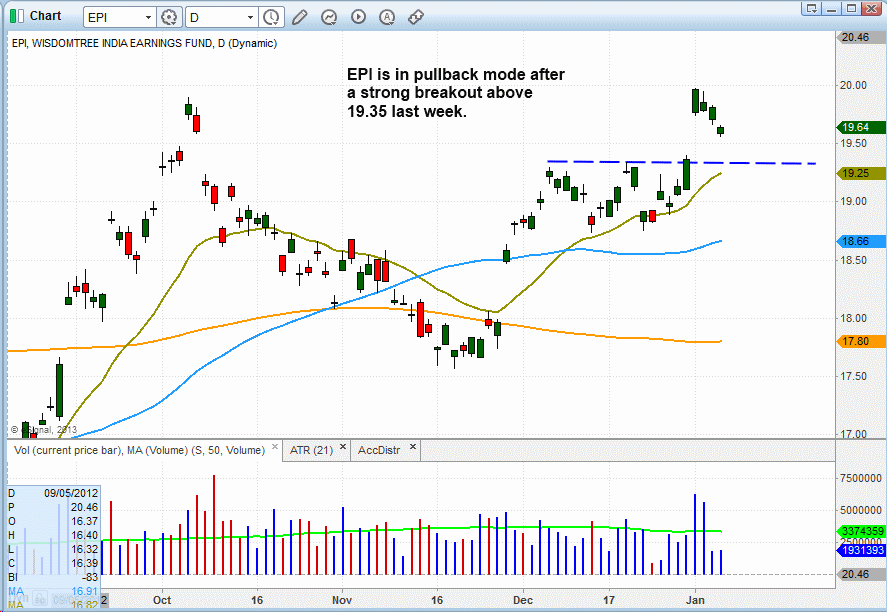

In yesterday’s (January 7) technical ETF trading commentary of The Wagner Daily newsletter, we mentioned the possibility of a Pullback swing trade buy entry developing in the WisdomTree India Earnings Fund (EPI) during the next few days. As we were anticipating, EPI indeed pulled back for the third day in a row yesterday, and did so on lighter than average volume (which is positive).

On the hourly (60-minute) chart interval (which is not shown below), EPI has just retraced to “undercut” its 20-period exponential moving average (20-EMA), which usually provides near-term support in strong breakouts. The ideal Pullback Buy Setup is at least 3 to 7 days in length (retracement from the high), with volume declining on the pullback, and orderly price action along the way. So far, this setup meets our criteria for pullback entry.

Although we’d love to see EPI pull back closer to the prior breakout level at $19.40 in order to establish an even lower risk position, we do not want to miss the next potential move higher when the bullish momentum of the recent breakout resumes. As such, we have placed EPI on our official ETF Trading watchlist as a possible buy entry. The technical trading setup of EPI is shown on the daily chart below:

Although there is a decent likelihood EPI will meet our criteria for buy trigger today, it may still pull back for one more day before attempting to resume the bullish momentum of its recent breakout. If that happens, we may be able to establish a lower-risk buy entry point tomorrow (January 9).

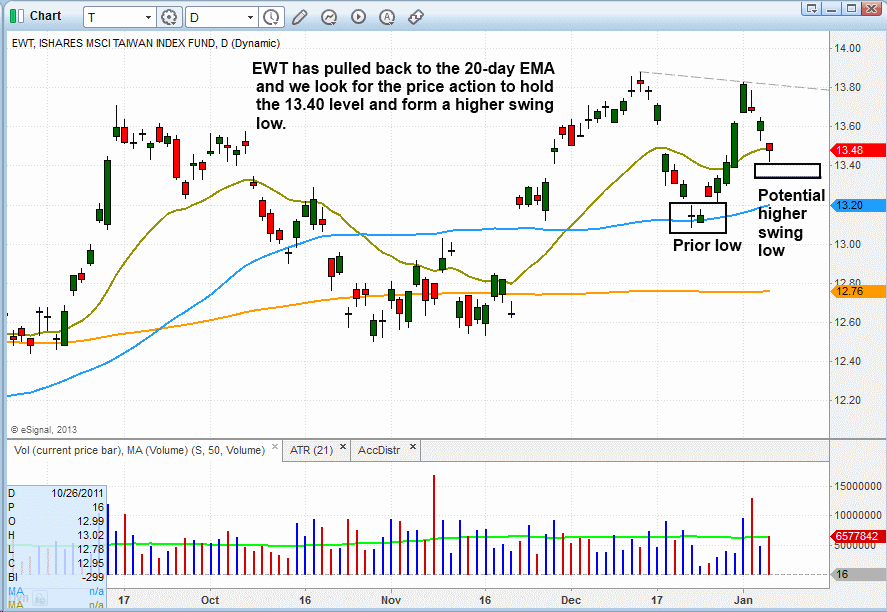

Along with EPI and EWS (discussed in yesterday’s newsletter), the iShares MSCI Taiwan Index (EWT) is another international (Asian) ETF trade setup we are adding to today’s “official” watchlist as a potential ETF swing trade entry. As you can see below, the daily chart of EWT shows the bullish basing action that has formed since the 50-day moving average (50-MA) crossed back above the 200-day moving average in September.

For bullish chart patterns, we are always looking for the price action to tighten up within a base of consolidation, and we are now seeing that with the price action finding support at the 50-MA in late December, and potentially finding support at the 20-day EMA this week.

If the price action holds the 20-EMA and triggers a swing trade buy entry, we may be able to add to the position on the way up (below $13.80) if there is some sort of one or two-day pause. If not, then we may have to add on a breakout above $13.80 or $14.00.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Two Asian ETFs To Buy On A Pullback Today: EPI And EWT

Published 01/08/2013, 07:37 AM

Updated 07/09/2023, 06:31 AM

Two Asian ETFs To Buy On A Pullback Today: EPI And EWT

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.