Shares of Twilio Inc. (NYSE:TWLO) jumped over 10% during yesterday’s after-hours trade, as the company’s splendid second-quarter results and upbeat 2017 outlook overshadowed the effect of loss of some business from Uber.

Twilio reported second-quarter results yesterday, wherein the top line came ahead of our expectations, while the bottom line matches the same. Also, the company witnessed year-over-year improvement on both the counts.

Recovers from Uber Hangover

The recently reported strong quarterly results clearly indicate that the company has been able to mitigate the loss of revenues from Uber.

It should be noted that Uber uses Twilio services for a variety of used cases such as driver and rider communication, driver marketing and several others. Till 2016, Uber used Twilio’s platforms in most of its geographical operations. However, since first-quarter 2017, Uber is “optimizing by used case and by geography” and is planning to "move communications for some use cases in-app." This means that Uber is now trying to operate its messaging services internally.

Looking at the recent development in its biggest customer’s strategy on communication services, Jeff Lawson is concerned and opines that this will restrain Twilio’s overall growth in 2017. Uber’s contribution to Twilio’s revenues has now declined to approximately 9% in the second quarter from roughly 12% in the previous quarter and 13% in the year-ago quarter.

Despite this, the company managed to report robust revenue growth, as well as narrowed its quarterly loss per share on a year-over-year basis, returning itself once again on growth trajectory mainly due to its sustained focus on launching new products, global expansion, go-to-market sales and acquisition strategies.

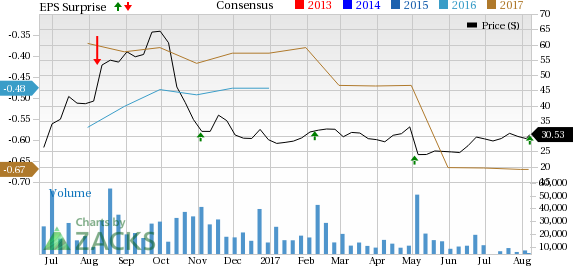

Notably, Twilio’s shares have outperformed the industry to which it belongs to in the last three months. The stock has gained 31.8% in the said period, while the industry recorded growth of just 3.1%.

Let’s discuss second-quarter results in detail.

Quarter in Detail

The company’s second-quarter revenues surged 48.6% year over year to $95.9 million and surpassed the Zacks Consensus Estimate of $86 million. Also, it came ahead of management’s previously guided range of $85.5–$87.5 million. Furthermore, the company’s base revenue jumped 55% year over year, while excluding Uber, it escalated even at a faster rate of 65%.

The robust top-line performance was mainly driven by remarkable year-over-year growth in active customer account which was a result of the company’s consistent focus on introducing products and its go-to-market sales strategy.

During the reported quarter, the company registered a whopping 41% rise in active customer accounts, adding over 12,651 accounts in the last 12 months, bringing the total count to 43,431 as of Jun 30, 2017. During the second quarter alone, Twilio added over 2,700 active customer accounts.

Moreover, the company announced that “We had a total of 42 product announcements around SIGNAL this year, including Twilio Functions, our serverless computing product, new analytics products, our voice recognition product we built in conjunction with Google (NASDAQ:GOOGL) and support for several new third-party communications channels like Alexa, Slack, Twitter and email for companies want to communicate with their customers in a growing list of new mediums.”

Non-GAAP gross profit jumped 50.7% year over year to $54.9 million, while margin expanded 80 basis points (bps) to 57.2%. Per Twilio, year-over-year increase was stemmed by the combination of efficiency gains and a better product mix.

Non-GAAP operating expenses flared up 41.4% year over year to $59.6 million. The year-over-year surge was mainly due to increased investment in research and development, and sales to capitalize on the market opportunity. However, as a percentage of revenues, the figure contracted 310 bps to 62.2% from 65.3% in second-quarter 2016.

Further, the company’s non-GAAP operating loss came down to $4.7 million from $5.7 million reported in the year-ago-quarter. Non-GAAP net loss came in at $4.8 million or 5 cents per share, down from the year-ago quarter figure of $5.9 million or 8 cents. Also, non-GAAP loss per share came much below the management’s guided range of a loss of 10–11 cents. The year-over-year improvement in the bottom line was mainly driven by sturdy top-line growth, which was partially offset by elevated operating expenses and higher share count.

The company’s adjusted loss (including one-time expenses and income but excluding stock based compensation) of 20 cents per share, came in line with the Zacks Consensus Estimate.

The company exited the quarter with cash and cash equivalents of $289.2 million, slightly up from $288.5 million at the end of the previous quarter. In addition, during the first half of the year, the company uses $4 million worth of cash for operational activities.

Outlook

Buoyed by strong quarterly performance, Twilio raised its full-year outlook and provided encouraging guidance for the third quarter. For 2017, Twilio now expects revenues to come between $371 million and $375 million (mid-point $373 million), up from $356–$362 million (mid-point $359 million) projected earlier. This is significantly higher than the Zacks Consensus Estimate of $359.16 million.

Similarly, base revenue is estimated to be in the range of $348.5–$350.5 million, higher than the previous forecast of $340–$343 million. Non-GAAP net loss is now projected to come in the range of 22–24 cents, much lower than its previous projection of 27–30 cents per share.

For the third quarter, Twilio estimates revenues to come between $91 million and $93 million (mid-point $92 million). This is higher than the Zacks Consensus Estimate of $89.04 million. Base revenue is anticipated to be in the range of $86.5–$87.5 million. Non-GAAP net loss is projected to come in the 7–8 cents per share range.

However, the company expects that loss of business from Uber will continue to affect its base revenue growth and expansion rate till mid 2018.

Our Take

San Francisco, CA-based Twilio offers cloud-based software that helps developers make and receive phone calls, text messages and video chats. The company boasts a strong clientele that includes the likes of Netflix (NASDAQ:NFLX) , salesforce.com (NYSE:CRM) and Twitter among others. Furthermore, the long-standing relationship with Amazon (NASDAQ:AMZN) is particularly noticeable. Twilio uses Amazon Web Service (AWS) to host its platform. Additionally, Amazon invested during Twilio’s Series E round funding in 2015.

The company’s key initiatives, which include product innovation, global expansion and acquisitions, are helping it in gaining customers, which bodes well for long-term growth. We opine that proliferation in cloud and mobile penetration across the globe will continue to fuel Twilio’s customer growth over the long run.

However, Uber’s recent strategy on utilizing communication services will have a negative impact on Twilio’s overall prospects throughout this year. Furthermore, intensifying competition in the communications market and growing prevalence of in-app push notifications are major concerns. Moreover, customer concentration is a headwind.

Currently, Twilio carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Twilio Inc. (TWLO): Free Stock Analysis Report

Salesforce.com Inc (CRM): Free Stock Analysis Report

Original post