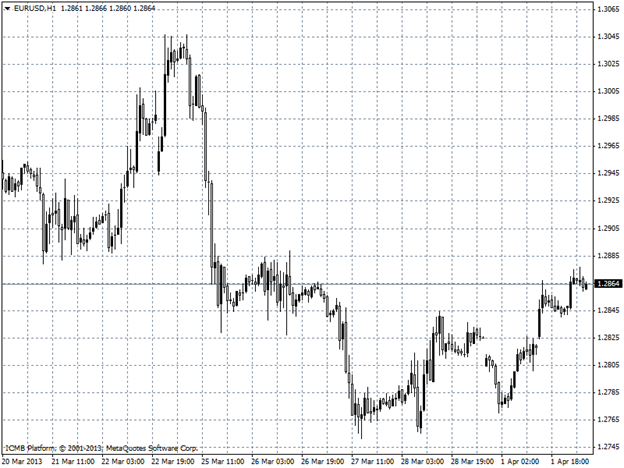

German inflation probably slowed in March to the lowest level in more than two years. The inflation rate in Europe’s largest economy fell to 1.7 percent from 1.8 percent in February, That’s the lowest since November 2010. While the 17-nation euro area remains mired in recession, the Bundesbank predicts the German economy has found its way back to growth in the first quarter after a 0.6 percent contraction in the final three months of 2012. It forecasts inflation will average 1.5 percent this year and 1.6 percent in 2014. Cyprus government officials will seek easier bailout terms in talks with representatives of the European Union and International Monetary Fund today, before a meeting of euro-area finance officials later this week. The euro rose to 1.2860. EUR/USD" title="EUR/USD" width="624" height="468">

EUR/USD" title="EUR/USD" width="624" height="468">

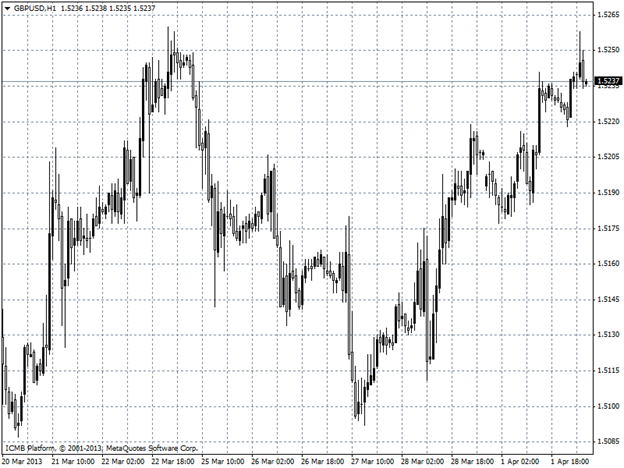

GBP/USD

The U.K. economy will avoid another recession and exports will help propel a “modest” recovery this year, according to the British Chambers of Commerce. The BCC’s gauges of domestic and foreign demand at manufacturers and services companies all rose last quarter, with the export measures close to a record. The economy’s performance is weak by long-term historical standards. However, while remaining below trend for some time, growth is likely to stay in positive territory. The pound rose 0.1 percent to 1.5230.  GBP/USD" title="GBP/USD" width="624" height="468">

GBP/USD" title="GBP/USD" width="624" height="468">

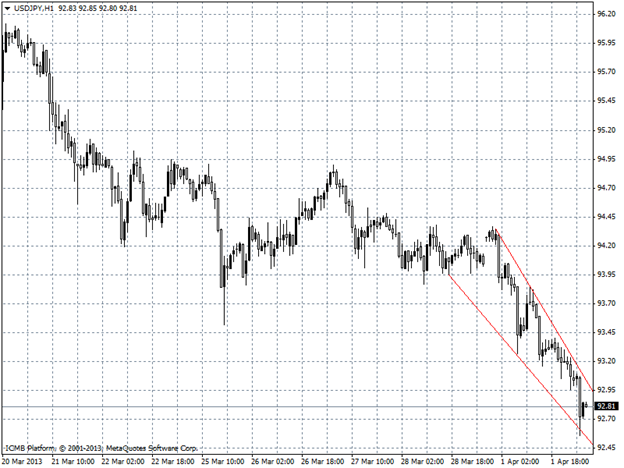

USD/JPY

The yen climbed to the strongest level in almost four weeks against the dollar after a gauge of U.S. manufacturing expanded less than forecast, adding to haven demand and damping bets the Federal Reserve might slow its bond- buying under quantitative easing. Most of what you’re seeing today is really based off the back of the poorer-than-expected U.S. numbers, Any expectation of the U.S. stepping back from QE should be tempered somewhat. The Japanese currency appreciated 1.2 percent to 92.90 yen per dollar. USD/JPY" title="USD/JPY" width="624" height="468">

USD/JPY" title="USD/JPY" width="624" height="468">

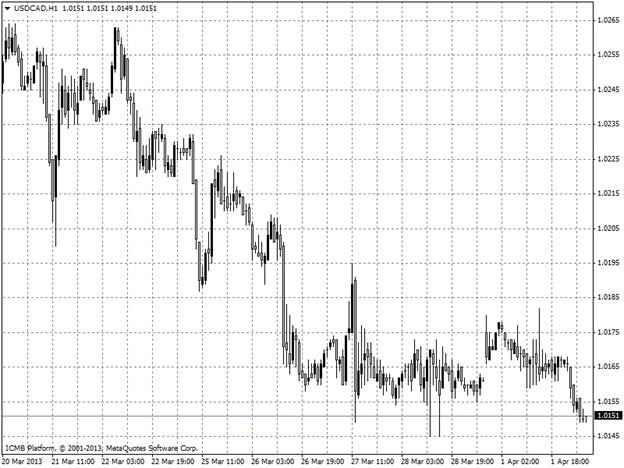

USD/CAD

The Canadian dollar traded at almost a five-week high against its U.S. counterpart as futures traders decreased bets on the currency’s decline before data forecast to show a second consecutive month of job gains. The loonie, as the currency is nicknamed, fluctuated versus the greenback after a report on manufacturing in the U.S., Canada’s largest trading partner, trailed forecasts in March. Canada added 5,000 jobs in March, There was a lot of down pressure on the loonie early in March and we’ve seen a bit of a lift in the loonie in the last couple of weeks and part of that has been driven by people covering their short positions, My overall thesis is that we trade down, because some of this up-move has been driven by short covering. The fact that’s taken place should give guys increased confidence that the next leg down is the next step. The loonie was up 0.1 percent at C$1.0168 per U.S. dollar.  USD/CAD" title="USD/CAD" width="624" height="468">

USD/CAD" title="USD/CAD" width="624" height="468">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Tuesday's Major FX Pairs

Published 04/02/2013, 06:46 AM

Updated 04/25/2018, 04:40 AM

Tuesday's Major FX Pairs

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.