First-quarter earnings season is heating up. Among some of the high-profile names set to report this week are Twitter Inc (NYSE:TWTR) and Snap Inc (NYSE:SNAP), with results from each due April 23. Both social media stocks have a history of making outsized moves after earnings, and a positive reaction for outperforming TWTR and SNAP could shake some of the weaker bearish hands loose.

Twitter's Weekly 4/28 Options Hot Today

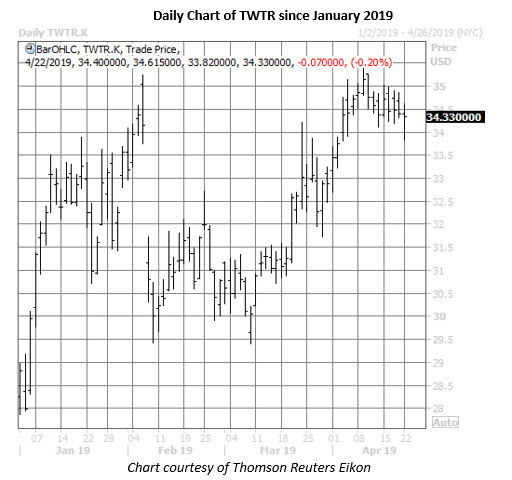

Twitter will report first-quarter earnings ahead of tomorrow's open, and the stock is down 0.2% at $34.33 in today's trading. Over the past eight quarters, TWTR has averaged a single-session post-earnings swing of 12.6%, regardless of direction, with the options market pricing in a slightly bigger 15.9% move for Tuesday's session.

The shares have closed higher the day after earnings exactly four times in the past two years, and there's plenty of skepticism to unwind, should Twitter stage another post-earnings breakout. Specifically, 18 of 25 brokerages maintain a "hold" or "strong sell" rating on TWTR, even though it's gained 19% year-to-date. More recently, the stock has added 17% since an early March test of the $30 level.

Today's options traders are positioning for another post-earnings pop. Amid accelerated trading -- the 80,000 calls traded so far is two times the expected intraday amount -- buy-to-open activity has been detected at the weekly 4/26 35- and 38-strike calls, implying expectations TWTR stock will rally above the strikes by the close this Friday, April 26.

Snap Stock Holds Above Support Before Earnings

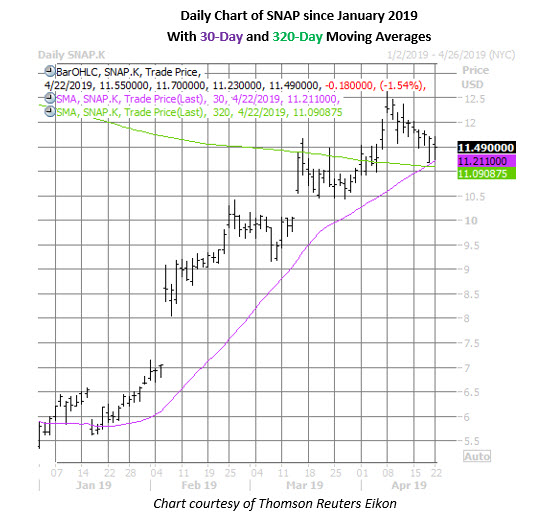

Snap stock has put in a tremendous performance on the charts this year, more than doubling since its Dec. 31 close at $5.51. Ahead of the firm's turn in the earnings confessional after tomorrow's close, the shares are down 1.5% at $11.49 but are finding a familiar floor at their rising 30-day moving average. Just below here is the equity's 320-day trendline, a former layer of resistance that could switch to a more supportive role.

Looking back at the past two years' worth of earnings data, SNAP stock has averaged a one-day post-earnings move of 19.8%. This time around, Trade-Alert currently places the stock's implied earnings deviation at a loftier 23.9%. There's been just one other time the shares have matched or exceeded this expected move in the session after earnings -- a 47.6% surge in February 2018. Snap came close last quarter when it jumped 22% the day after earnings.

Options traders have been loading up on long calls an accelerated clip in recent weeks. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), SNAP's 10-day call/put volume ratio of 2.89 registers in the 93rd annual percentile, meaning the rate of call buying relative to put buying has been quicker than usual.

Elsewhere, short sellers have been reducing their exposure to Snap shares. Short interest fell 21.3% in the two most recent reporting periods to 92.31 million shares. It would still take shorts more than a week to cover these remaining bearish bets, at the average pace of trading, which could create bigger tailwinds for SNAP stock.

Meanwhile, there's room for analysts to upwardly revise their outlooks for outperforming SNAP, considering 87% maintain a "hold" or "strong sell" rating on the stock. Plus, the average 12-month price target sits below current levels at $9.89. Earlier today, in fact, Credit Suisse (SIX:CSGN) raised its Snap price target to $13 from $10.50, saying "the Android App's release serves as another step in the long-term recovery."