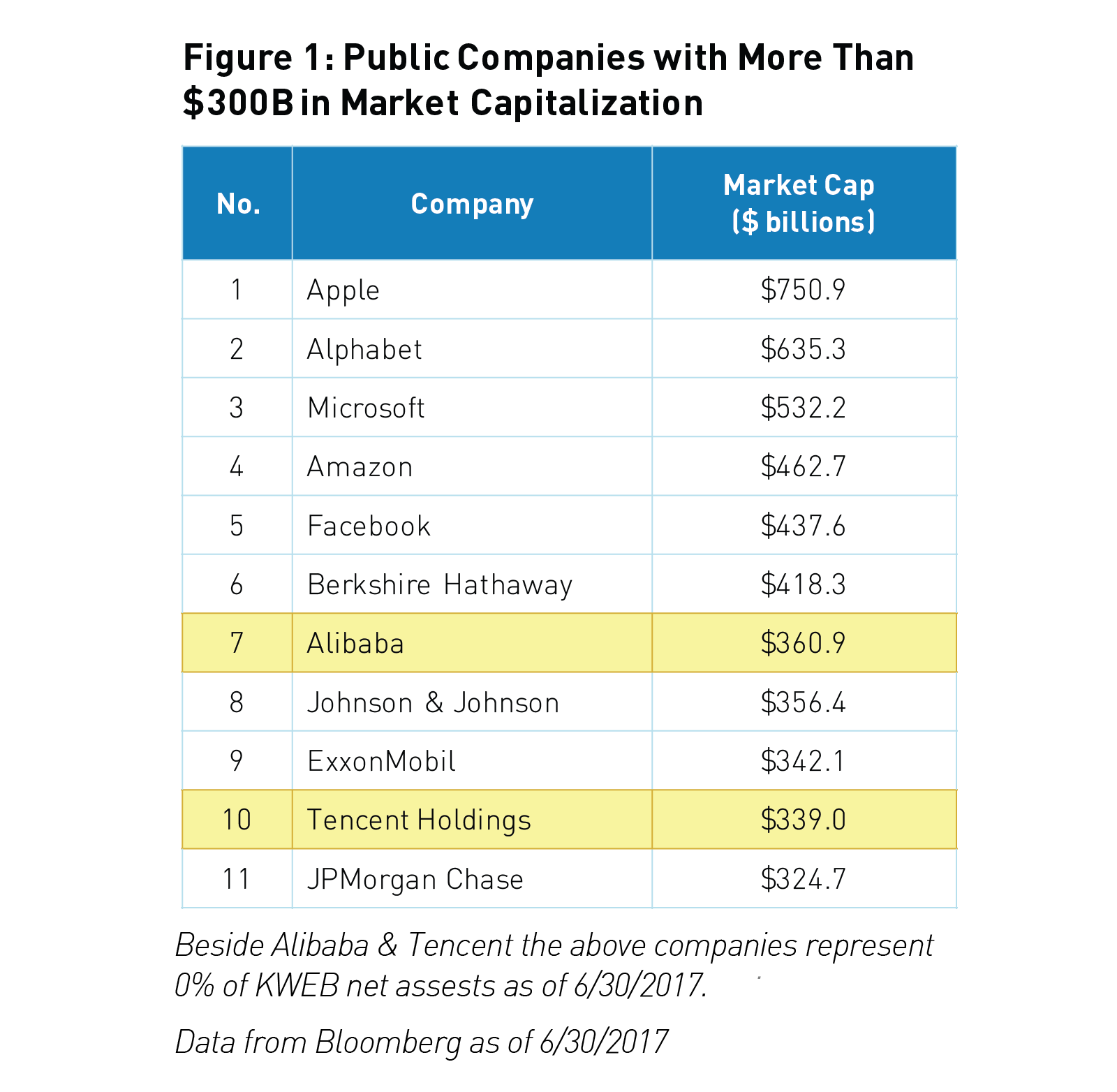

In May 2017, Alibaba Group Holdings Ltd (NYSE:BABA) and Tencent Holdings Ltd ADR (OTC:TCEHY) exceeded $300 billion in market capitalization for the first time, placing these two Chinese tech companies in an elite group that, as of June 2017, only counts nine other companies globally among its members. While this growth is exciting, it also begs the question: having reached such an enormous size, how much room is left for Alibaba (NYSE:BABA) and Tencent to grow?

