Assume you have annual income of $60,000 and credit card debt of $10,000. No problem.

Assume you have the same income but credit card debt of $360,000. Big problem!

The US government has annual income of approximately $3 Trillion and official debt in excess of $18 Trillion. This does not count other liabilities such as Fannie and Freddie, and massive unfunded liabilities. But assuming “only” $18 Trillion in debt (optimistic) the US has the same ratio as a family with $60K income and $360K in credit card debt.

But this is not recognized as a problem because the Treasury sells bonds and the Fed “prints” the currency to buy the bonds. Debt increases and the US government spends. Life is good for politicians and bankers.

When does massive debt become a problem?

The US government “rolls over” the debt, pays the interest, and borrows more. This works as long as global confidence in the dollar remains solid.

But as the world increasingly shuns the dollar, chooses to transact business in other currencies, and uses the dollar less, those dollars held in foreign reserves probably will flood home and create a tidal wave of domestic inflation.

You might think that can’t happen because the dollar is king and the US has a massive military to enforce “dollar discipline” upon other countries. But history shows that reserve currency status lasts until another country rises to replace the formerly dominant country, such as when the US and the dollar replaced Great Britain and the British pound. China is rising and stockpiling gold, the only real money and soon to become a far more valuable asset. By contrast, the western world is selling its gold and delaying the inevitable devaluation of our un-backed fiat currencies. This is a big problem for the west but good for Asia.

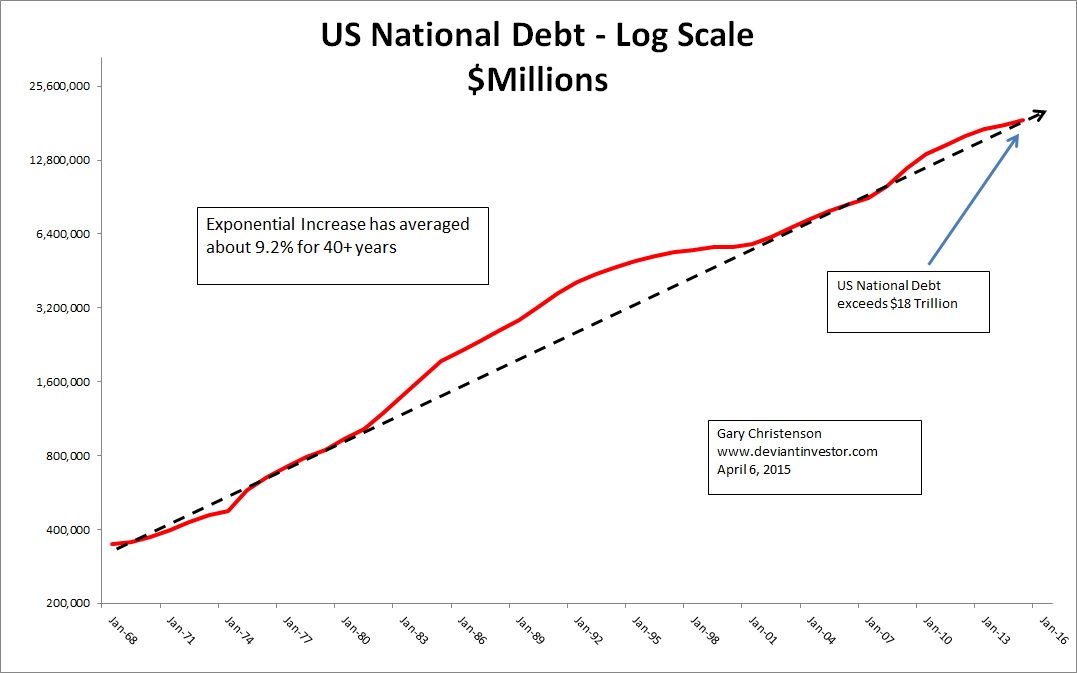

Examine the following log-scale graph of US official debt. Debt is growing at 9% per year while the economy limps along at 1% or 2% (depending on dodgy inflation estimates and who is counting) and is not sustainable.

WE CAN CONCLUDE

The model of increasing debt growing far more rapidly than the underlying sluggish economy, which must support that debt is not sustainable.

The mismanaged currencies will eventually implode, crash and burn, or reset in some traumatic way, but perhaps not soon. Think yen, euros, pounds, dollars and currency crisis.

Central bank and government mismanagement is similar to massive individual credit card debt backed by inadequate income. What happens when the credit card company cranks up the interest rates or the individual loses his source of income?

The difference is that the US, the EU, Japan and the UK “print” currency to cover the revenue shortfall, while our hypothetical individual does not have that option.

There is no free lunch in global economics. Eventually someone pays for the excessive expenses. Currently savers and pension funds are generating minimal income from the artificially low interest rates that central banks have forced upon our respective economies. They are “paying” through their reduced income, and everyone is “paying” with devalued currencies and higher prices.

Swiss Interest yields out to 10-year are currently negative. Germanyields are negative. What rational person will “invest” euros with a guarantee of negative earnings for 10 years in an unstable currency that might not even exist in a few years? This bond market insanity arose from weak economies, bad management, corrupt banking, and controlled markets.

Gold and silver are real assets, not denominated in a currency backed by the credit of insolvent central banks and politician promises.

The US bond market has been supported by printing trillions of dollars that purchased bonds and drove yields to multi-generational lows. In Europe yields have fallen negative as mentioned above. When bond “yields” are negative, those bonds are forecasting trouble. (Hint: buy gold.)

When debt is rolled over and never repaid, how much is the debt truly worth? Would you lend money to someone who assured you he could only repay the debt by borrowing a larger amount from another person? Clearly not, but this is normal in modern “twilight zone” finance.

Gold and silver are real. All paper currencies and fiat debt are less real, less solid, and less reliable. Worse, these are becomes increasingly less real and more unreliable every year as governments devalue their currencies.

My conclusion is that the world has slipped into a “twilight zone” of economic insanity and lost touch with real assets.