Yesterday, the Turkish lira hit a new all-time high, as the Turkish Central Bank (TCB) cut its rate for the third month in a row, as it was initially expected. Also, we received the US initial and continuing jobless claims, which came out on the mixed side. During the early hours of the Asian morning today, it was Japan's turn to deliver its inflation numbers for October.

During the European morning, Norway released its QoQ Q3 GDP growth rate, which was much better than initially anticipated. However, the main focus was on the UK's retail sales numbers, core, and headline on a MoM and YoY basis. Later on, all eyes will be on the Canadian retail sales numbers for September.

Turkish Lira Gets Hit Once Again

Yesterday, the Turkish lira hit a new all-time high, as the Turkish Central Bank cut its rate for the third month in a row, as it was initially expected. The Bank's Committee decided to cut the one-week repo rate by 100 bps during yesterday's meeting. Back in October, the Bank cut the rate by a surprising 200 bps, and in September, the cut was for 100 bps. Turkey's President Erdogan continues to apply pressure on the TCB, as he believes that higher interest rates cause higher inflation. So far, this idea does not prove to be worthy, as inflation in the country continues to skyrocket.

US Jobless Claims Numbers

Also, we received the US initial and continuing jobless claims yesterday, which came out on the mixed side. The continuing ones have improved, falling below the forecast of 2120k and showing up at 2080k. However, the initial claims have moved above the forecasted 260,000 and come out at 268,000. That said, this was still 1,000 below the adjusted previous number of 269,000.

Nevertheless, this has been the second week in a row that the actual reading fails to beat the initial forecast. In addition to the initial and continuing jobless claims, the US delivered the Philadelphia Fed manufacturing index for November. Initially, the figure was believed to have improved just slightly, going from 23.8 to 24.0. However, the actual number showed up at 39.0. It's the highest it has been in six months.

Japan Inflation And Norway's GDP

During the early hours of the Asian morning today, it was Japan's turn to deliver its inflation numbers for October. The headline YoY figure rose for the second month in a row, showing up at +0.1%. The last time that the figure was not in negative territory was back in September 2020.

The main increases that drove the number higher were because of the fuel and utility prices. Recreational and cultural segments did move higher as well, contributing to a slight hike in inflation. The Japanese yen did not move much on the news, as we expect it to remain vulnerable mainly to the sentiment in the equity world and act as a haven.

During the European morning, Norway released its QoQ Q3 GDP growth rate, which came out much better than initially anticipated. The previous was at +1.0%, the forecast stood at +3.2%, but the actual number showed up at +3.8%.

The Norwegian krone strengthened against its major counterparts after the news was released. However, it may stay vulnerable mainly to the fluctuations in the price of oil. As the price is now moving lower, NOK could start losing ground again against some of its counterparts, such as EUR and USD.

