Turning Points For The Week Of March 4-8Summary

Federal Reserve presidents have all noted increased downside risks due to slowing growth, higher trade tensions, and the possibility of a hard Brexit.

The leading indicators are still modestly bearish; building permits are still declining, the four-week moving average of initial unemployment claims is moving higher, and the yield curve is still flat.

The weak employment report is the third weak coincidental economic indicator report in the last month.

The purpose of the Turning Points Newsletter is to look at the long-leading, leading, and coincidental indicators to determine if the economic trajectory has changed from expansion to contraction -- to see if the economy has reached a "Turning Point."

I've increased my recession probability in the next six to 12 months to 30%. The employment report is the third weak report in a row for a coincidental economic indicator. That, combined with the increased risks from a weaker EU and China, a hard Brexit, and increase trade tensions are too much to ignore

Before delving into the data, I wanted to look at Federal Reserve analysis -- or, more specifically, Fed analysis of economic risks along with recent policy pronouncements from the OECD. Let's start with the Fed.

Lael Brainard (emphasis added):

Policy uncertainty has been elevated recently and has been cited as an important factor in the financial volatility late last year ... Trade dispute escalation remains a risk ... Trade dispute escalation remains a risk ...

There are also important downside risks abroad. Most immediately, a "no-deal Brexit" would have adverse consequences for Britain, and potentially more broadly, given London's role as a financial center. Within the euro area, countries such as Italy and France face domestic challenges. And a hard landing in China would have spillovers through financial and trade channels.

NY Fed President Williams (emphasis added):

In addition, there’s geopolitical risk on the horizon that’s creating angst. I know we’re all on tenterhooks waiting to see what will happen at the end of this month to our good friends across the pond. And concerns around trade negotiations continue to loom large. These geopolitical risks leave an imprint on the economy as businesses put off hiring and investment decisions until the air has cleared.

Boston Fed President Rosengren (emphasis added):

However, many of the underlying global growth issues that generated the recent spate of financial-market concerns are as yet unresolved,” Rosengren said. These issues include slowing growth in China and Europe, constraints on international trade, the potential for Brexit-generated challenges, and problems at some European banks.

And this week, the OECD noted that global economies are slowing (emphasis added):

The global expansion is continuing to lose steam, and faster than anticipated a few months ago. Growth in Europe has been particularly disappointing, as trade growth both within the EU and with external partners has stalled. Business and consumer confidence has plummeted in advanced economies as trade tensions persist, high levels of policy uncertainty in Europe linger, and the pace of China’s slowdown continues to raise concerns.

At a minimum, the number of risks will depress sentiment, which in turn lowers activity. Should one of these risks materialize, growth will take a larger hit. There is a universal consensus regarding increased downside risks, which the OECD has noted is showing up in the data.

Leading Indicators

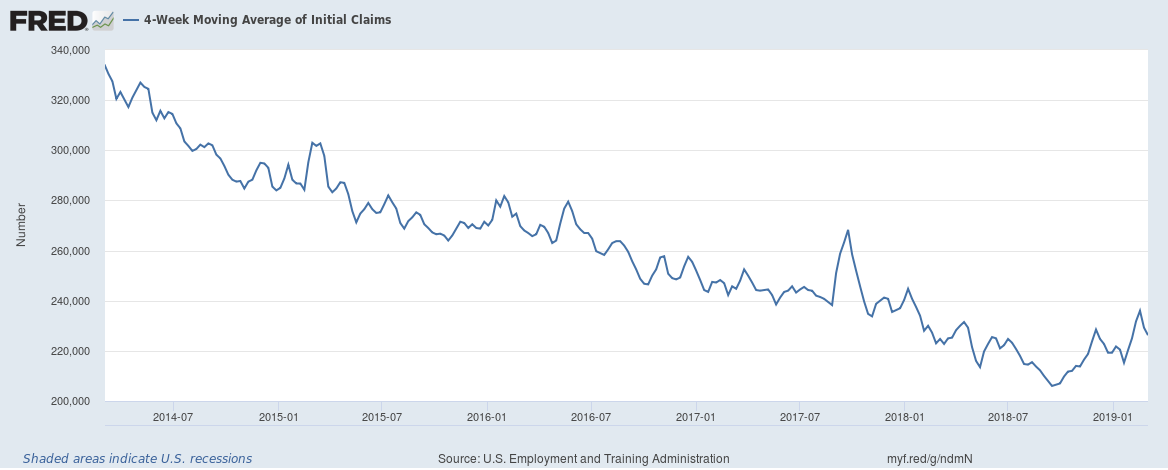

The only new data this week was the Department of Labor's release of initial unemployment claims:

The good news is this number declined in the last two weeks. But it remains in an uptrend that started in the 3Q18. It's still possible that it has reached its lowest point of this expansion.