One way to evaluate this question is to study the growth patterns of similar internet technology companies that have already hit the $300 billion mark. For example, Google* first joined the group in May 2013 while Amazon (NASDAQ:AMZN) and Facebook* did the same in November 2015. These companies may provide insight into how Alibaba and Tencent might perform going forward.

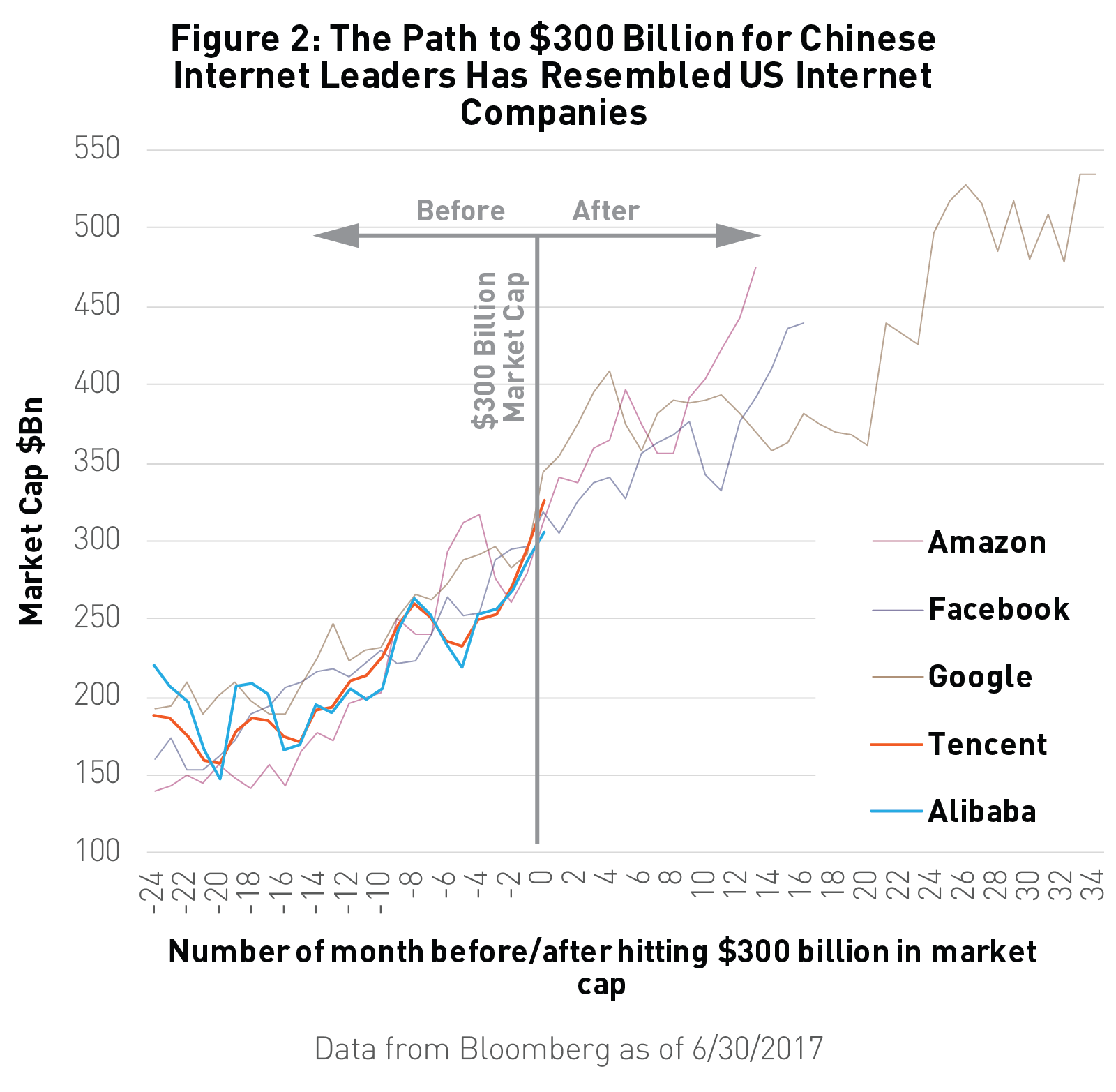

According to data from Bloomberg, hitting this valuation did not interrupt the growth of Google (NASDAQ:GOOGL), Amazon or Facebook (NASDAQ:FB). Figure 2 explains this by showing the paths to $300 billion in market cap for internet technology companies. The graph shows the months leading up to each company reaching $300 billion (represented by negative numbers) and those directly afterward (represented by positive numbers). After reaching $300 billion in market cap, Google, Amazon, and Facebook continued to grow steadily. Google even went on to increase its market cap to $534 billion over the next three years, and by June 30, 2017, it more than doubled to $635.3 billion.