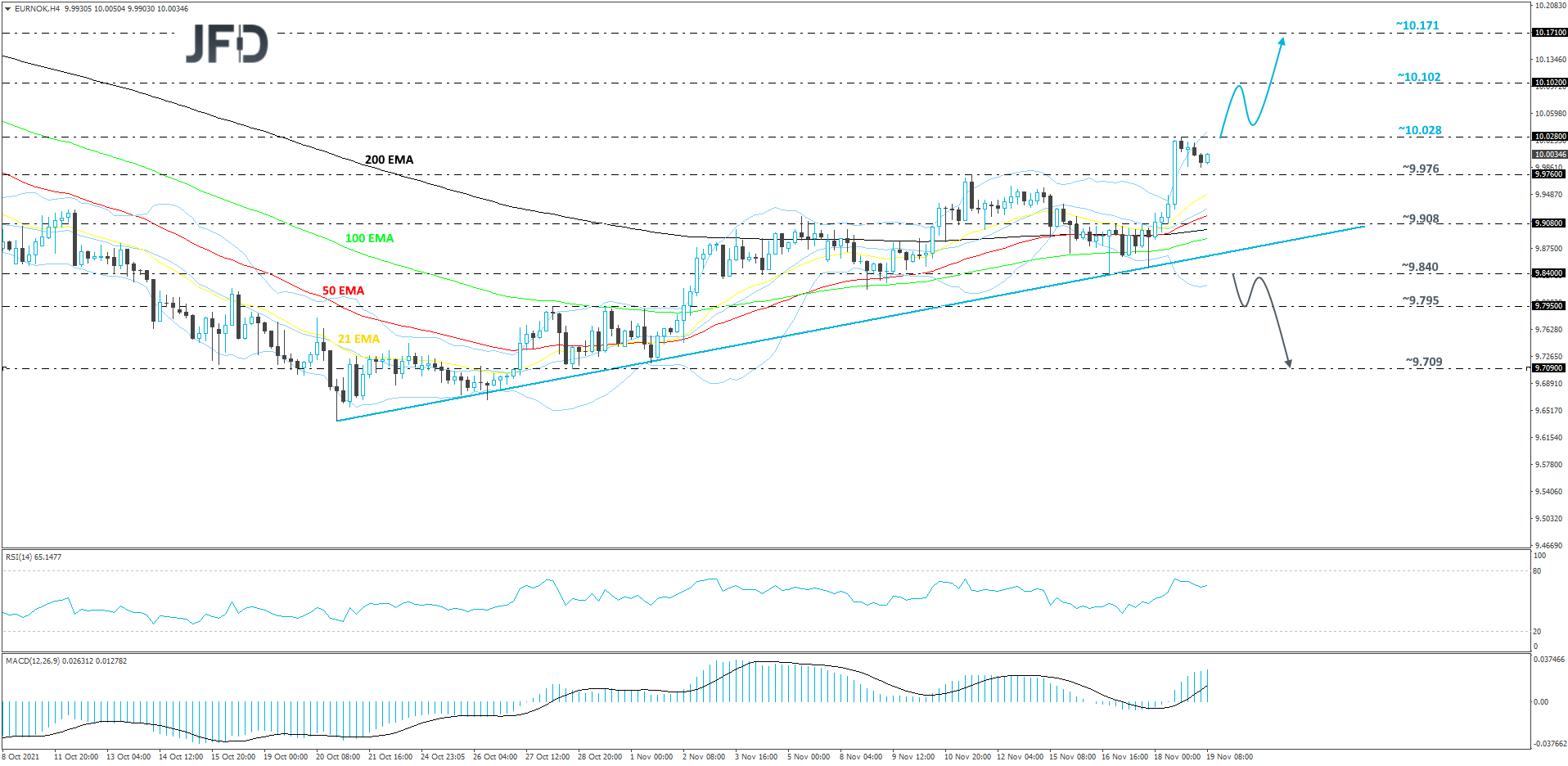

EUR/NOK – Technical Outlook

Looking at the technical picture of EUR/NOK on our 4-hour chart, we can see that the pair continues to run above a short-term upside support line drawn from the low of Oct. 20. As long as the rate stays somewhere above that line, we will continue aiming higher.

Suppose the pair makes a run above the 10.028 barrier, the current highest point of November. In that case, this will confirm a forthcoming higher high, possibly clearing the path towards higher areas. EUR/NOK could then rise to the 10.102 obstacle, a break of which may lead the rate to the 10.171 level, marked by the highest point of October.

On the downside, the pair would need a break of the aforementioned upside line. Also, a drop below the 9.840 hurdle, marked by the current lowest point of this week, might attract a few more sellers, as a forthcoming lower low would be confirmed. The pair may then slide to the 9.795 obstacle or even to the 9.709 area, marked by the low of Oct. 28.

UK and Canada Retail Sales

However, the main focus was on the UK's retail sales numbers, core and headline, MoM, and YoY basis. All readings managed to beat their initial forecasts. The October core MoM figure came out at +1.6%, against the expected +0.4%. The headline one appeared at +0.8% against the expected +0.5%. The last time the headline MoM number was in positive territory was back in April of this year. The pound reacted positively to the news and may continue rising a bit more, at least for now.

Later on, all eyes will be on the Canadian retail sales numbers for September. Unlike its neighbor, the US, which delivered its positive retail sales numbers on Tuesday, Canada is expected to show its figures below zero. The core MoM reading is forecasted to come out at -1.0%, which would be well below the previous +2.8%.

The headline MoM figure is believed to show up -1.7%, below the previous +2.1%. Suppose that is the case and the actual figures appear the same or lower than the forecast. In that case, this might have a slightly negative effect on the Canadian dollar, as the currency could remain mainly affected by the price of oil. Canada will also release its new housing price index for October on a MoM basis. That figure is believed to increase by a tenth of a percent, going from +0.4% to +0.5%.