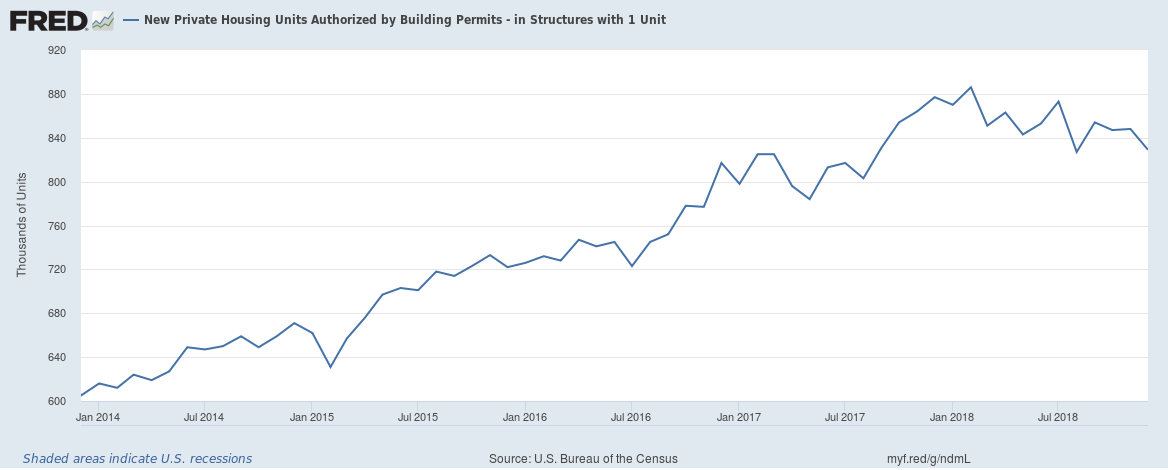

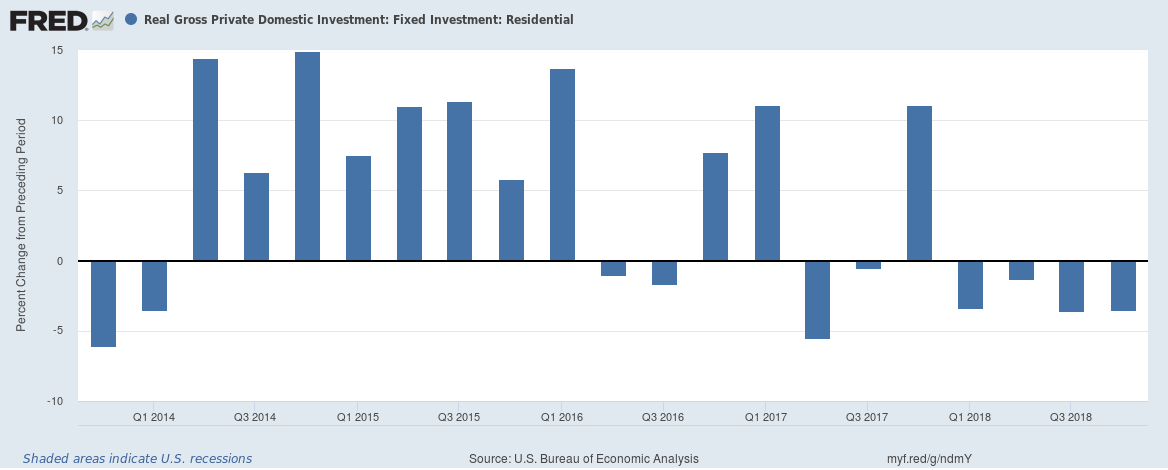

Due to the Fed's rate-hiking policy, building permits are still trending lower. In fact, residential investment has declined in six of the last seven quarters:

Finally, the yield curve is still compressed while sections of the curve are still inverted.

