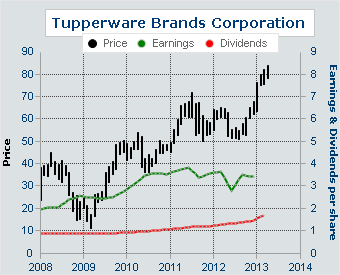

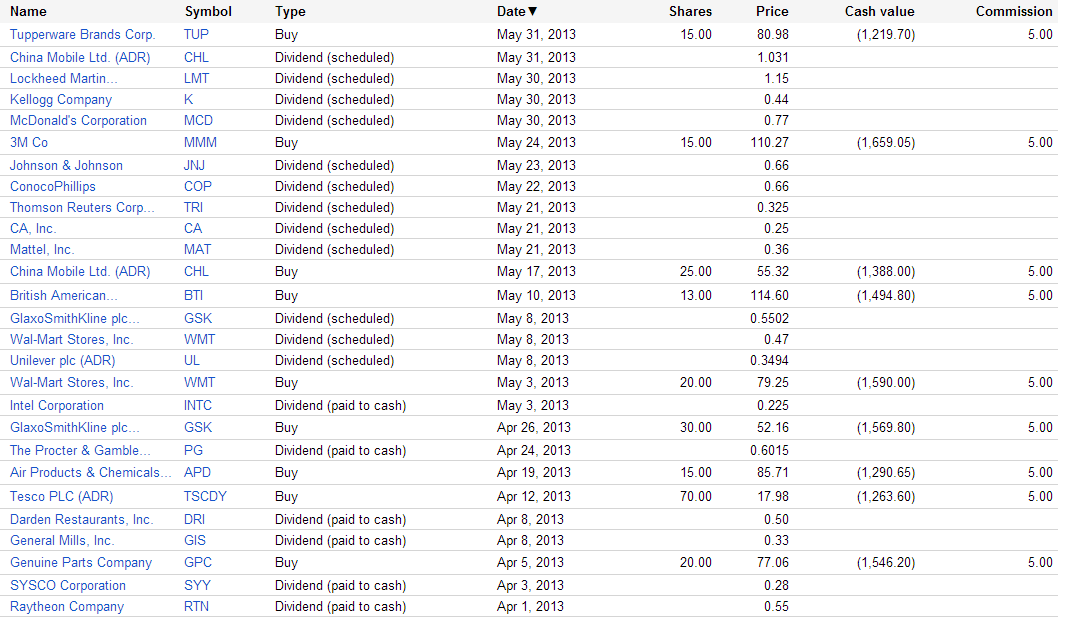

Tupperware (TUP) is the next dividend stock buy for the Dividend Yield Passive Income Portfolio (DYPI). I bought 15 shares of the direct marketing company. Here is a snapshot of the company:

Tupperware Brands Corporation is a global direct seller of products across multiple brands and categories through an independent sales force of 2.8 million. Product brands and categories include design-centric preparation, storage and serving solutions for the kitchen and home through the Tupperware brand and beauty and personal care products through its Armand Dupree, Avroy Shlain, BeautiControl, Fuller, NaturCare, Nutrimetics and Nuvo brands.

The total purchase amount was $1,219 and should bring me around $35 bucks in dividends per year. The current yield amounts to 3.06 percent at a P/E of 23.47. Due to the growth, the forward P/E is at 12.73.

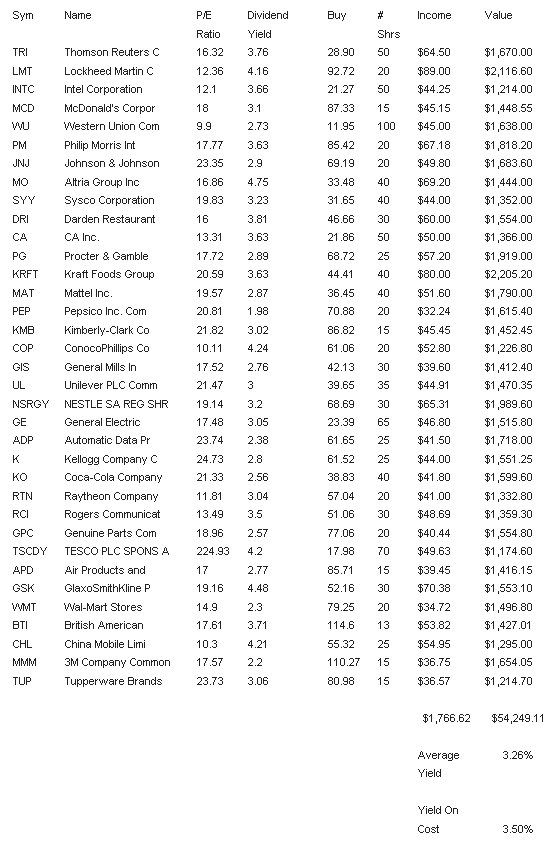

The full-year dividend income of the DYPI-Portfolio is now estimated at $1,766. With 50 percent cash, I plan to reach the $3,000 bucks by the end of this year. All I need to do is to buy a stock each week with a yield above the 3 percent mark. As of now, I’ve achieved this goal. The current yield on cost is at 3.50 percent.

The performance of the stockholdings is at 7.14 percent. Because of the high amount of cash and the slow purchase process, the full portfolio has a performance of 4.04 percent.

Here is the income perspective of the passive income portfolio:.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Tupperware Added To My Dividend Yield Passive Income Portfolio

Published 06/03/2013, 01:18 AM

Updated 07/09/2023, 06:31 AM

Tupperware Added To My Dividend Yield Passive Income Portfolio

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.