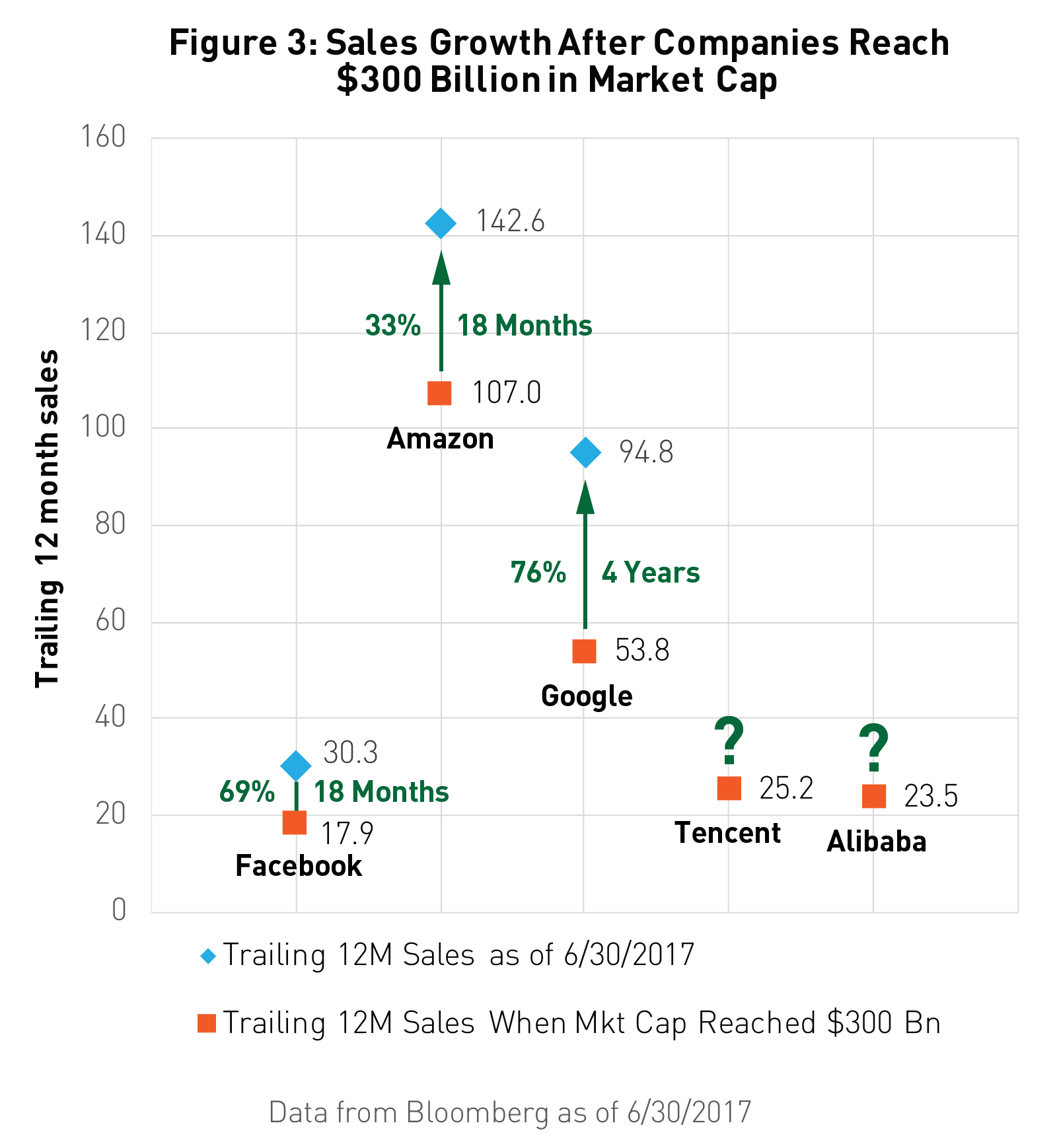

Additionally, Figure 3 shows how each company’s sales continued to grow after achieving $300 billion in market cap, ranging from 33% sales growth by Amazon to 76% sales growth by Google. Share prices have similarly continued to rise as the value of Google, Amazon, and Facebook’s stock prices increased by 102.8%, 51.0%, and 38.8% respectively from when they first reached $300 billion to June 30, 2017.

We believe that if China’s internet giants continue to follow a similar model as that of their US predecessors, there is potential for future growth. When taking China’s market and demographics into account, we believe that future could look even brighter.

China’s E-Commerce market size surpassed the US in 2014 and, by 2016, had reached a total market size of $749 billion. As measured by the CSI Overseas China Internet Index, the sector has rallied more than 40% year to date. Also, Alibaba and Tencent have the advantage of operating in a Chinese internet environment that is still developing. Today, only about half of China’s 1.3 billion citizens have access to the internet as opposed to 88.5% of the US population. This means that, as China continues to develop and modernize, China’s internet penetration may also continue to grow and represent a significant market opportunity.

Surveying the globe for the next internet technology company with the right characteristics to join the $300B club, we believe that there could be a number of viable candidates in the China internet sector. For example, NetEase Inc (NASDAQ:NTES) is a Chinese internet conglomerate that is lesser-known in the United States but is the second largest video game company in China (second only to Tencent) and was the seventh largest video game company in the world by revenue in 2016. While its market cap of $39.5 billion is about 9 times smaller than that of Alibaba and Tencent, NetEase’s net revenue rose 68% year over year in 2016, and it reached $5.7 billion in total sales in May 2017, only about 4 times less than the two Chinese tech leaders.