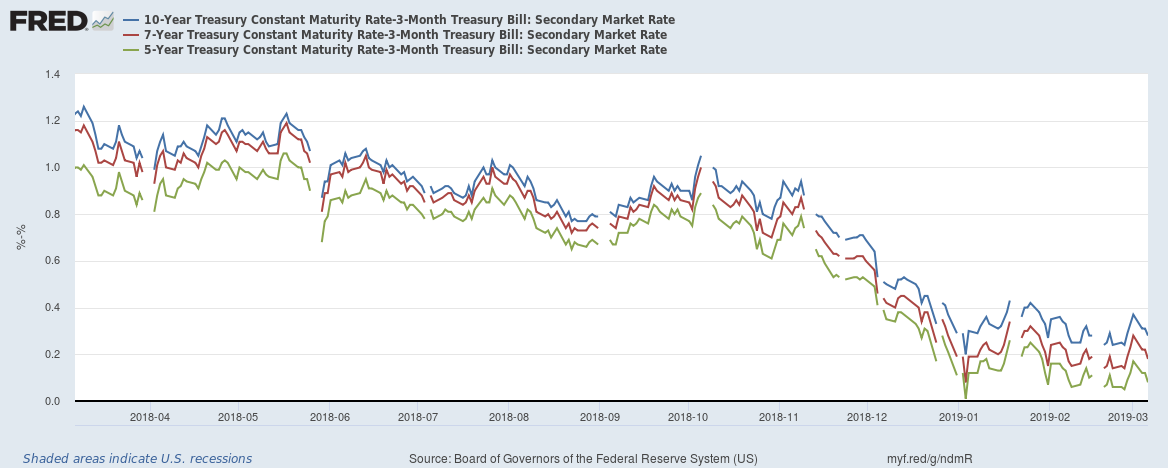

The 10-year-3-month spread continues to print between 20 and 40 basis points. Spreads in the belly of the curve (the difference between the 10-year-3-month (in blue), 7-year-3-month (in red), and the 5-year-3-month (in green)) are still very small. All three have remained below 40 basis points since February 1.

Spreads in the belly of the curve (the difference between the 10-year-3-month (in blue), 7-year-3-month (in red), and the 5-year-3-month (in green)) are still very small. All three have remained below 40 basis points since February 1.

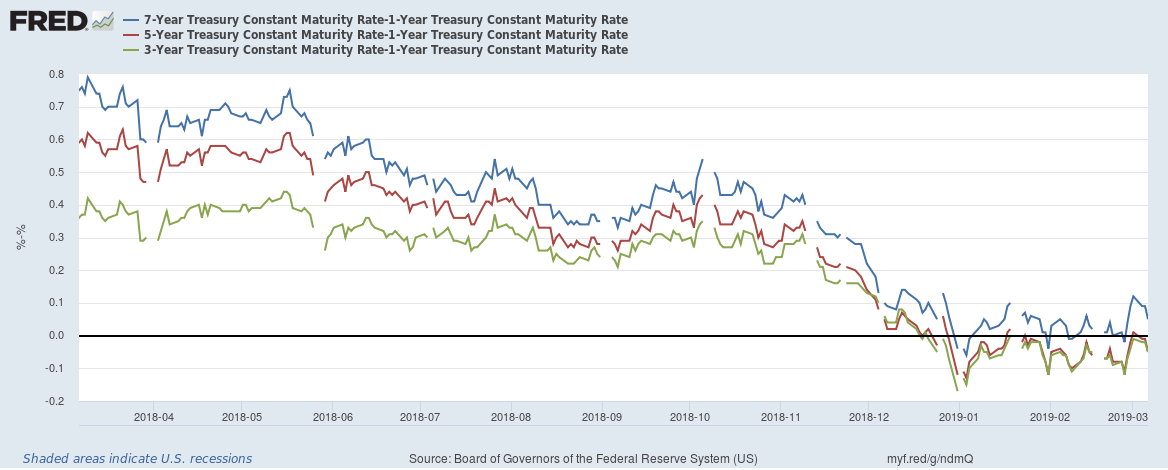

The 5-1 and 3-1 spreads (red and green, respectively) remain inverted. The 7-1 spread briefly inverted in early January and continues to flirt with inversion.

