If you’re a newbie to the Wall Street Daily Nation, you’re in for a real treat.

Each Friday, I try my darndest to zip my lips and let some carefully selected graphics do the talking for me.

This week, I’m dishing on Twitter’s highly anticipated (and highly overvalued) IPO, the stock massacre that wasn’t and a thief that robs us all.

Pictorial enlightenment begins in three, two, one…

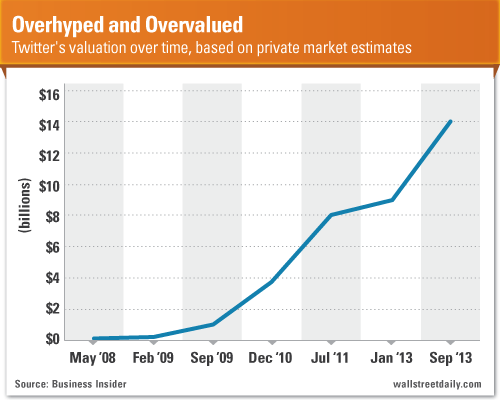

The Tweet Heard Round the World

Social media mania is heating up yet again. And all it took was 135 characters (including spaces) to do it.

And now inquiring minds want to know: Will the Twitter IPO be hot or not?

Well, as I’ve said countless times before, IPO performance always comes down to valuation. (Remember Facebook (FB), anyone?)

One look at this chart should immediately dampen any rational investor’s expectations.

If you still can’t resist the temptation to buy into the hype, at least be smart about it. Check out my colleague Marty Biancuzzo’s latest piece here. He ferreted out two less-risky ways to get a piece of the action.

Rest assured, I’ll be providing more analysis on Twitter’s upcoming IPO in the weeks ahead, too.

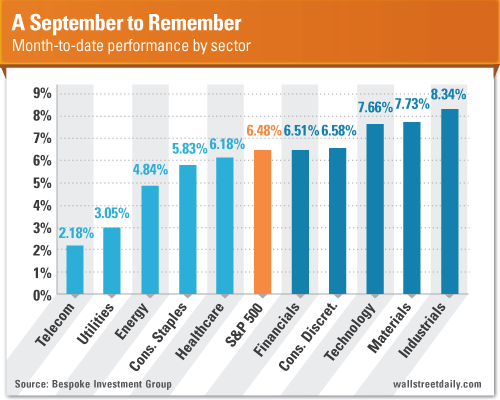

A Double Whammy for Market Pundits

So, yeah, that whole September taper thing that everyone expected to be announced Wednesday? It didn’t happen. (We told you so.)

And that thing about September being the worst month for stocks? Yeah, it doesn’t appear to be happening, either. (We told you so.)

So far this month, the S&P 500 Index is up 6.48%.

On a sector-by-sector basis, cyclicals are outperforming the S&P 500 Index. (The energy sector is the lone exception.) Whereas defensive sectors are underperforming the market. Take a look:

As Bespoke Investment Group notes, the discrepancy is “typical in a strong market.” Indeed!

If you’re putting new money to work, buy into the strength by finding undervalued opportunities in the best-performing sectors. If you need help, we’re here for you.

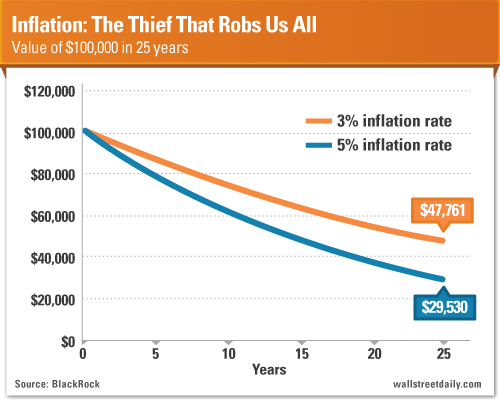

Use Protection

Rich or poor, old or young, inflation is the thief that robs us all. And a new chart out from BlackRock demonstrates how costly even moderate inflation can be.

A mere 2% bump in inflation rates can mean the difference between eroding 52% versus 70% of our wealth over time.

Inflation might not be at the top of everyone’s worry list right now. But it’s going to be eventually, given that the Fed is dead set on printing money into eternity. So a little gold could go a long way to protect us.

That’s it for this week. Before you go, though, let us know what you think of this weekly column – or any of our recent work at Wall Street Daily.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Twitter Hype, The Stupidity Of Crowds And A Thief That Robs Us All

Published 09/20/2013, 06:26 AM

Updated 05/14/2017, 06:45 AM

Twitter Hype, The Stupidity Of Crowds And A Thief That Robs Us All

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.