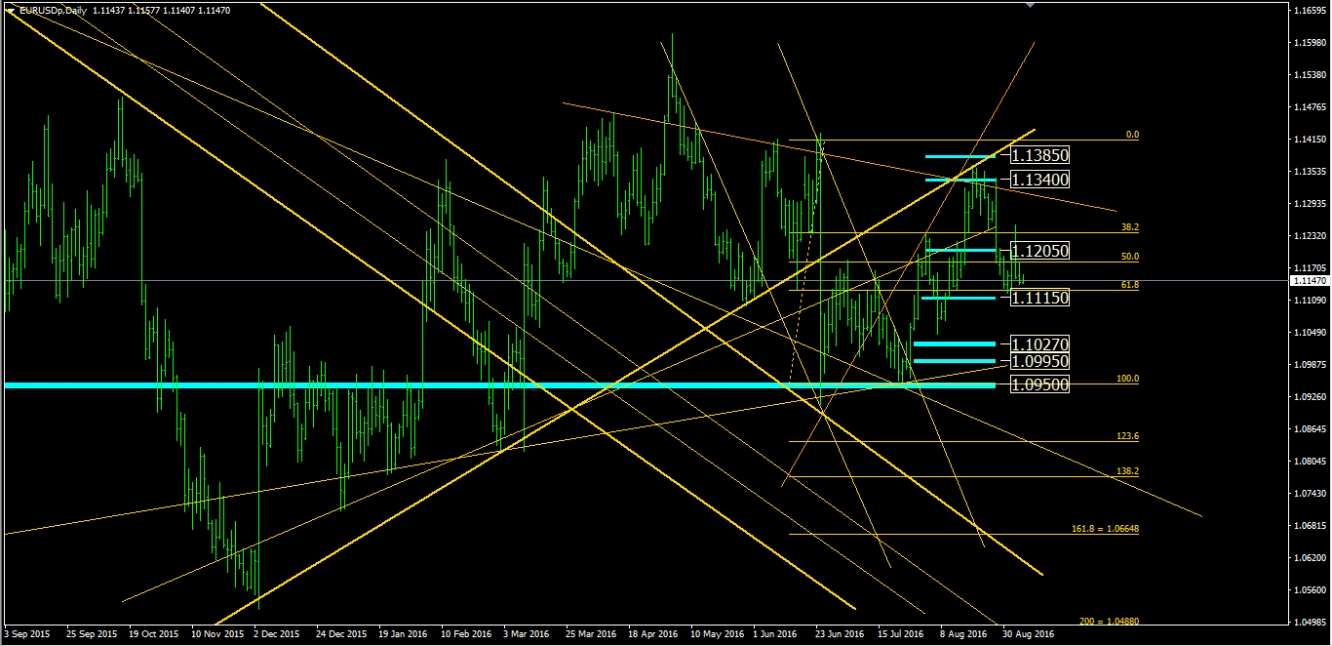

EUR/USD

Weekly Trend: Neutral

1st Resistance: 1.1205

2nd Resistance: 1.1340

1st Support: 1.1115

2nd Support: 1.1027

EUR

Recent Facts:

22nd of July 2016, German Manufacturing PMI (key indicator of the activity level of purchasing managers in the manufacturing sector as surveyed in Germany)

Better than Expected. Setting a new high from May 2014

28th of July, German Unemployment Change

Better than Expected.

29th of July, European CPI (key preliminary inflation data in Europe)

Higher than Expected. Setting a new high since last February

18th of August, European CPI confirmed at 0.2% as Expected and as per previous month

23rd of August, German Manufacturing Purchasing Managers' Index (PMI) and Markit Composite PMI: they measure the activity level of purchasing managers in the manufacturing sector in Europe

Contrasted: Markit Eurozone PMI inched up to a seven-month high, while Manufacturing PMI and German Services PMI slow down in August

31st of August, European CPI (key preliminary inflation data in Europe)

Slightly lower than Expected

1st of September, Eurozone Manufacturing PMI

Slightly worse than Expected

USD

Recent Facts:

21st of July 2016, Existing Home Sales

Better than Expected. Setting a new high since August 2015, which was the highest value of the last 6 years

29th of July, Gross Domestic Product QoQ (preliminary)

Worse than Expected. Actual = +1.2% Expectations were at +2.6%

12th of August, U.S. Retail Sales (essential for a better understanding of the Fed’s future interest rates policies)

Worse than Expected

16th of August, Building Permits

Worse than Expected

17th of August, FOMC Meeting Minutes (U.S.A.)

