Actionable ideas for the busy trader delivered daily right up front

- Tuesday uncertain..

- ES pivot 1400.25. Holding above is bullish.

- Rest of week bias lower technically.

- Monthly outlook: bias up.

- ES Fantasy Trader remains short at 1395.00.

Well, it looks like not much has changed since last week. I'm starting to feel like the opening scene in Casablanca where the narrator talks about the refugees who come to Casablanca where they wait... and wait... and wait. Although my call for Monday was correct as the Dow did in fact finish lower, it has more the feel of flipping coins than anything else. Obviously this can't go on forever, but is tomorrow the day? Read on...

The technicals (daily)

The Dow: Make it six straight reversal candle sin a row now for the Dow with another hanging man. Nothing has changed here, except that RSI got even more overbought today. The analysis remains the same: looking toppy but requiring confirmation.

The VIX: Well there was one development today - the VIX blew right through its support at 14.5 to close at 13.70, a level we have not seen since - get ready for it - June of 2007. I had to back out to the monthly chart to find that one. And while we're there, I note that the monthly stochastic has just executed a bearish crossover from a low level. Short term though, we have a gap-down inverted hammer that could signal a reversal with highly oversold indicators. But - (insert broken record here) after being fooled so many times already, we require confirmation.

Market index futures: Tonight all three futures are up at 1:23 AM EDT with ES higher by 0.11%, most of that coming on a pop at 9 PM on (I think) a news item about increased electricity demand in China. Meanwhile we now have four straight hanging men in a row here and tonight's candle is developing as a doji too. The only difference is that RSI has now hit 100 for the first time since February 9th. While it's tempting to start ignoring this parade of reversal candles that don't, I'll note that an RSI at 100 is generally a pretty good indication that the top is coming. Also, this parade of dojis are moving us closer to the right hand edge of the rising RTC. When we get there, that will be a bearish setup. The RTC is one of the best indications of trend changes there is.

ES daily pivot: Tonight the pivot notches up again from 1399.08 to 1400.25. We broke above the old level this afternoon and remain just a few points above the new line. That's bullish on the face of it but bears close watching.

Dollar index: As expected, the dollar moved lower on Monday, dropping 0.18% on a gap-down spinning top. More indecision!

Euro: The euro gained ground for the second day in a row and in so doing traded entirely outside its descending RTC for a bullish trigger. With confirmation from a stochastic just executing a bullish crossover, I'd say look for a higher euro on Tuesday.

Transportation: And finally, more indecision from the trans with a dragonfly doji today. The most telling feature here is that this was good enough to move us right to the edge of the descending RTC which could give us a bullish setup on Tuesday if we get any advance at all.

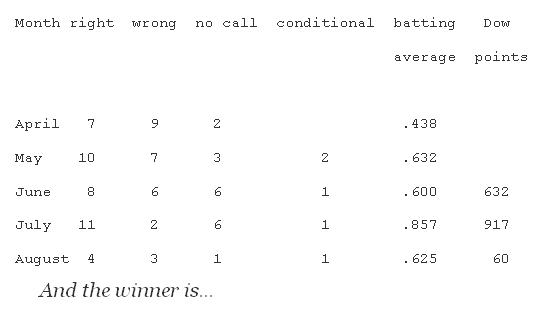

Accuracy (daily calls):

With such a gaggle of dojis on the charts tonight, it's difficult to make a reasoned call in either direction. The Dow and ES are both giving warnings of a decline but the euro and the trans suggest a move higher. The VIX and the dollar are simply unclear. And TLT, after looking like it would go higher today, did not. But Dr. Copper does look to have peaked and is moving lower. What to make of all this? Darned if I know. If I had to make a wild guess, I'd say it's not out of the question that we get yet another small-range doji day of indecision. I already got fooled once into expecting a decline that didn't happen. Now I'm just going to wait until I see it. Therefore I am simply calling Tuesday uncertain. I always hate to punt, but that's really all I'm seeing tonight.

Disclaimer: (My lawyer made me do it) This blog is not trading or investment advice, account management or direction. All trades listed here are presented only as examples of the author's personal trading style. Investing entails significant risk and trading entails even greater risks. Act accordingly.