Coincidental Indicators

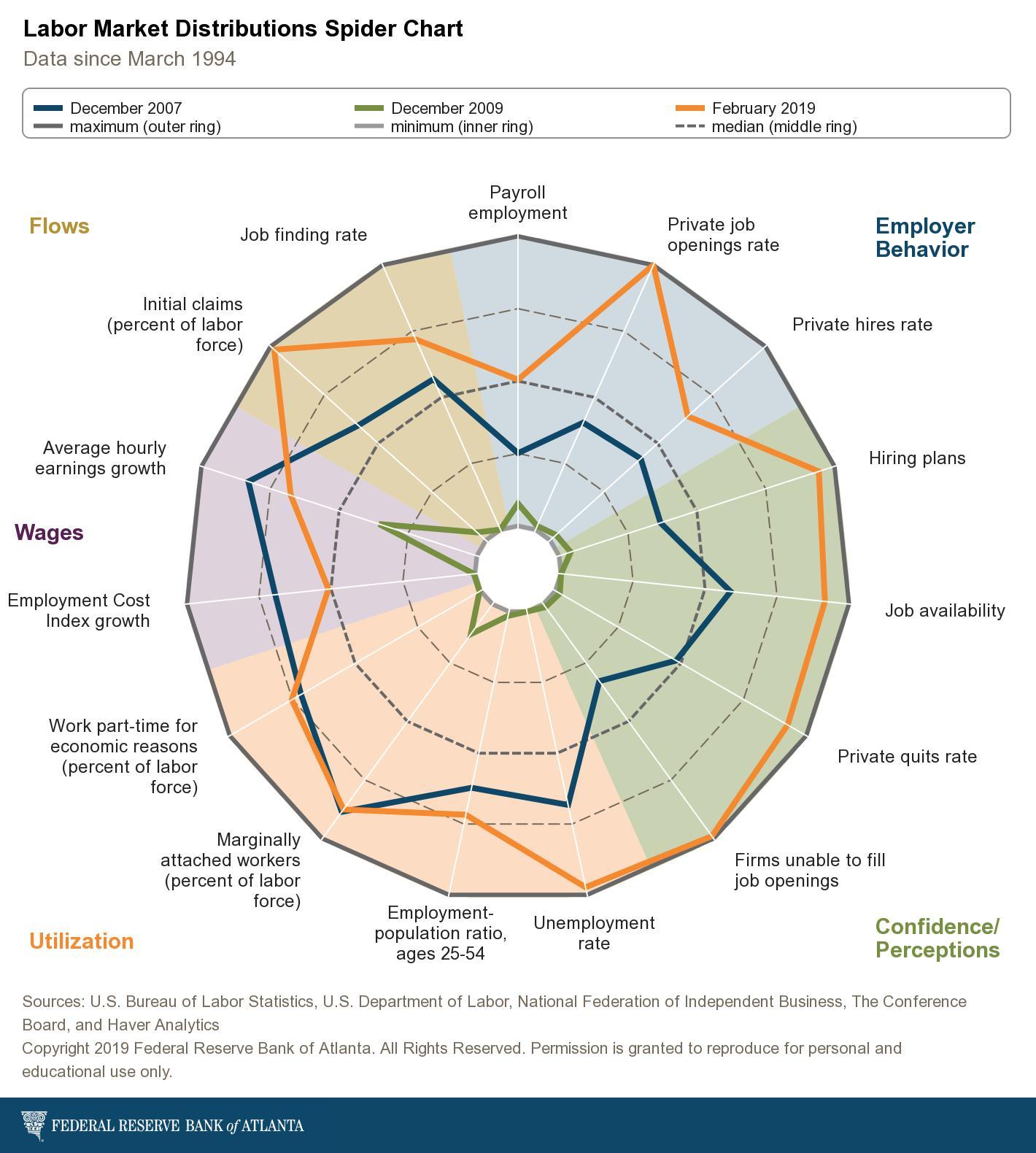

The latest coincidental economic data has not been encouraging. Both retail sales and industrial production dropped in their latest reports. Now we can add the labor market to the list of underperforming coincidental indicators. Before we look at the report, let's take a macro view of the labor market with the Atlanta Fed's Labor Market Spider Chart:

The gold line is the labor market now (without Friday's report) while the dark blue line represents the data from the peak of the last expansion. With the exception of utilization data, the current labor market is in far better shape than it was at the height of the last expansion.

