Turning Points For The Week Of March 18-22Summary

- An argument can be made that the economy is slowing but that a recession isn't imminent.

- Financial stress is low, corporate yields are down.

- The leading data is softer but not cratering. The coincidental numbers are still strong.

The purpose of the Turning Points Newsletter is to look at the long-leading, leading, and coincidental economic indicators to determine if the economic trajectory has changed from expansion to contract -- to see if the economy has reached a "turning point."

The nuts and bolts of this weekly newsletter are derived from the work of two economists: Arthur Burns and Geoffrey Moore. And I'm not the only person who writes on this material. Other sources also do similar work, the most prominent being the Conference Board, which publishes leading, coincident, and lagging economic indicators every month. But everybody uses more or less the same input data.

That being said, this week I'm going to look at a wider set of data to see if there's an argument that we're experiencing a slowdown rather than a prelude to a recession. There's a fair amount of data that supports the slowdown argument, starting with the Fed, which is now in a "wait and see" mode (emphasis added).

In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

The accompanying dot plot strongly implied there would be no more rate hikes this year. This is good news for the markets and economy, as it means that the cost of money will no longer increase.

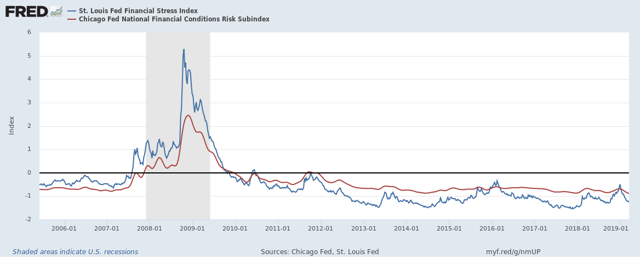

Financial stress -- which typically spikes before a recession -- is low:

The St. Louis Financial Stress Index (in blue) and Chicago Fed National Financial Conditions Risk Index are both at low levels. (The Kansas City number is as well, but it's only released monthly. And, as it uses the same base material as the St. Louis number, it's largely redundant).

The corporate debt markets have also come in across the risk spectrum:

AAA yields have declined from 3.8% to ~3.4% -- a decline of .5% or 50 basis points.

BBB yields are down about .6% or 60 basis points; they've fallen from 4.8 to 4.2%.

CCC yields have also come in; they've fallen from a high of 13. 79% to ~11.75.

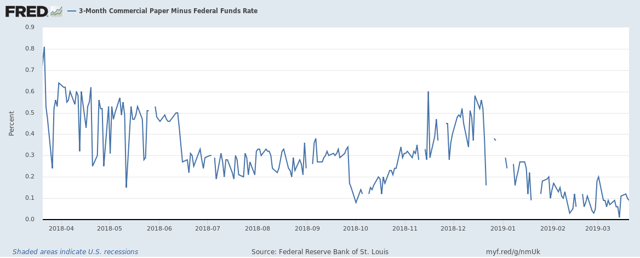

The three-month commercial paper spread is around. 1% - near its lowest level in a year.

The stock market has rebounded, retaking most of its gains (today's losses notwithstanding).

These financial market indicators all show an easing of credit terms and bullishness on the economy.

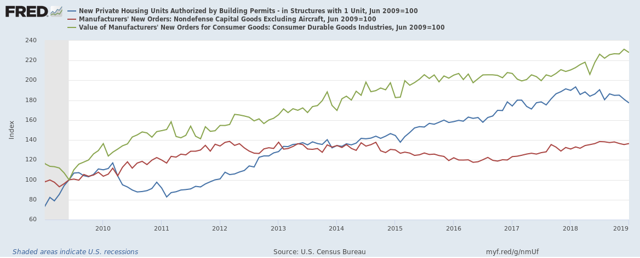

As for the non-financial leading indicators, most are softer but haven't crashed:

Building permits (in blue) are off, but they haven't cratered. New orders for durables goods ex-aircraft (in red) have declined modestly but are mostly higher. And new orders for consumer durable goods (in green) are still in good shape.

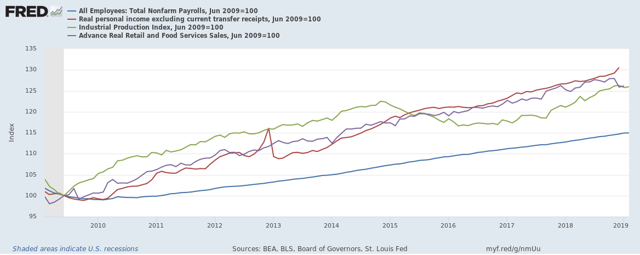

Finally, coincidental numbers are all in longer-term uptrends still:

Payroll employment (in blue) remains in a solid uptrend, real personal income ex-transfer payments (in red) is at a five-year high, retail sales (in blue) has been flat but hasn't cratered, and industrial production (in green) is still in good shape.

All these data points support an argument that the economy is slowing but that a recession isn't imminent.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.