Tutor Perini Corporation’s (NYSE:TPC) earnings improved nearly 37% year over year to 59 cents in second-quarter 2017 from 43 cents recorded in the year-ago quarter. Earnings also beat the Zacks Consensus Estimate of 57 cents.

Operational Updates

Total revenue went down 4.7% year over year to $1,247 million, missing the Zacks Consensus Estimate of $1,416 million.

Barring Civil, revenues declined across all segments. Revenues in the Building segment dipped 6.8% to $508.8 million, while Specialty Contractors declined 11.6% to $281.9 million in the reported quarter. On the other hand, revenues in the Civil segment climbed 6.7% year over year to $428 million.

Cost of sales decreased 4.5% to $1,144 million from $1,198 million in the year-ago quarter. Gross profit was down 6.3% year over year to $102.8 million. Gross margin contracted 20 basis points (bps) to 8.2%.

General and administrative expenses flared up 12.9% year over year to $68.8 million. Operating profit came in at $34 million, plunging 30.3% from $48.8 million in the year-earlier quarter. Operating margin was 2.7%, reflecting a 100-basis point decline from 3.7% in the year-ago quarter.

Financial Updates

As of Jun 30, 2017, cash and cash equivalents were $172.9 million versus $146 million as of Dec 31, 2016. The company recorded cash used for operating activities of $34.6 million during the six-month period ended Jun 30, 2017, compared with cash inflow of $4.6 million in the comparable period last year.

Long-term debt, excluding current portion, amounted to $832 million as of Jun 30, 2017, compared with $673.6 million as of Dec 31, 2016.

Backlog and Pending Orders

Total backlog as of Jun 30, 2017, was $7.6 billion, up 21% compared to $6.2 billion as of Dec 31, 2016. Backlog grew this quarter as a result of the robust market demand.

Significant new awards in the second quarter included the I-74 bridge project in Iowa, the East Side Access CQ33 mass-transit project in New York, two healthcare building projects in California, additional scope of work for a technology office project in California, additional scope of work for the Hudson Yards Platform project, the Henry Hudson Bridge design-build project in New York, and the MD4 highway improvements project in Maryland.

Outlook

Tutor Perini affirmed its guidance for 2017, with revenue expected to be in excess of $5.5 billion and earnings per share expected in the range of $2.10–$2.40.

The company expects to gain from increased backlog and continued success in winning new projects, combined with the benefits anticipated from the FAST Act, California’s SB1 transportation bill and several large voter-approved transportation funding measures. Further, it continues to win contracts and has the prospects of winning future awards given significant volume of pending awards.

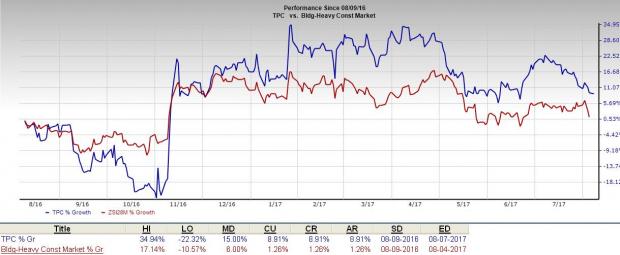

Share Price Performance

Over the last one year, Tutor Perini outperformed its industry with respect to price performance. The stock gained around 8.91%, while the industry recorded growth of 1.26% over the same time frame.

Zacks Rank & Stocks to Consider

Currently, Tutor Perini carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the sector include Sterling Construction Company, Inc. (NASDAQ:STRL) , KB Home (NYSE:KBH) and Owens Corning (NYSE:OC) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Sterling Construction has expected long-term growth rate of 11.00%.

KB Home has expected long-term growth rate of 16.66%.

Owens Corning has expected long-term growth rate of 14.80%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Owens Corning Inc (OC): Free Stock Analysis Report

Tutor Perini Corporation (TPC): Free Stock Analysis Report

Sterling Construction Company Inc (STRL): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

Original post

Zacks Investment Research