- United Airlines shares have lost more than 12% since the beginning of 2022

- Spike in jet fuel prices may curb Q1 profitability

- Despite the current volatility, long-term investors could consider buying UAL at current levels

Shares of domestic and international airline operator, United Airlines (NASDAQ:UAL), are down 12.4% so far this year and 37.3% in the last 12 months, having hit a multi-year high of $63 on Mar. 18, 2021. By comparison, the Dow Jones Airlines Index has lost 9.6% since January.

Along with other travel stocks, United Airlines shares suffered, especially in the early months of the coronavirus pandemic. With the vaccine rollout over a year ago, UAL stock has seen improving returns and a more positive business outlook.

However, the recent Russian invasion of Ukraine has led to a sudden increase in oil prices, rattling airline stocks once again. Jet fuel is the most important cost item for the industry, so in early March, the shares tumbled to a 52-week low of $30.54.

The airline released Q4 financials on Jan. 19. Total operating revenue was $8.2 billion, implying a decline of 25% from Q4 2019. While capacity was down 23%, total revenue per available seat mile (TRASM) dropped 3% during the quarter. The fuel price was approximately $2.41 per gallon. Adjusted net loss for Q4 and for the full year 2021 was $0.5 billion and $4.5 billion respectively.

On the results, CEO Scott Kirby commented:

"While Omicron is impacting near term demand, we remain optimistic about the spring and excited about the summer and beyond.”

Management also shared its outlook with the investment community saying that the airline started 2022 with a scaled-back schedule, reflecting the impact of the Omicron spike on demand, and as a result, full-year capacity will be down vs. 2019.

In Q1 2022, management forecasts total operating revenue to decline by 16-18% compared to Q1 2019. Meanwhile, the quarterly fuel price was estimated to be $2.51 per gallon, but these estimates were offered before the war in Eastern Europe.

Prior to the release of the quarterly results, United Airlines stock was around $45. But now, as we write, it is changing hands for $37.90. This means UAL shares have lost roughly 15% since the last reporting date.

