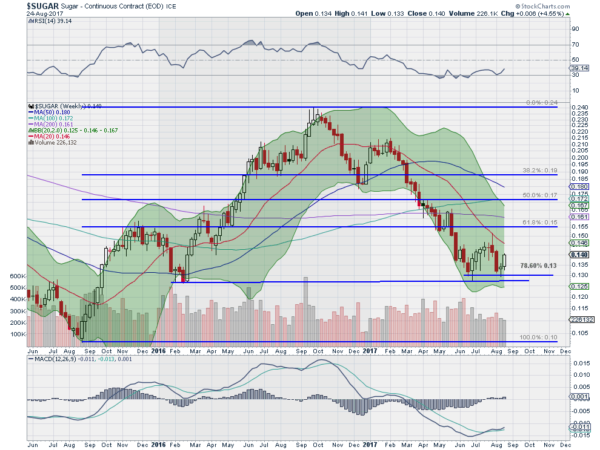

A spoonful of sugar helps the medicine go down…” Sugar has been going down, not the medicine. Since making a top in September last year sugar has pulled back for 12 months. This retraced 78.6% of the move higher that happened over the previous 12 months. Does sugar move in 12 month cycles? The sample size is small so it is difficult to make that leap. But the price action does set up for a reversal again now.

The chart below shows 3 key indicators to watch. The first is the Bollinger Bands®. They have flattened out on the bottom, giving support. A turn higher would be the first positive indicator. The RSI bottomed in May and June and is now trying to move back higher. A break to the upside through the mid line would be a second indicator.

The third is the MACD. It bottomed in June and is now crossing up. that in itself is a buy signal for many. All three moving in the right direction would be a big plus for sugar. But the most important indicator, price, needs to get over 14.7 to confirm a reversal out of a double bottom. That should also take it over the 20-week SMA, a marker that ended the last bull move when it crossed down in November 2016. Maybe it is time to try a spoonful of sugar again.