Economists see the December meeting as the most likely time for a rate increase since it follows the U.S. presidential election

23rd of August, U.S. New Home Sales: it measures the annualized number of new single-family homes that were sold during the previous month

Better than Expected. Setting a new high since December 2007

25th of August, U.S. Core Durable Goods Orders MoM (measures the change in the total value of new orders for long lasting manufactured goods, excluding transportation items)

Better than Expected

26th of August, U.S. Yellen’s (Fed Chair) Speech

Fed’s Yellen says case for another interest-rate hike has strengthened but eyes on the next data from U.S.

31st of August, ADP Nonfarm Employment Change and Pending Home Sales

Both better than Expected

2nd of September, Nonfarm Payrolls

Worse than Expected

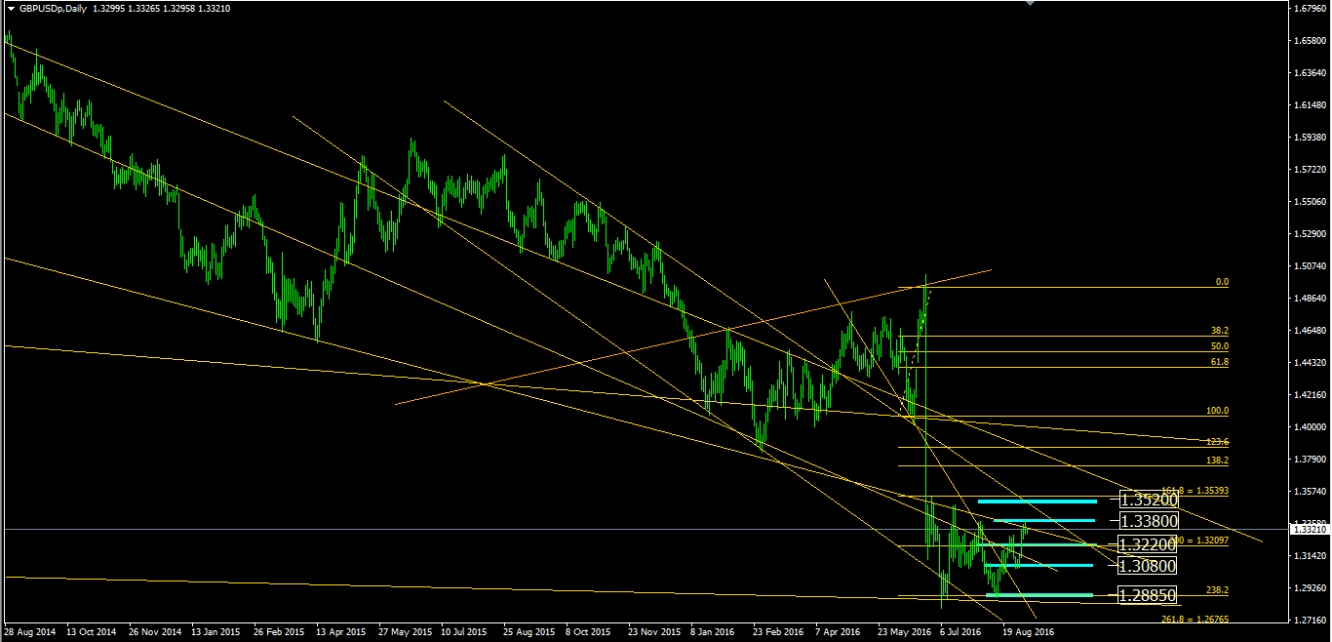

GBP/USD

Weekly Trend: Neutral

1st Resistance: 1.3220

2nd Resistance: 1.3380

1st Support: 1.3080

2nd Support: 1.2885

3rd Support: 1.2680

GBP

Recent Facts:

22nd of July 2016, UK Services PMI (key indicator of the activity level of purchasing managers in the services sector)

Worse than Expected. Setting a new historical low, the lowest value of the last 7 years

27th of July 2016, Gross Domestic Product (preliminary)

Better than Expected

4th of August, Bank of England Interest Rates decision (expected a cut)

Bank of England lowers Interest Rates as Expected (record low of 0.25%) and increases purchase program

9th of August, Manufacturing Production (measures the change in the total inflation-adjusted value of output produced by manufacturers)

Slightly Worse than Expected

9th of August, Trade Balance

Worse than Expected. Setting a new historical low

16th of August, UK Consumer Price Index (measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation)

Higher than Expected. Setting a new high since January 2015

18th of August, UK Retail Sales

Better than Expected. Core Retail Sales YoY at the highest since November 2015

1st of August, UK Manufacturing PMI (key indicator of the activity level of purchasing managers in the services sector)

Better than Expected. Setting a new historical high since December 2015

5th of September, UK Services PMI

Better than Expected

USD

Recent Facts:

See above.

