On Friday, December 14th, Credit Suisse announced a 10:1 reverse split of the VelocityShares Daily 2x VIX ST ETN (TVIX), effective the 21st. I had pretty much given up on TVIX it because its price had slid way past the logical reverse split point and has traded below $1 for the last 16 trading days. However instead of fading to black, TVIX will soon be back into a reasonable trading range.

In addition to a reverse split it appears that Credit Suisse has been working on TVIX’s tracking problems. In February 2012 Credit Suisse got nervous about the rapid growth and size of TVIX, and temporarily pulled the plug on new share creation.

Market makers need the share creation process to keep the price of Exchange Traded Products (ETPs) from rising too far above their Net Asset Value (NAV). Typically if the ETP’s price floats too high they short the security with the knowledge that the ETP issuer is usually happy to issue new shares at the NAV price they can buy to cover the short—guaranteeing the market maker a risk-free profit. The selling naturally drives the price of the security down.

Credit Suisse restarted partial share creations a month later, but in the interim the NAV of TVIX had plummeted 56%—while the market price of TVIX only floated down 15%. The resultant correction vaporized $277 million of TVIX value in a day. Subsequent tracking still wasn’t great—Credit Suisse’s partial solution was expensive for the market makers and only profitable for them to short the ETP if it was 5% to 15% above the NAV price—better but still a horrible tracking percentage.

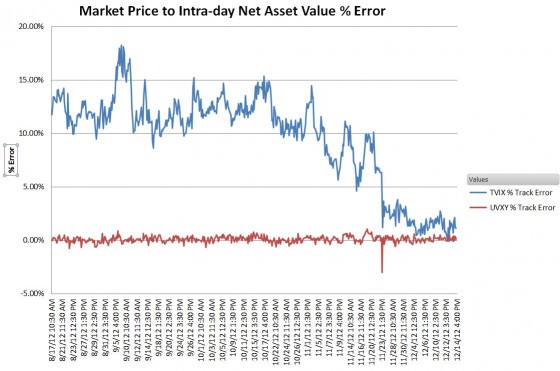

Apparently Credit Suisse has been working on the share creation problem. The TVIX prospectus was revised in early November and starting November 23rd, TVIX’s tracking improved considerably. The chart below shows its tracking error alongside of ProShares’ VelocityShares Daily 2x VIX ST ETN (UVXY) — its closest competitor.

When TVIX’s tracking error dropped suddenly on November 23rd it appears that it spooked some investors into dumping their UVXY. It took its market makers a while to right the ship…

We’ll have to watch this for a couple of weeks, but it appears that TVIX’s tracking error has dropped into a much more reasonable 2% to 3% range.

Year to date in 2012 TVIX is down an astonishing 97%, but it was even a worse year than normal for 2X leveraged volatility funds. Next year I project a 90% loss, so TVIX might not require reverse splitting until around December 2013.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

TVIX Gets A New Lease On Life

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.