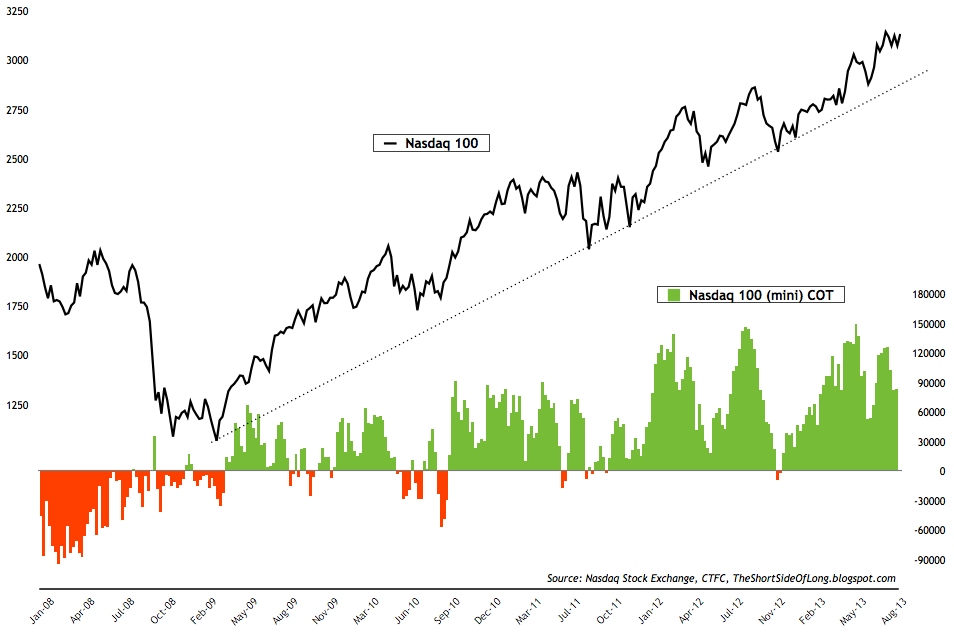

The Nasdaq continues to make new highs and Fund exposure keeps trending higher (but they tend to be longest around highs and short near lows).

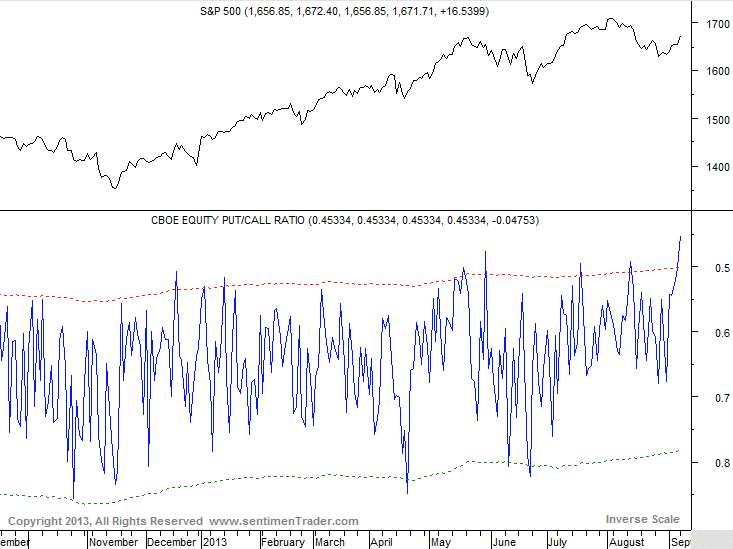

The put/call ratio in the S&Ps is at the highest level in a year (retail money expects higher prices). There are roughly 45 puts traded for every 100 calls. More than a 2:1 ratio. Careful!

Conversely, the appetite for puts peaked in mid November last year (S&Ps on LOWS @ 1350). Put skew also popped in mid/late April of 2013 (S&Ps test 50 day moving average @ 1535 - Metals in free fall). Finally, there was a voracious retail desire for puts in mid/late June of 2013 (S&Ps break the 50 day moving average following Bernanke Taper Comments. Emerging Markets tailspin. Bond markets fall out of bed).

