Twitter Inc. (NYSE:TWTR) recently rolled out the Twitter Lite application on Alphabet’s (NASDAQ:GOOGL) Android devices in 24 countries across Africa, Asia, Europe, the Middle East and Latin America.

Twitter Lite was first introduced by the company in April 2017 for users with poor network speed and limited storage.

Per its latest blog post, the app will occupy less than 3 MB space on Android phones and load faster in 2G and 3G networks. It requires significantly less data but operates faster, thereby making it affordable in regions where data charges are very high.

Twitter mentioned that Lite will also cover real-time updates on topics related to news, sports, entertainment, politics, and other desirable ones.

The company rolled it out after the experiment in Philippines showed encouraging results. Per the company, tweets sent showed an increase of 50% through this platform.

The company’s efforts to make the app more user-friendly will lead to an increase in engagement. Shares of Twitter have gained 27.1% year to date, underperforming the industry’s 30.2% rally.

International Expansion to Drive Growth

Twitter’s adjusted monthly average users (MAUs) of 330 million as of third quarter are derived from growth in both United States and the international market. Twitter’s revenues are highly dependent on the international market.

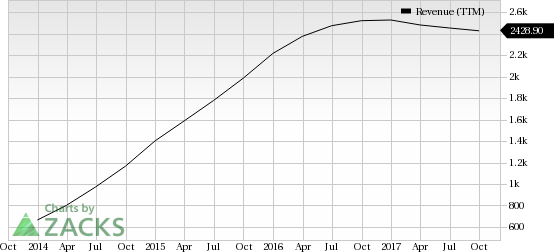

In the last reported quarter, the company earned nearly 43.7% of its revenues from international markets. International revenues increased 6% year over year to $258 million in the third quarter while U.S. revenues decreased 11% year over year to $332 million.

The company’s focus to expand globally as the domestic market nears saturation is prudent in our view. Under its re-elected CEO, Jack Dorsey, the company is focusing on boosting user growth rate and engagement levels.

We believe that with an increase in engagement levels, Twitter’s ad revenues should benefit greatly. This is very important for a company that is undergoing a slowdown in ad revenues, its primary growth driver. In the last reported quarter, advertising revenues were down 8% year over year.

We note that the developing nations offer wide scope for growth because of lower Internet penetration due to lack of proper infrastructure. Twitter Lite will help the company to counter increasing competition from peers like Google, Facebook (NASDAQ:FB) and Snap (NYSE:SNAP) who are all striving to expand their user base in emerging nations.

However, apart from resolving problems related to Internet access, the company also needs to focus on hurdles in the emerging nations such as lack of awareness regarding social media platforms and unavailability of smartphones, in our view.

Zacks Rank

Twitter sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Twitter, Inc. (TWTR): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Original post

Zacks Investment Research