What To Expect From United Airlines Stock

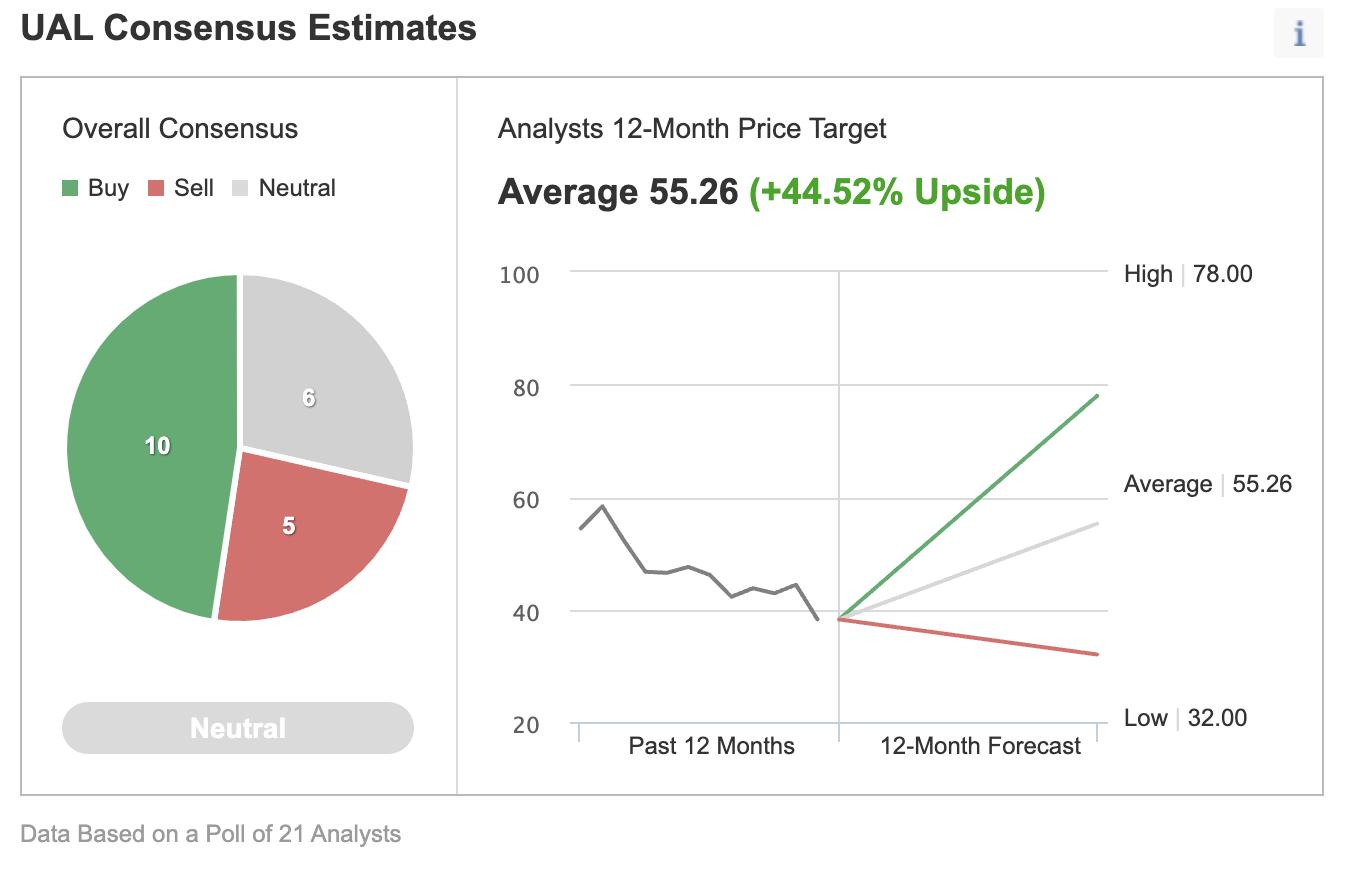

Among 21 analysts polled via Investing.com, UAL stock has a "neutral" rating.

Source: Investing.com

Wall Street also has a 12-month median price target of $55.26 for the stock, implying an increase of more than 44% from current levels. The 12-month price range currently stands between $32 and $78.

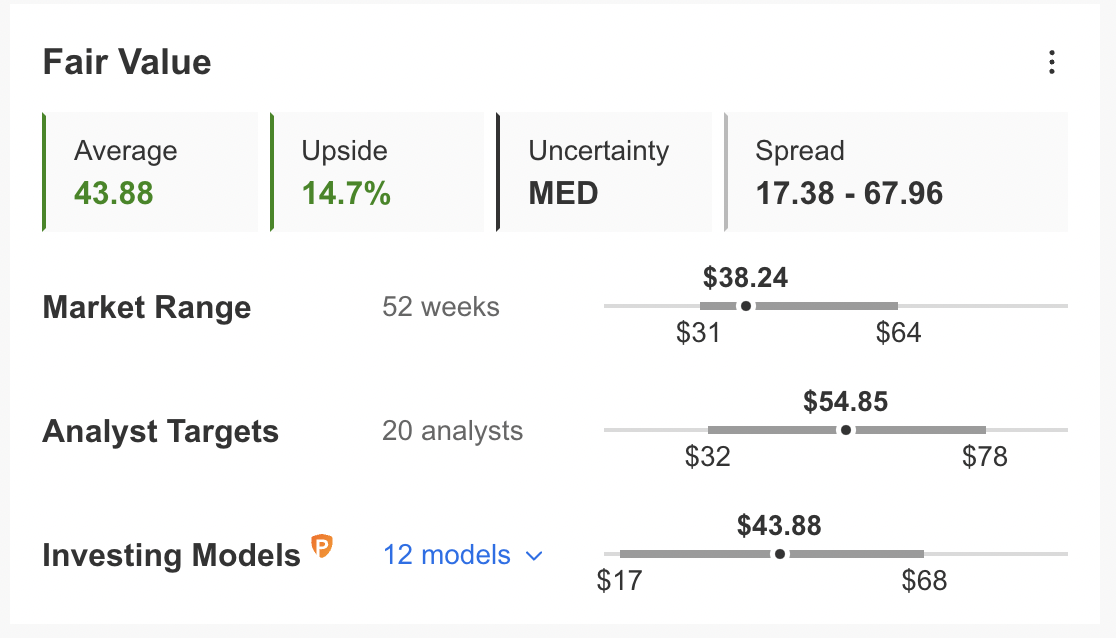

Meanwhile, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for UAL stock stands at $43.88.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase by about 15%.