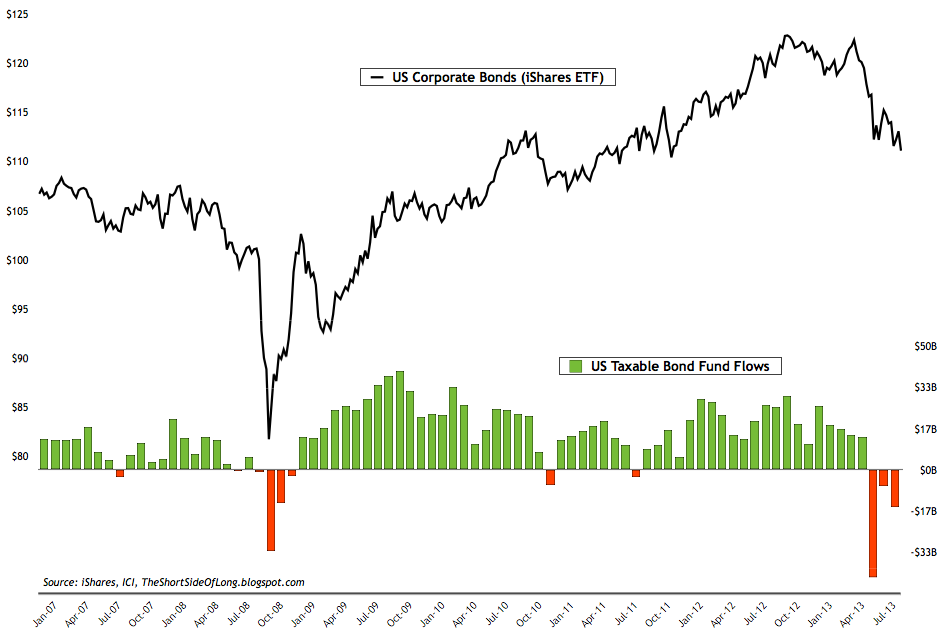

Now, looking at Fixed Income/Bond Funds going into next week's all important FOMC (TAPER) meeting. As you can see, money has been leaving Fixed Income at a rate last seen in Fall of 2008 (pre QE1/Tarp/etc).

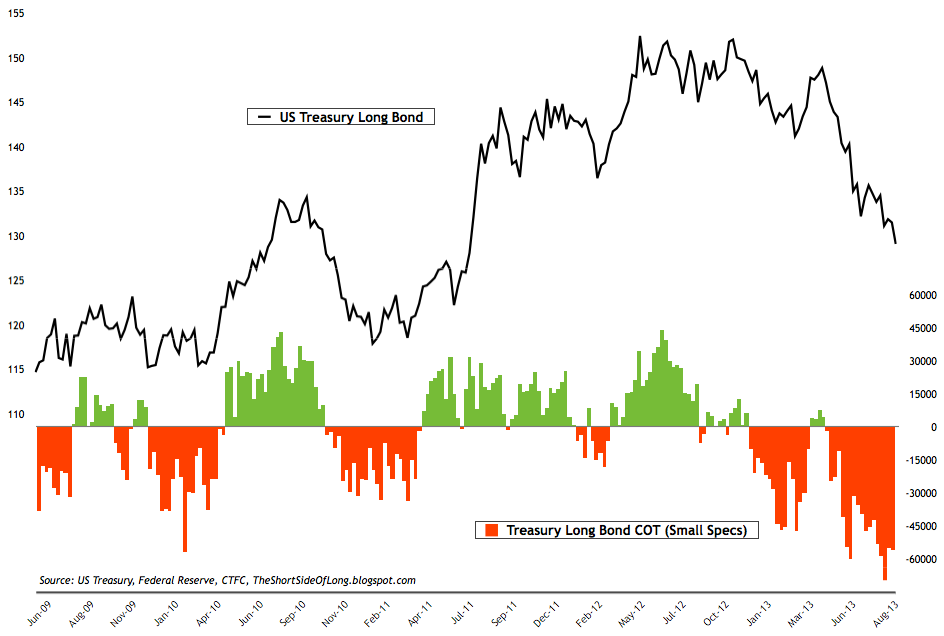

And here's a long term look at the Treasuries Commitment of Traders Report (speculators are SHORT Fixed Income going into Bernanke's penultimate meeting). I wouldn't necessarily advocate for outright longs, but I would be uncomfortable on a boat that's loaded this heavily on one side.

