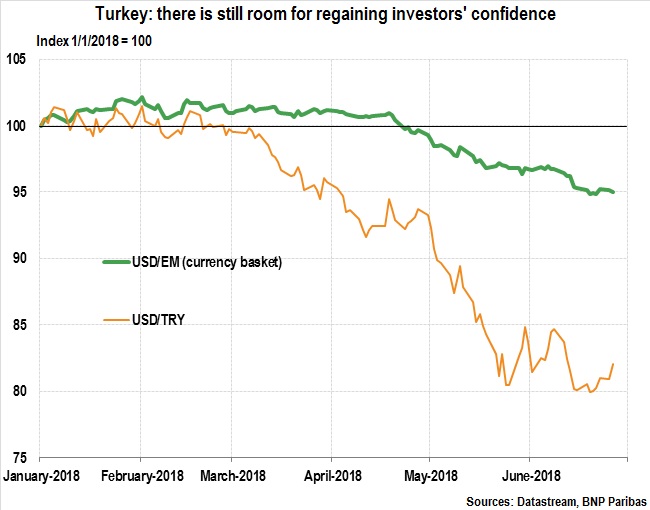

Following President Erdogan’s re-election and AKP-MHP’s victory in the parliamentary elections on June 24th, the markets reacted positively, welcoming the end of political uncertainty in the short term. But the relief was short-lived. Over the past three months, the USDTRY has depreciated by 15% and the Istanbul stock exchange has dropped by 18%. Meanwhile, 2-year government bonds yields have climbed by 450 basis points (bps) to 18.45%, against the backdrop of a significant, albeit late, monetary policy tightening, and 5-year CDS premia on sovereign Eurobonds have increased (+110 bps).

Amid financial tensions in Emerging Markets and rising geopolitical risks, the markets are concerned about Turkey’s macroeconomic and political trajectory. The government needs to address high macro imbalances (i.e. inflation and current account deficit), and a clear confirmation of the independence of the central bank is required. Will President Erdogan prove his pragmatism once again?

by Sylvain BELLEFONTAINE