Our expectation is for UAL stock to build a base between $35 and $40 in the coming weeks. Afterwards, shares could potentially start a new leg up.

United Airlines bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $43.88, as suggested by valuation models.

Finally, investors who expect UAL stock to bounce back in the weeks ahead could consider setting up a covered call.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on UAL stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Covered Call On UAL Stock

Intraday Price At Time Of Writing: $37.90

For every 100 shares held, the covered call strategy requires the trader to sell one call option with an expiration date at some time in the future.

As we write, UAL stock is at $37.90. Therefore, for this post, we'll use this price.

A stock option contract on UAL (or any other stock) is the option to buy (or sell) 100 shares.

Investors who believe there could be short-term profit-taking soon might use a slightly in-the-money (ITM) covered call. A call option is ITM if the market price (here, $37.90) is above the strike price ($37).

So, the investor would buy (or already own) 100 shares of UAL stock at $37.90 and, at the same time, sell a UAL May 20 $37-strike call option. This option is currently offered at a price (or premium) of $5.10.

An option buyer would have to pay $5.10 X 100 (or $510) in premium to the option seller. This call option will stop trading on Friday, May 20.

This premium amount belongs to the option writer (seller) no matter what happens in the future; for example, on the day of expiry.

The $37-strike offers more downside protection than an at-the-money (ATM) or out-of-the-money (OTM) call.

Assuming a trader would now enter this covered call trade at $37.90, at expiration, the maximum return would be $420, i.e., ($510-($37.90 - $37) X 100), excluding trading commissions and costs.

Risk/Reward Profile For Unmonitored Covered Call

An ITM covered call's maximum profit is equal to the extrinsic value of the short call option.

The intrinsic value of an option is the tangible value of the option if it were exercised now. Thus, the intrinsic value of our UAL call option is ($37.90-$37) X 100, or $90.

The extrinsic value of an option is the difference between the market price of an option (or the premium) and its intrinsic price. In this case, the extrinsic value would be $420, i.e., ($510 – $90). Extrinsic value is also known as time value.

The trader realizes this gain of $420 as long as the price of United stock at expiry remains above the strike price of the call option (i.e., $37).

At expiration, this trade would break even at the UAL stock price of $32.80 (i.e., $37-$4.20), excluding trading commissions and costs.

Another way to think of this break-even price is to subtract the call option premium ($5.10) from the price of the underlying United stock when we initiated the covered call (i.e., $37.90).

On May 20, if UAL stock closes below $32.80, the trade would start losing money within this covered call set-up. Therefore, by selling this covered call, the investor has some protection against a potential loss. In theory, a stock's price could drop to $0.

What If UAL Stock Reaches New All-Time High?

As we have noted previously, such a covered call would limit the upside profit potential. The risk of not participating in UAL stock's potential appreciation fully would not appeal to everyone. However, within their risk/return profiles, others might find that acceptable in exchange for the premium received.

For example, if UAL stock were to reach a new high for 2022 and close at $64 on May 20, the trader's maximum return would still be $420. In such a case, the option would be deep ITM and would likely be exercised. There might also be brokerage fees if the stock is called away.

As part of the exit strategy, the trader might also consider rolling this deep ITM call option. In that case, the trader would buy back the $37 call before expiry on May 20.

Depending on her/his views and objectives regarding the underlying UAL stock, s/he could consider initiating another covered call position. In other words, the trader could possibly roll out to a May 20 expiry call with an appropriate strike.

Bottom Line

The exact market timing of the next step for UAL shares is difficult to determine, even for professional traders. But options strategies provide tools that might prepare for sideways moves or even drops in price.

We regard covered call options as a potential way to earn additional income from your stock portfolio. Such a strategy also helps lower portfolio volatility. Interested investors might consider increasing their knowledge base.