We also cannot forget to mention China’s well-established search engine and online services provider, Baidu Inc (NASDAQ:BIDU), which some refer to as the “Google of China.” Baidu is currently China’s most popular search engine and is the fourth most visited site in the world. It has begun positioning itself as a global leader in artificial intelligence (AI), having amassed a 1,700-person research team and spent about $3 billion on R&D over the past two and a half years. It boasts an even bigger market cap than NetEase at $62.2 billion and had an annual revenue of $10.2 billion in 2016.

Maybe more of a long-shot contender for joining the $300B club is Momo Inc (NASDAQ:MOMO), a rising Chinese internet company which operates a popular social networking and live-streaming app. We include Momo on the list of contenders because of its rapid growth. Although it went public less than three years ago, it already reached a market cap of $7.3 billion as of June 2017 and has 85.2 million monthly active users as of March 2017. So far, Momo has seen net revenues increase by 421% year over year.

The KraneShares CSI China Internet ETF (KWEB) is an exchange traded fund offering holistic exposure to these trends and opportunities within China’s internet sector. KWEB holds Alibaba, Tencent, NetEase, Baidu, Momo, and 28 other Chinese internet stocks. We believe this basket approach to the China internet sector can take advantage of the growth potential of smaller companies like Momo while also minimizing volatility through holding larger companies like Alibaba and Tencent. This approach aims to provide maximum potential for growth while attempting to limit volatility. Figure 4 highlights how, over the past year, KWEB has delivered strong returns with less volatility than any single one of its holdings.

Reaching $300 billion in market capitalization is a huge achievement for any company. As firms like Google, Amazon, and Facebook have demonstrated, hitting this milestone does not mean that there is no more room for growth for Alibaba and Tencent. With that said, small-to-mid cap internet companies in China often provide strong potential for growth–but with corresponding volatility. We believe KWEB strikes an appropriate balance between large and small-to-mid cap companies while allowing investors to potentially benefit from the growth of the China internet sector as a whole.