Forex News and Events

TRY under fire after twin bombings in Istanbul

The Turkish lira had another rough start into the week, losing almost 2% against the greenback after the explosion of two bombs in Istanbul on Saturday. The lira, which has been increasingly sensitive to local political risk and the risk development on a broad basis, is heading into a complicated year as the improved US yield outlook is dragging investors out of emerging markets. On the political side, President Erdogan’s AK party has submitted a bill aimed at extending the powers of the president at the expense of the prime minister. The proposed constitutional changes would shift Turkey toward an executive presidential system from a parliamentary one. If passed, this bill will most likely not be viewed positively by international investors as it will put the continuity of stability in jeopardy and will increase political tensions within the country.

The Turkish economy is already struggling to finance a massive trade deficit of roughly $15 billion, while GDP growth showed further signs of weakness recently. GDP growth slid into negative territory in the third quarter as it contracted 1.8%y/y versus 0.3% median forecast and 3.1% in the June quarter. Unfortunately, the outlook is not so pretty as the central bank continues to struggle with strong inflationary pressure, which is enhanced by the weak lira, and finds itself forced to tighten monetary policy. Indeed, in late November the CBRT increased two of its benchmark rates, lifting the repurchase rate by 50bps to 8% and the lending rate by 25bps to 8.50%. The TRY’s reaction was muted as the market continued to focus on the US enhanced yield outlook, hoping for Donald Trump to give a boost to the world’s largest economy.

Oil gives commodity currencies a boost

Commodity currencies, led by NOK and CAD dominated gains against the USD in the Asian session. The catalyst was OPEC and non-OPEC oil producers reaching their first deal since 2001 to reduce the global oil glut. Crude oil prices initially surged 5% on news of the completed deal and since last Thursday have rallied 9.74% to $54.51. However, after an initial spike, Asian regional equity market indices declined (exceptions: ASX tracking commodity, specifically coppers surged higher). Given the general euphoria around the first deal in 15 years and Saudi Arabia signalling its wiliness to cut more, we could see Brent oil heading to $58 (WTI $56). Given the overstretched USD positioning (five Fed hikes by end of 2018) and room for further oil upside we believe that the Trump reflation theme is running hot and therefore would play long commodity FX trades in the near-term. In equites, higher oil has already been priced in so traders should steer clear of US energy sector plays (US valuations look rich, making discounted Europe a smart, relatively valuable trade).

Long GBP

We remain constructive on GBP in the near-term. The UK CPI inflation rate looks to have accelerated in November to 1.1% (2-year-high) aided by an increase in food and fuel prices. With housing and labour markets still tight the BoE will likely keep policy unchanged this week. Also, the UK Supreme Court will continue to hear the appeal around the High Court ruling that the government must get parliamentary permission before triggering Article 50 and beginning the withdrawal process form the EU. While Brexit will remain the primary generator of short-term volatility, mid-term improvement in the UK domestic economy coupled with a side-lined BoE will allow the GBP to strengthen. We view sell-offs in GBP/USD as an opportunity to reload long positions.

USD/CAD - Strong Selling Pressures.

The Risk Today

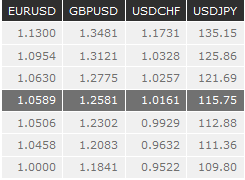

EUR/USD's weakness is back. Hourly resistance is given at 1.0874 (08/12/2016 high). Support can be found at 1.0506 (05/12/2016 low). Buying pressures seem stronger around 1.0500. Expected to show further weakness around that level. In the longer term, the death cross indicates a further bearish bias despite the pair has increased since last December. Key resistance holds at 1.1714 (24/08/2015 high). Strong support given at 1.0458 (16/03/2015 low) is on target.

GBP/USD is riding higher. Hourly support is given at 1.2302 (18/11/2016 low). Expected to show renewed pressures towards resistance at 1.2771 (05/10/2016 high). The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY is trading higher. The pair has broken resistance given at 114.83 (16/02/2016 high). Hourly support can be found at 112.88 (05/12/2016 low). Significant support is given around 111.36 (28/11/2016 low). Stronger support lies at 108.56 (17/11/2016 low). Expected to see continued short-term bullish pressures. We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is trading mixed. Key support is given at the parity. Hourly resistance lies at 1.0205 (30/11/2016 high). The technical structure suggests that the buying pressures are not enough. The road is wide-open for renewed weakness. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.

Resistance and Support: