Forex News and Events

The political unrest in Brazil will certainly not be any good for the real at week open. After Friday’s gap-open at 3.1972 and advance to 3.2798, a second consecutive session of gap in BRL is very much likely should politicians fail to cool-off the mounting anger against Rousseff’s government. The corruption scandals, hiking inflation, higher unemployment and the inability to agree on a solid budget bill which, at this stage, is totally not in line with efforts to step toward a fiscal discipline required by investors, generates a complex problem. In fact, investors need a solid fiscal discipline in Brazil to make sure that country’s debt, the Brazilian real, and the inflation remain under control, so that they would invest to generate jobs and revenues in Brazil. On the other hand, the fiscal consolidation (lower spending, higher taxes) will certainly not make Brazilians smile, who will first need to carry heavier costs on their personal budgets before any improvement can materialize. The risk of a deeper recession is just sitting there, placing the BCB in an uncomfortable position. The sell-off in BRL and up-trending inflation calls for higher Selic rate, while investing in Brazil (which is the most needed) simply gets more expensive. In a report last week, the rating agency Fitch had mentioned 3.75 levels verse US dollar for the local companies to gain back their international competitively. With the endogenous inflation effect, even this level may happen to be insufficient to boost country’s exports while the global economic recovery gives no signs of improvement (except the US).

Following sizeable protests, which gathered over a million Brazilians in the streets on Sunday, the government pledged to present a package of anti-corruption measures said Secretary General Rossetto and Justice Minister Cardozo. The package should include drastic political reforms such as ban on corporate finance of electoral campaigns (to avoid new Petrobas-like scandals). Yet in any case, the fundamental negative bias will made it hard for the USD/BRL to ease back below the 3.0- psychological threshold.

Turkish lira benefits from capital flows out of Brazil

We can show several reasons why the lira opened better bid this Monday. The expectations of a status quo on Tuesday MPC meeting (Mar 17th), cooler political tensions on Basci’s CBT since last week meeting with President Erdogan, globally flatter USD (as correction amid last week’s heavy USD demand), lower oil prices, all explain the stronger lira. But not only. The mounting tensions in Brazil and the acceleration in capital outflows are partially being deviated to Turkish lira. At this point, even the risk lovers and risky profit seekers step out of Brazil assets as country’s idiosyncratic risks combined to hawkish FOMC expectations no more justify long BRL exposure at the moment. In a similar risk category, the lira offers interesting yield spread, especially with unchanged rate expectations on Tuesday. The lira appetite has also its limits however. Walking into FOMC decision, the adjustment in risky holdings will certainly keep the USD/BRL downside limited at 1.5840 (Mar 12/13th double bottom).

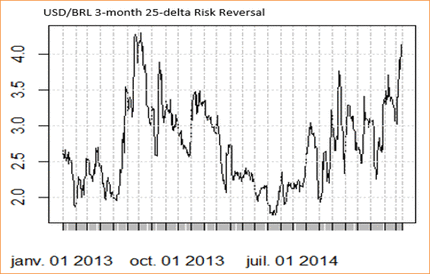

Significant rise in BRL put options

The Risk Today

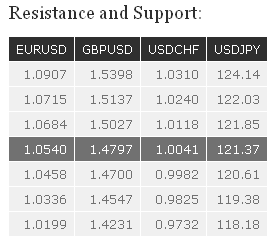

EUR/USD

EUR/USD continues its steep decline and is now challenging the 1.0500 psychological support. Hourly resistances can be found at 1.0684 (12/03/2015 high) and 1.0907 (09/03/2015 high). In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, any strength is likely to be temporary in nature. A key resistances stands at 1.1534 (03/02/2015 high). Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support).

GBPUSD

GBP/USD has broken the key supports area between 1.4952 (23/01/2015 low) and 1.4814. Hourly resistances can be found at 1.5027 (12/03/2015 high) and 1.5137 (09/03/2015 high). An hourly support lies at 1.4700 (13/03/2015 low). In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness. Strong supports stand at 1.4231 and 1.3503. A key resistance can be found at 1.5552.

USDJPY

USD/JPY is consolidating below the key resistance at 121.85 (see also the long-term declining channel). Hourly supports can be found at 120.61 (09/03/2015 low) and 119.38 (03/03/2015 low). A major resistance stands at 124.14. A long-term bullish bias is favoured as long as the key support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured.

USDCHF

USD/CHF is showing some signs of consolidation after its recent sharp rise. Hourly supports can be found at 0.9982 (12/03/2015 low) and 0.9825 (09/03/2015 low). A strong resistance stands at 1.0240. In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. A key support can now be found at 0.9374 (20/02/2015 low, see also the 200-day moving average).