Headquartered in San Francisco, CA, Twitter Inc (NYSE:TWTR) is a platform that connects a user to a network of people, news, ideas, opinions and information on a global scale. A user can tweet his/her take on any subject in real time, which can be retweeted by others. Tweets are limited to 140 characters.

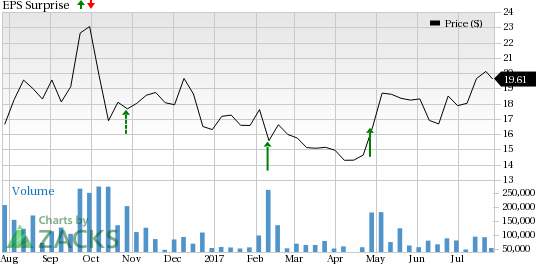

Zacks Rank: Currently, Twitter has a Zacks Rank#1 (Strong Buy) but that could change following its second quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key details from the just-released announcement below:

Earnings: Twitter reported adjusted loss per share of 2 cents that came in much narrower than the Zacks Consensus Estimate of loss of 12 cents. However, Twitter’s users at 328 million MAUs this quarter was unchanged from the first quarter of 2017 but grew 5% year over year. DAUs were up 12% year over year.

Revenue: Revenues of $573.8 million beat Zacks Consensus Estimate of $536.8 million Year over year, revenues were down 4.7%.

Key Stats: In the quarter, the company reported loss from operations of $38.4 million, narrower from $86.4 million reported in the prior year quarter.

Stock Movement:Twitter shares are down over 8% following the second quarter 2017 results.

Check back later for our full write up on this TWTR earnings report later!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Twitter, Inc. (TWTR): Free Stock Analysis Report

Original post