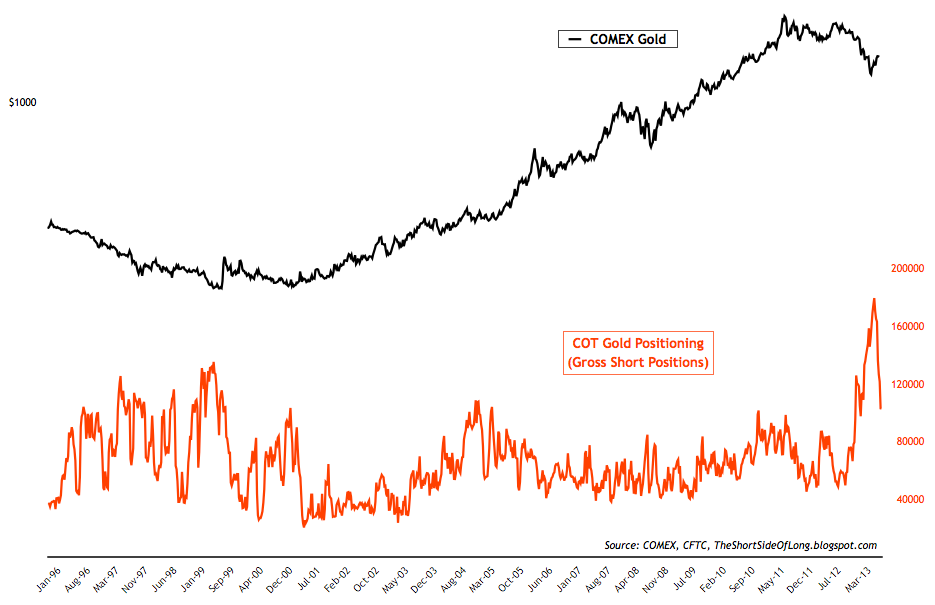

Finally, I was pounding the pavement about the over-reaction in the Gold (and particularly Silver in late June (and earlier). In my mind, Silver testing $18 and Gold around $1200 seemed like an emotional, liquidating market. The Gold Silver ratio at 67:1 also seemed incongruous. Price and the ratio have been reconciled a bit in the past 8 weeks and they are now largely range bound. This is what the short squeeze looks like in Gold.

Personally, I don't see a great directional opportunity in the Metals right now. Volatility (implied) in GC and SI was relatively high about 2 weeks ago with 30 day Gold vol around 25% (very high relative to S&Ps) and short dated Silver vol around 45%. In the interim, front month Metals vol has come in to 20% and 35% respectively.

Today's Headlines

- Syria seems responsive to Russian overtures that they be given time to turn over Chemical weapons stockpile.

- Goldman, Visa, and Nike will be included in the rebalanced DJIA (first in years) as Hewlett, Alcoa and Bank of America are excluded (low priced dogs). Keep in mind the DJIA is a PRICE weighted index (poor barometer).

- Poor Italian GDP as well as French Industrial Production (if you think all is well on the other side of the Atlantic I have some marsh land for sale).

Finally, be aware of the huge move higher in the Shanghai Index of late (up 15% in about 6 weeks).

I'm NOT and Equity guy, but the FXI seems like it finds support around 32-31 and congestion between 40-42.

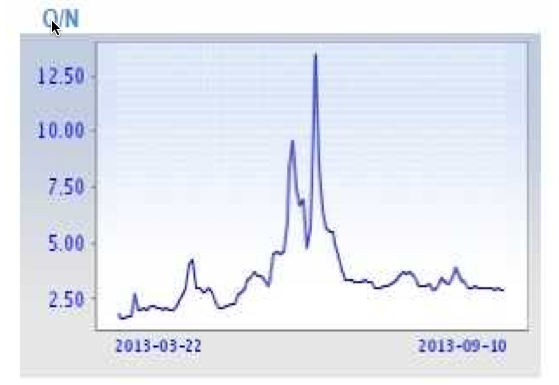

But again, it's ALL ABOUT CHEAP MONEY.....things get rocky when rates spike, particularly when they do so quickly. Here's a look at overnight Shibor. You were rewarded for buying China when "blood was in the water" (borrow rates spiking). Same goes for most Global markets which found support in late June/early July following interest rate pops.

I don't know if now is the time to buy/hold/or sell, but Buffett was on to something when he said:

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.