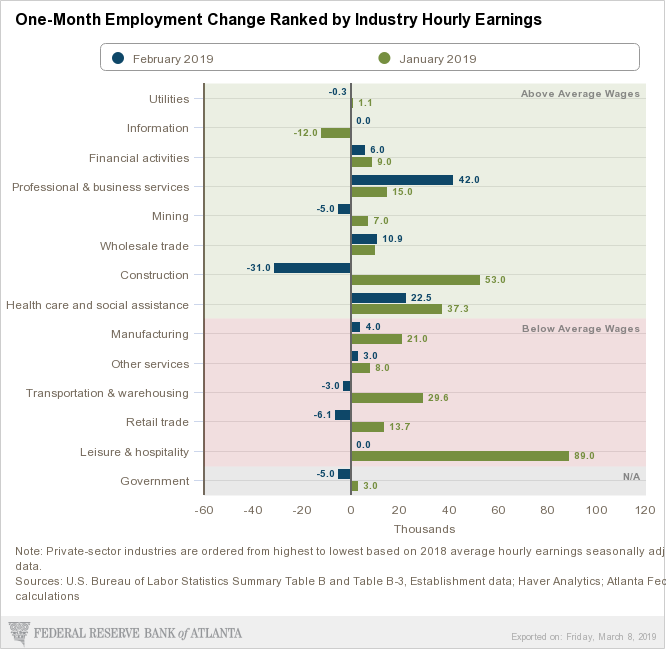

Which brings us to Friday's report, which had a mere gain of 20,000 establishment jobs -- a very weak reading. The following chart from the Atlanta Fed shows the changes in growth between the last two months:

Two drops immediately stand out: construction, which had an absolute decline of 84,000, and retail, with an absolute decline of 89,000. Combined, these total 173,000. Bad weather could have caused the former. It's possible to argue that a combination of bad weather and the government shutdown (which hit consumer sentiment hard) caused the decline in retail sales jobs.

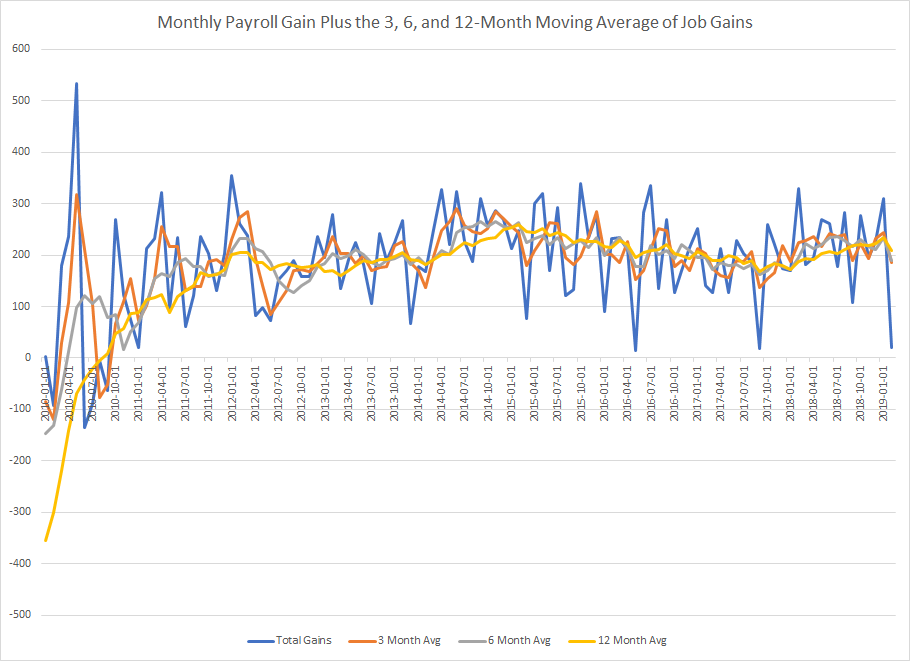

Despite the bad report, the moving averages are still strong:

The 3, 6, and 12-month moving averages of the monthly gain in establishment jobs are still clustered around 200,000 (186,000, 190,000, and 209,000, respectively).

Still, this is the third coincidental economic report in a row that has surprised to the downside in a pretty big way. For that reason, I'm increasing my recession probability in the next 6-12 months to 30%.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.