Cloud name Twilio Inc (NYSE:TWLO) is down 4.5% at $70.98 in afternoon trading, as options traders gear up for the company's third-quarter earnings report, which is slated to surface after the market closes this Tuesday, Nov. 6. Below we will take a look at what the options market has priced in for the stock's post-earnings moves, and see how TWLO has been faring on the charts of late.

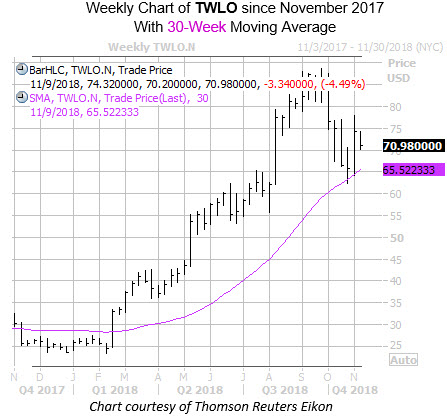

Twilio has been an overall outperformer on the charts during the past year. The cloud concern has more than tripled year-to-date, and in late September surged to a fresh record high of $88.88. TWLO stock recently suffered a notable sell-off alongside the rest of the equities market, but the dip was quickly contained by its rising 30-week moving average.

Digging into its earnings history, TWLO closed higher the day after reporting in five of the last eight quarters, including impressive 18% gains after the last two events. Looking broader, the shares have averaged a 12.6% move the day after earnings over the last two years, regardless of direction. This time around, TWLO options traders are expecting a nearly double 23% swing for Wednesday's trading.

Looking toward option-buying trends, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows Twilio stock with a 10-day put/call volume ratio of 1.00, ranking in the 93rd annual percentile. In other words, puts have been bought to open over calls at a faster-than-usual clip during the past two weeks -- indicating a skeptical mood among speculative players as TWLO earnings approach.

Despite steep pre-earnings implieds, TWLO has regularly rewarded holders of its options over the last 52 weeks. The stock's Schaeffer's Volatility Scorecard (SVS) reading stands at a 92 (out of 100), meaning TWLO has tended to make outsized moves over the past year, relative to what the options market has priced in -- a boon to premium buyers. And with 7.3% of the stock's float sold short, an upside surprise could spark a short squeeze -- potentially sparking another bigger-than-forecast earnings move this week.