The Turkish regulator has released performance data for the Turkish banking sector to end-October. It paints a picture in line with trends visible in banks’ third-quarter results, showing that the system is so far managing to stay ahead of rising NPLs while maintaining decent levels of profitability

Provisioning keeps pace with NPLs

The Turkish banking sector's aggregate net profit increased by 11.5% year on year to TRY 45.9bn in 10M18. Net profit growth improved slightly from the 9M18 run-rate (11.1%), as the profitability of securities portfolios increased following heavy investment in CPI linkers. While the lira depreciation continued to weigh on bank profitability, as did higher provisioning costs, banks are succeeding in defending NIM even as loan volumes decline.

Overall, banks' net interest income rose by 29.6% YoY over the period, down slightly on the 9M18 number following the central bank of Turkey's dramatic rate hike in September. Rising loan defaults resulted in an almost six-fold increase in provisions for general loan losses, which was the main reason for 48.7% growth in non-interest expenses. Total loans grew by 20.4%, considerably less than last year’s run-rate.

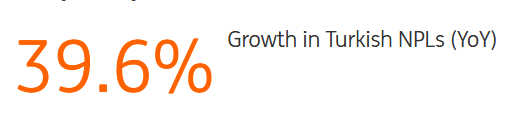

As expected, FX adjusted loan growth slowed markedly. While the stock of NPLs grew by 39.6%, special provisions for NPLs increased by 42.3% y/y, showing banks’ ability to cover souring loans while maintaining profitability. The NPL ratio was up by 50bps YoY to 3.6%. The rate of deterioration in the NPL ratio strengthened from the past couple of months, in line with what we saw in banks’ Q3 results.

Finally, regulatory forbearance continues to support the sector's capital metrics. Average CAR improved by 1.3ppts to 18.2%, while the Tier 1 capital ratio rose 0.5ppts to 14.5%. Recall that most banks’ capital ratios derive around 300bp of benefit from regulatory forbearance measures introduced over the summer.

Our take

This latest data release supports our contention that the banks should be able to manage their way through the coming downturn. It is impressive that banks have managed to increase provisions faster than the rate of NPL growth while still improving profitability, even in the current stressed environment. The banks’ strong starting positions, with RoE of around 15%, low headline NPL ratios and coverage ratios more than 100%, makes them well placed to face the future with confidence.

The main fly in the ointment concerns transparency around capital ratios, with headline numbers artificially inflated by forbearance measures targeting RWA calculations

However, the market seems to have taken these in its stride, while banks made considerable efforts to communicate the effects of the forbearance measures on their Q3 results. Capital ratios should continue to improve as we expect loan growth to slow and internal capital generation to remain strong. Recent suggestions of capital/liquidity relief coming from a plan to turn mortgages into ABS suitable for repo with the central bank could be of further marginal assistance.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means.