG), and S&P Health Care SPDR (XLV). In case you missed it, our initial technical analysis on buying the Gold ETF (GLD) was posted on our trading blog two days ago. Of these three ETFs, we are now adding two of them to our “official” ETF Trading Watchlist as potential stocks to buy.

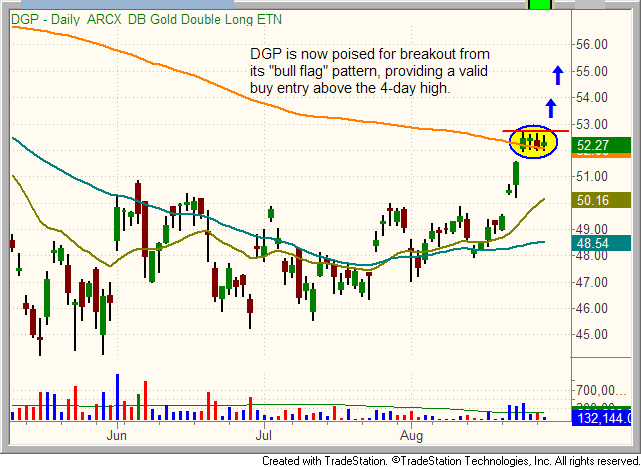

The first potential ETF trade is GLD, which has now formed a tight “bull flag” formation over the past four days. But rather than buying GLD, we are targeting the leveraged Gold Double Long ETN (DGP) for buy entry instead.

As annotated on the chart below, our technical buy trigger for DGP will be a breakout above the 4-day high:

Although leveraged ETFs like DGP have a tendency to underperform the nonleveraged ETFs over longer holding periods, some of these ETFs are fine for trading shorter-term, momentum-driven trades, while providing the benefit of using less capital to achieve potential upside gains.

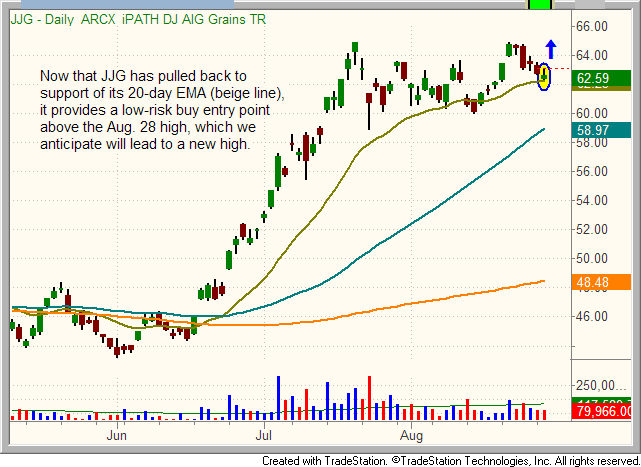

In addition to DGP, we are now also targeting JJG for “official” buy entry. Monday, it provided us with the slight pullback we were looking for and bounced perfectly off of support of its 20-day exponential moving average. As such, we are now looking for a buy entry above Monday’s high, with a stop below the 20-day exponential moving average (plus some “wiggle room”). The technical swing trade setup in JGG is shown below:

Despite the relatively flat closing prices in the broad market, all but one of the 8 open positions in our model trading portfolios (6 individual stocks and 2 ETFs) showed relative strength to the major indices by rallying moderately higher yesterday. As we frequently mention, the only time we really pay much attention to the performance of the main stock market indexes is when it comes to instances of heavier volume gains (“accumulation days”) or heavier volume declines (“distribution days”). What always matters more is the performance of individual positions.

When we are doing our jobs by simply buying stocks and ETFs with solid bases of consolidation and relative strength, it frees us from the concern and worry of having to pay attention to how much the Dow moves up or down every day (unlike the talking heads of financial news networks who constantly dwell on the performance of the popular market indexes). For now, our objective, rule-based market timing model remains in buy mode, so we will continue to be positioned on the long side of the market, albeit with reduced share size.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Two Commodity ETFs Poised For Explosive Gains This Week

Published 08/29/2012, 04:03 AM

Two Commodity ETFs Poised For Explosive Gains This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.