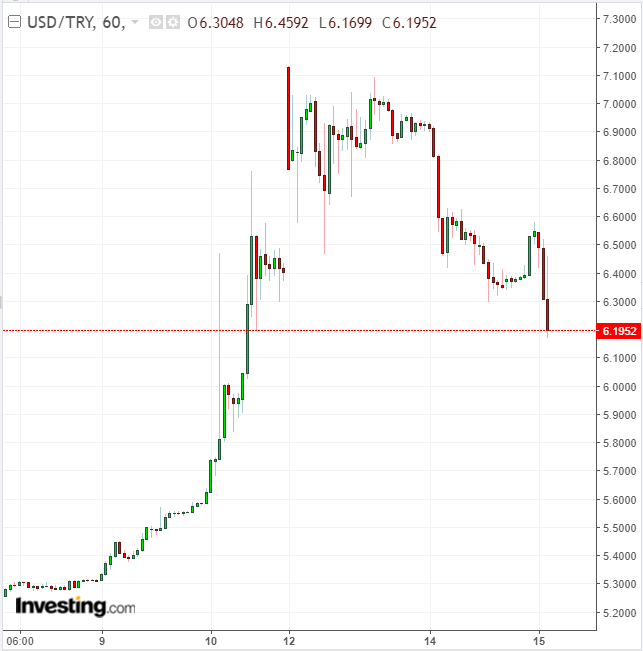

The Turkish lira rebounded Tuesday from its record low Monday, but the crisis is far from over. The USD/TRY’s decline of more than 40% since the beginning of the year is hitting other emerging market currencies, as well as the euro. Turkey's currency strengthened to 6.5 lira to the dollar in Tuesday trading, after hitting 7.13 on Monday. It opened higher this morning as well.

Turkey's central bank finally responded to the crisis, providing liquidity through a higher interest rate facility than its traditional one-week repo. The central bank is seeking to avoid an increase in the benchmark repo rate from its current 17.75%, in accordance with President Tayyip Erdogan’s aversion to high rates. Instead, it is providing liquidity at the overnight rate of 19.25%. The central bank also lowered reserve requirements, freeing 10 billion lira ($6 billion) as well as $3 billion in gold liquidity.

But the dramatic fall in the Turkish currency has spread well beyond the country. The Indian rupee and South African rand, in particular, have also been hit as investors flee emerging market currencies. Even the euro has been affected, due to the exposure of European banks to Turkish borrowers, who will now find it much more difficult to repay their foreign currency loans. Turkish corporate debt is at 70% of GDP, while the foreign currency component is 35%.

This week, the euro fell below its trading band of $1.15 to $1.18 to reach $1.137 on Tuesday. Spanish, French and Italian banks all have billions of dollars of exposure.

Central Bank Independence in Doubt

A key issue for investors is how much of an independent stance the central bank can maintain. Erdogan’s reelection in June, with expanded powers, has reinforced his authoritarian tendencies, including his desire to control monetary policy. The central bank is walking a tightrope between inviting further intervention from the president and alarming foreign investors.

German Chancellor Angela Merkel urged Erdogan this week to respect the independence of the central bank. Her voice counts for a lot, not only because she is the de facto political leader of Europe, but because of Germany’s large Turkish population and close ties in trade and investment.

The Turkish president needs allies like Merkel in his current standoff with US President Donald Trump over detention of an American pastor in Turkey. Trump has slapped punitive tariffs on Turkish steel and aluminum, ostensibly in reaction to the currency’s decline, but with political overtones from the dispute.

Inflation in Focus

Investors are more focused on Turkish inflation, now running above 15% and looking for the central bank to boost interest rates to slow an overheating economy. Erdogan, however, wants to keep the monetary stimulus to promote growth. In the meantime, Turkey is running up a huge current account deficit and its borrowing costs are increasing.

This is the perfect storm that the US dispute has now catalyzed into a financial crisis. As long as the central bank feels its hands are tied on the interest-rate issue, it cannot defuse it with the one measure foreign investors are looking for.

In the meantime, Trump and Erdogan need to find a way out of the bind they have maneuvered into with some sort of face-saving reconciliation. It is the type of pivot that Trump used with North Korea and could serve him again with NATO-ally Turkey.