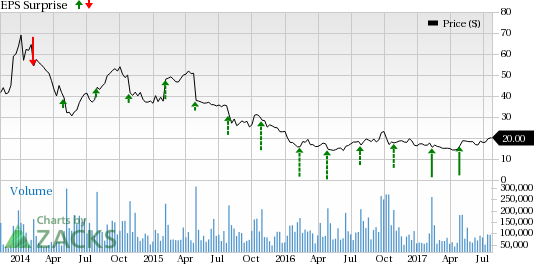

Twitter, Inc. (NYSE:TWTR) is set to report second-quarter 2017 results on Jul 27 before the opening bell. The company recorded a positive earnings surprise of 68.75% in the last quarter. It has also delivered an average positive earnings surprise of 50.37% over the trailing four quarters. Let’s see how things are shaping up for this announcement.

Factors to Consider

User growth (especially daily average users) and ad revenues will remain investors’ areas of interest in the upcoming results.

In the last reported quarter, Twitter recorded a relatively impressive increase in monthly average users (MAUs) with a jump of 2.8% sequentially and 6% year over year. Also, daily average users (DAUs) were up 14%. This has somewhat renewed interest in the stock.

We note that Twitter has vastly outperformed the industry in the last three months. While the stock returned 26.4%, the industry gained 11.6%.

Though with a little over 328 million users, Twitter falls way behind other social media services like Facebook Inc (NASDAQ:FB) , which has over 2 billion users. The complex nature of the service has been often considered a major hindrance to user growth.

Twitter has been making user-friendly changes to its platform to make it more appealing. In the second quarter, the social media platform announced that it has revamped its mobile app to make it simpler to use, including bolder headlines and easier to reply to tweets.

Moreover, to improve ad revenues, Twitter has been hawk eyed on boosting video content, especially “live” content on its platform. This is because online video content generates relatively more revenues than its text-based counterparts.

However, given the ad revenue potential, competition is fast intensifying in this space, with all social media companies – including Twitter, Facebook and Snapchat – pumping huge amount of resources to increase live-video viewing on their platform.

For the second quarter, adjusted EBITDA is expected to be in a range of $95–$115 million while EBITDA margin is expected to be in a band of 21–21.5%.

Earnings Whispers

Our proven model does not conclusively show that Twitter is likely to beat earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Twitter has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate stand at a loss of 12 cents.

Zacks Rank: Twitter sports a Zacks Rank #1. Though Zacks Ranks #1, 2 or 3 increase the predictive power of the ESP, the company’s Earnings ESP of 0.00 makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 and 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some stocks that, per our model, have the right combination of elements to post an earnings beat this quarter.

Cypress Semiconductor Corp (NASDAQ:CY) has an Earnings ESP of +11.11% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

PayPal Holdings Inc (NASDAQ:PYPL) has an Earnings ESP of +3.13% and a Zacks Rank #2

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Facebook, Inc. (FB): Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Twitter, Inc. (TWTR): Free Stock Analysis Report

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

Original post

Zacks Investment Research