Actionable ideas for the busy trader delivered daily right up front

- Tuesday uncertain.

- ES pivot 1628.50. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Last night I just wasn't able to get a good read on the market so I called it uncertain. I think Monday's finish pretty much bears that out as Mr. Market couldn't figure out which way he wanted to go with the Dow down 0.18%, the Nasdaq up 0.06% and the SPX flat. So now let's see if we can help the poor old guy find his way on Tuesday

The technicals (daily)

The Dow: Last night I mentioned the possibility that we might be headed for some sideways action and it looks like that's what's happening. For four days now, we've gotten small range dojis where the bears try to knock 'em down but the bull just gets right back up again. That leaves us with four days of up/down/up/down bouncing between around 15,060 and 15,120. With none of these dojis panning out and the Dow still in a rising RTC the only bearish sign remains the overbought indicators and that hasn't worked too well this year so far. So looks like just more of the same until something breaks.

The VIX: On Monday the VIX pretty much went nowhere, remaining stuck at the bottom of its latest trading range with a long inverted hammer. That's a potential reversal warning but here's an interesting observation - the VIX has put in four cyclic bottoms this year so far, on January 18th, February 19th, March 14th, and April 12th. Tuesday will be May 14th and we are once again at lows for the month. These have been coming like clockwork right around the middle of every month. On that basis alone, I'd say the VIX should be ready to begin a new uptrend any day now.

Market index futures: Tonight all three futures are mildly higher at 1:12 AM EDT with ES down by 0.06%. ES definitely has that sideways motion thing going now and Monday's action was enough to bump it out of its rising RTC for a bearish setup despite the green candle. The overnight action is meandering and providing little guidance. If we assume the sideways action will continue, then the next move will be lower as we're now sitting at the top of the range. Monday's high was 1633.25 and ES made exactly one attempt to breach that at 10:45 PM where it was rejected. If this market is to continue higher, we'll need to break above that number. SO far at least, it doesn't seem to be happening.

ES daily pivot: Tonight the pivot bumps up from 1626.92 to 1628.50. After spending most of Monday above the pivot, we remain above the new number, though by a bit less. As long as we don't break under, it's still bullish though.

Dollar index: Well you can forget the evening star. On Monday the dollar continued higher, tacking on another 0.16% to just hit its resistance line for the year so far. With the outsized move of the past three days, I'd expect theFed/QE kick to be about digested by now. The technicals will have to reassert themselves eventually.but with two dojis in a row now, I have to wonder if we're not going to try to advance a bit more here. We have a reversal warning, but no confirmation at this point.

Euro: Last night I wrote that on Monday "we could see the euro remain in the general vicinity of the 200 MA." And that is exactly what happened, with the euro putting in a long-legged doji that closed at 1.2973. The 200 day MA was, yes, 1.2973. The overnight is a different story though, with the euro taking off right at 8:15 PM and already up 0.31% as traders look to some good European economic news coming out Tuesday. SO technically, we have a bounce off the 200 MA, a stochastic that just squeaked out a bullish crossover and a descending RTC exit for a bullish setup - a triple play. I'd say the euro's going higher on Tuesday.

Transportation: On Monday the trans gave up most of Friday's gains to return to their support around 6340. With the indicators finally starting to come off overbought, this chart is looking a bit on the bearish side. Note too the .49% loss leading the Dow's smaller 0.18% fall.

We seem to have become wedged in a new crab market (only moves sideways). We've had a few of these so far this year, averaging about a week in length. Tuesday will make five days, so I'm expecting a resolution before too long. Which way though is hard to say. The VIX and the trans seem to be guiding lower, as well as the indicators for the Dow. But once this sideways business gets going, there's no way to tell just when the break will come, so unfortunately, I'm going to have to call Tuesday uncertain again. I guess I'll just go plant some marigolds or read a book until we get Mr. Market off top dead center.

ES Fantasy Trader

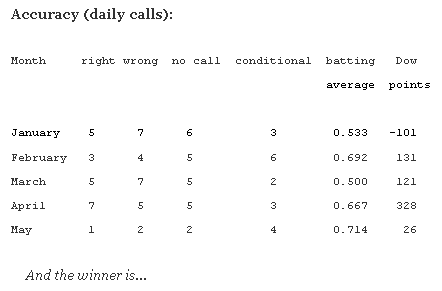

Portfolio stats: the account remains at $107,750 after 11 trades (9 for 11 total, 4 for 4 longs, 5 for 7 short) starting from $100,000 on 1/1/13. Tonight we stand aside again because of the "uncertain" call.