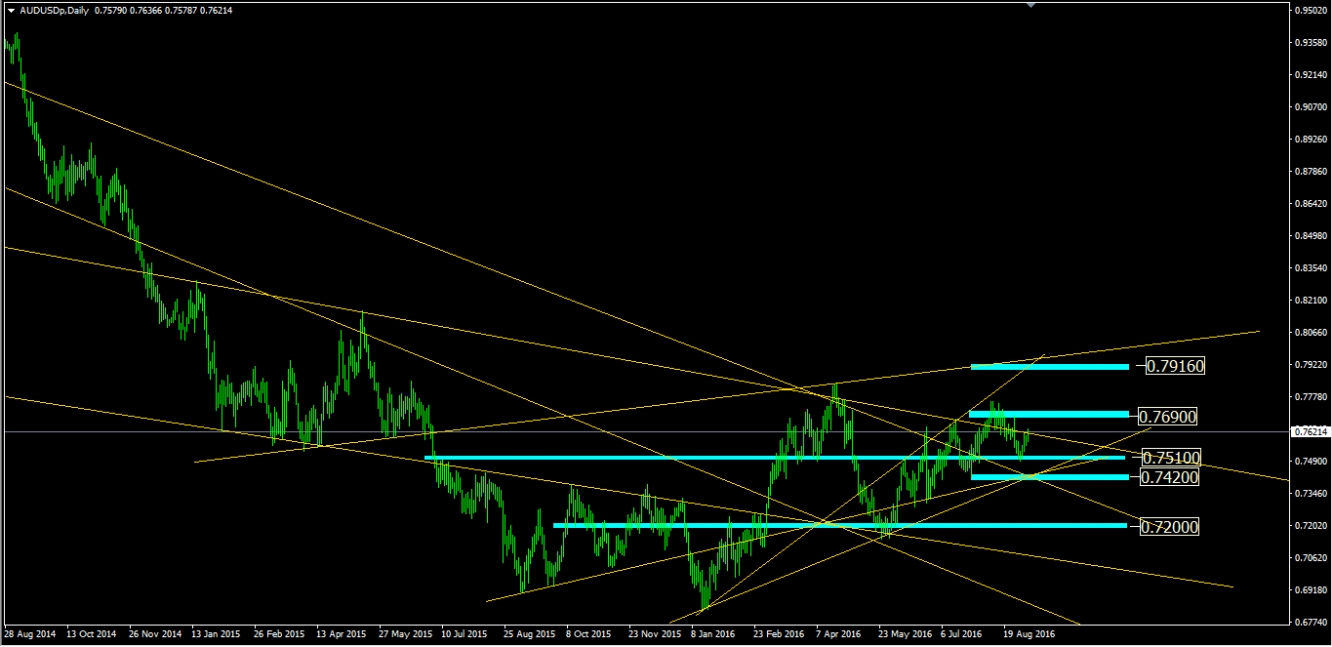

AUD/USD

Weekly Trend: Bullish

1st Resistance: 0.7690

2nd Resistance: 0.7916

1st Support: 0.7510

2nd Support: 0.7420

3rd Support: 0.7200

AUD

Recent Facts:

19th of July 2016, Reserve Bank of Australia Meeting

Possible further easing in the next month to counteract the negative shock from the Brexit vote

26th of July, CPI (key inflation data in Australia) pared

2nd of August, Interest Rates decision cut to from 1.75% to 1.50% as Expected

4th of August, Retail Sales (Jun)

Worse than Expected

11th of August, Reserve Bank of New Zealand's rate statement

Interest rates cut (to 2%) as Expected

18th of August, Employment Change

Better than Expected. Highest since the beginning of this year

24th of August, New Zealand Trade Balance and Australia’s Construction Work Done (it measures the change in the total value of completed construction projects)

Worse than Expected

1st of September, Retail Sales and Private New Capital Expenditure

Worse than Expected

USD

Recent Facts:

See above.