“The slowdown in aggregate demand contributes to the fall in inflation. Yet, exchange rate movements due to recently heightened global uncertainty and volatility pose upside risks on the inflation outlook. The Committee decided to implement monetary tightening to contain adverse impact of these developments on expectations and the pricing behavior.” – The Central Bank of Turkey, November 24, 2016Turkey’s central bank is in an awful bind. Turkey’s economy is getting squeezed at the same time its currency collapses. A little over a week ago the central bank chose what it thinks is the lesser of two evils and hiked interest rates in an attempt to support the Turkish lira.

“a) Overnight Interest Rates: Marginal Funding Rate has been increased from 8.25 percent to 8.5 percent, and borrowing rate has been kept at 7.25 percent,

b) One-week repo rate has been increased from 7.5 percent to 8 percent,

c) Late Liquidity Window Interest Rates (between 4:00 p.m. – 5:00 p.m.): Borrowing rate has been kept at 0 percent, and lending rate has been increased from 9.75 percent to 10 percent.”Unlike the rate hike nearly three years ago, THIS rate hike has so far failed to stem the bleeding in the lira. The Turkish lira continues to lose rapid ground to the likes of the U.S. dollar (USD/TRY) and even the euro (EUR/TRY).

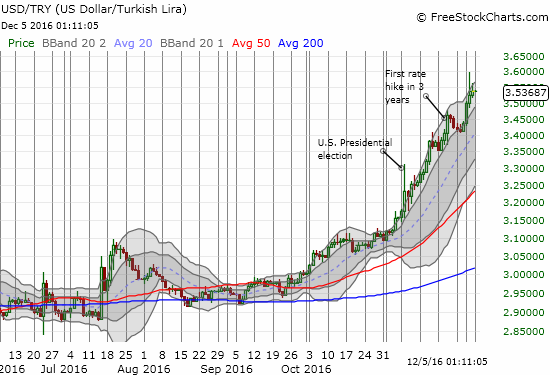

USD/TRY has sustained a parabolic move on a daily basis since a big breakout to all time highs at the beginning of November.

The rally in EUR/TRY confirms that the Turkish lira’s weakness is not just a disadvantage against the U.S. dollar.

USD/TRY is up about 15% since the end of October. The rally took a brief pause shortly after interest rates went up, but the rally picked right back up last week with just as much intense ferocity as before.

Here is a weekly chart for more perspective.

The Turkish lira: The picture of a currency in a near persistent collapse (USD/TRY rallying).

The weekly view highlights well the parabolic move since November’s big breakout. Parabolic moves are not supposed to last for long, and this expectation held true in early 2014. The lira lost so much, so fast, that the central bank was forced to act swiftly and forcefully.

One could argue that the latest move to save the currency is not nearly as urgent and as big as the move in 2014. However, at some point I do fully expect this parabolic move higher to exhaust itself even on it own. As a result, I decided to take on the risk of building a small position short USD/TRY in anticipation of a pullback.

So far, I have had to marvel at strength of the parabolic move. I have even had to hedge periodically against my position with quick trades in and out of long EUR/TRY. If USD/TRY manages to surpass the latest all-time high of around 3.60 that stretched the pair well above its upper-Bollinger Band (BB), I will have to consider backing down from this trade and changing strategy. That strategy would go to a more passive approach which waits for USD/TRY to cross below a threshold to trigger an accumulation of short USD/TRY. Right now, that point would be about 3.48 because it completely reverses USD/TRY’s move from the day it soared to 3.60.

Tensions should be high when the central bank announces its policy for 2017 at a press conference on Tuesday, December 6th.

Be careful out there!

Full disclosure: net long the Turkish lira

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Turkey's 1st Rate Hike In Nearly 3 Years Fails To Stem Lira’s Losses

Published 12/05/2016, 05:53 AM

Updated 07/09/2023, 06:31 AM

Turkey's 1st Rate Hike In Nearly 3 Years Fails To Stem Lira’s Losses

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.