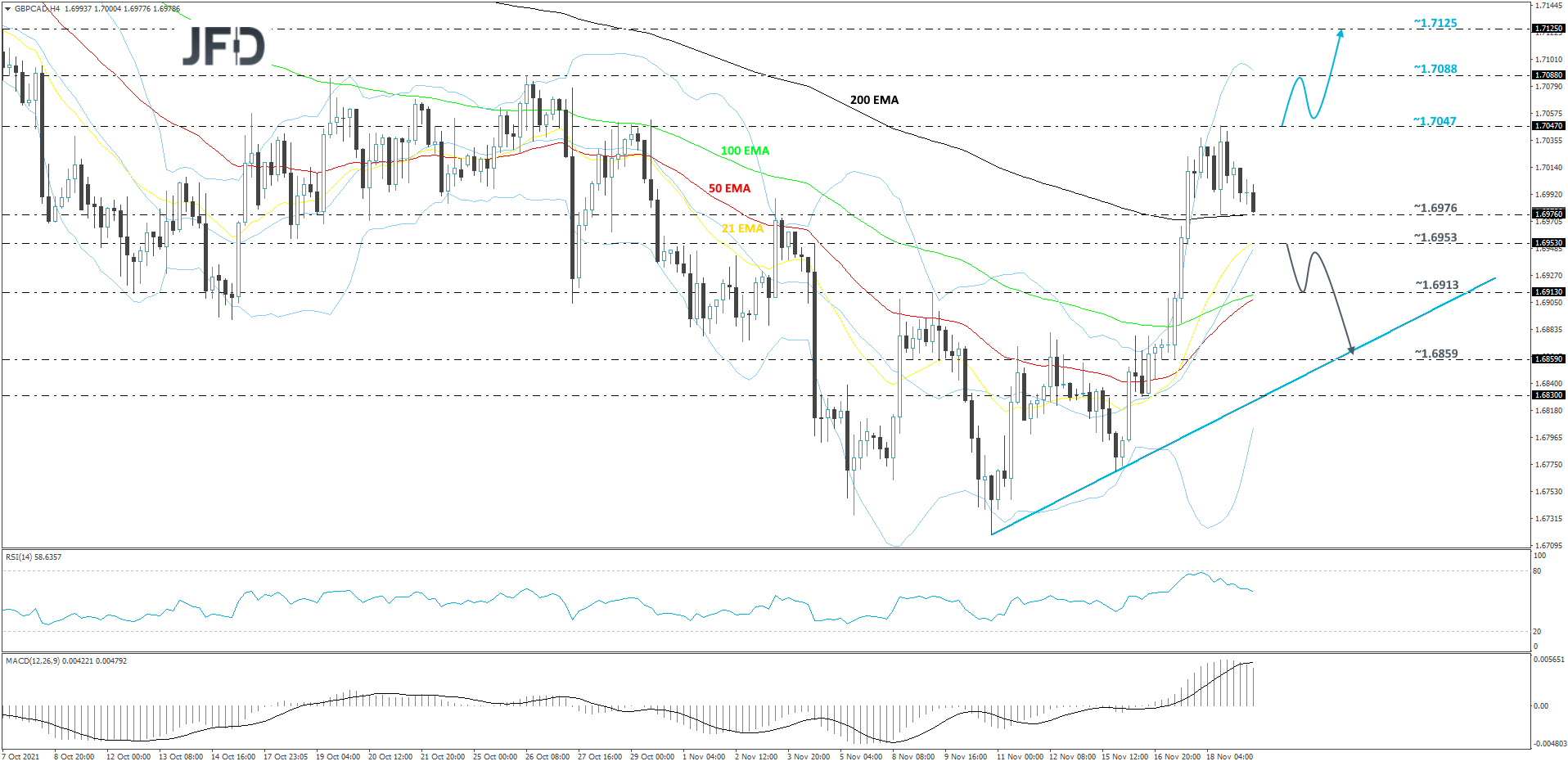

GBP/CAD – Technical Outlook

For now, GBP/CAD is trading well above a short-term tentative upside support line taken from the low of Nov. 10. At the same time, despite the slight correction lower, the pair is still balancing above all of its EMAs on our 4-hour chart, which could be seen as a positive sign. However, to get comfortable with higher areas, a break above the current highest point of November, at 1.7047, would be needed.

If eventually, a break above that 1.7047 barrier happens, this will confirm a forthcoming higher high, and more buyers may join in. GBP/CAD could then climb to the 1.7088 hurdle. If it fails to provide resistance and breaks, it might set the stage for a move to the 1.7125 level, marked by the high of Oct. 7.

On the other hand, if the rate falls below the 1.6953 hurdle, marked by an intraday swing high of Nov. 4, that could lead to a larger correction lower. GBP/CAD might fall to the 1.6913 obstacle, a break of which may lead to a drop to the 1.6859 level, which is the low of Nov. 17. Around there, the pair may test the aforementioned upside line, which could provide additional support.

As For The Rest Of Today's Events

US building permits on a MoM basis for October is coming out. There is no forecast for that number at the time of writing, but we know that the previous one was at -7.8%.