Twenty-First Century Fox, Inc. (NASDAQ:FOXA) just released its fourth-quarter and full-fiscal year 2017 financial results, posting earnings of $0.36 per share and revenues of $6.75 billion. Currently, FOXAis a Zacks Rank #3 (Hold), and is down 1.77% to $30.51 per share in after-hours trading shortly after its earnings report was released.

Twenty-First Century Fox:

Beat earnings estimates. The company posted earnings of $0.36 per share, topping the Zacks Consensus Estimate of $0.34 per share, which excludes $0.07 from non-recurring items.

Beat revenue estimates. The company saw revenue figures of $6.75 billion, beating our consensus estimate of $6.73 billion.

Twenty-First Century Fox reported a 2% rise in quarterly revenue, spurred by its cable business that brought in $4.33 billion. For the full-fiscal year 2017 the company reported revenues of $28.50 billion, with $16.13 billion coming from the cable sector.

The company reported fourth-quarter profit of $476 million, while FOXA posted full-year 2017 profit of $2.95 billion. The company’s earnings fell from $0.45 per share in the year-ago period.

“We delivered strong financial and operational momentum in fiscal 2017 driven by an acceleration in affiliate revenue growth which fueled fourth quarter cable segment OIBDA growth of 19%,” Executive Chairmen Rupert and Lachlan Murdoch said in joint statement. “The investment we have made in our video brands, and in programming that truly differentiates, is proving to be the right strategy.”

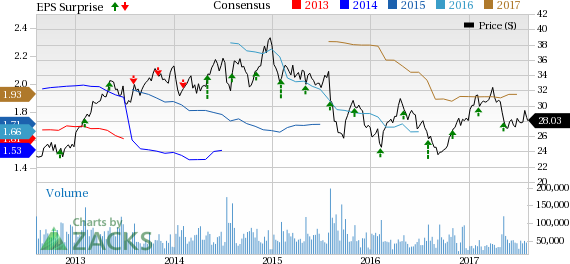

Here’s a graph that looks at FOXA’s Price, Consensus and EPS Surprise history:

Twenty-First Century Fox, Inc. is involved in creating and distributing media services. Its business portfolio consists of cable, broadcast, film, pay TV and satellite assets. Twenty-First Century Fox, Inc., formerly known as News Corporation, is based in New York, United States.

Check back later for our full analysis on FOXA’s earnings report!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Original post

Zacks Investment Research