Tungsten Corp (OTC:TUNG)’s FY17 results confirm it is making good progress in implementing its more focused strategy and reengineering its internal processes to create greater operational leverage as demand for its e-invoicing and related services grows. The sale of Tungsten Bank last year and the start made on internal repair measures were key steps in improving the business and management can now focus on delivering profit and exploiting the attractive growth opportunities it is addressing.

Full year 2017 results demonstrate progress

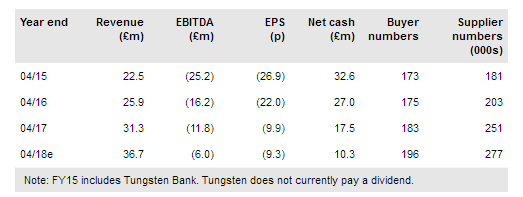

The group’s FY17 results showed revenue growth of 21% or 12% on a constant currency basis. Buyer revenue growth was particularly strong at 35%, partly reflecting successful contract renewal negotiations. The EBITDA loss reduced from £16.2m (restated to exclude Tungsten Bank) to £11.8m (-27%) or by 31% on a constant currency basis.

Net cash at the year end stood at £17.5m or £21.7m including invoice financing carried out on balance sheet on a transitional basis. The cash position reflects the benefit of the December sale of Tungsten Bank effectively refinancing the group as it makes progress towards profitability and operating cash generation.

To read the entire report Please click on the pdf File Below: