This could be a critical day for most of the emerging market currencies against the . , , and are a few cross rates worth mentioning in this update.

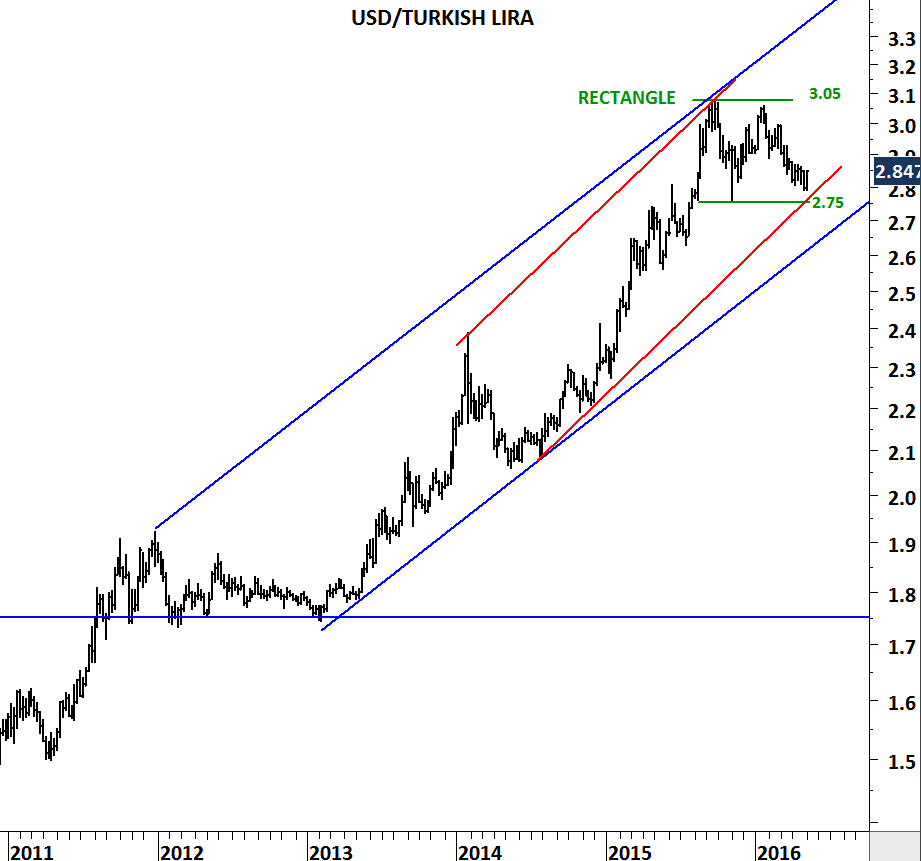

USD/TRY is possibly completing a rectangle chart pattern. The lower boundary of the year-long consolidation formed support between 2.75 and 2.80. A strong weekly close around 2.85 and above will likely reverse the last couple of months' strong-TRY trend and result in an upward move towards 3.05 levels.

|

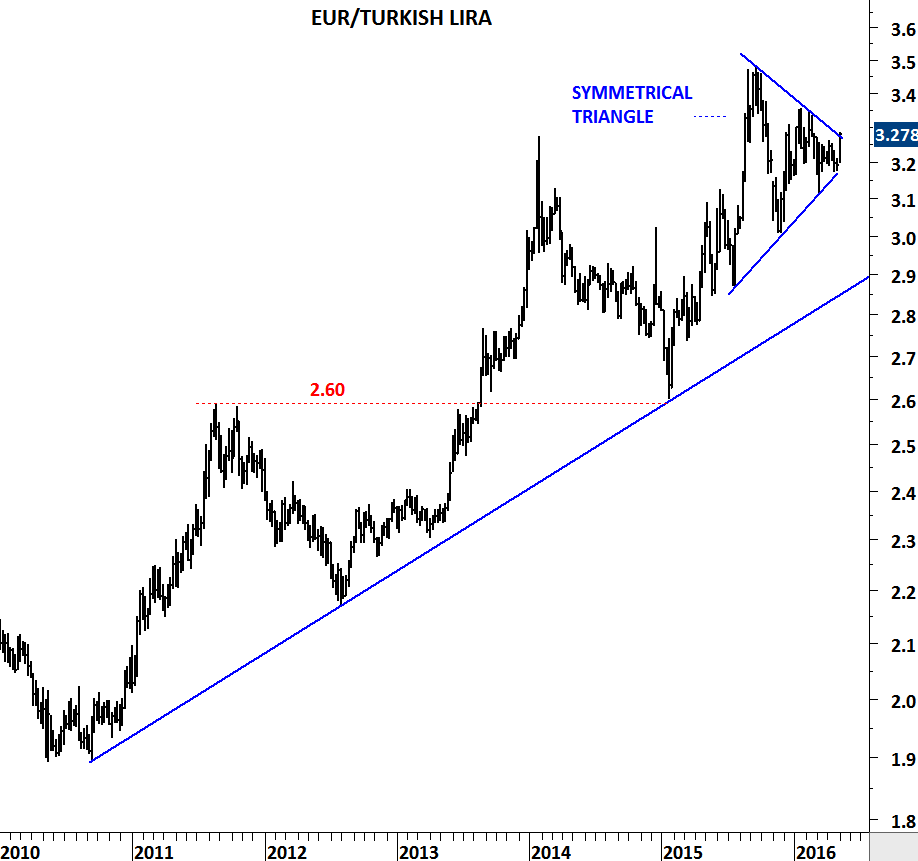

EUR/TRY is possibly completing a symmetrical triangle. Low volatility on the weekly scale suggests a strong trend period for the coming months. Again, a decisive breakout on weekly scale is required to confirm the completion of 7-month-long sideways consolidation. A weekly close above 3.30 levels will breach the resistance with enough margin.

|

|

|

Monthly scale price chart of USD/ZAR shows the importance of 13.80-14.15 area. 13.80 was the historical high that was broken on the upside. 14.15 is the 1-year-long moving average that acted as strong support since the uptrend on USD/ZAR began in 2011. Unless we see a decisive break below 13.80-14.15 area, USD should continue to gain strength against the rand.

|

|

|

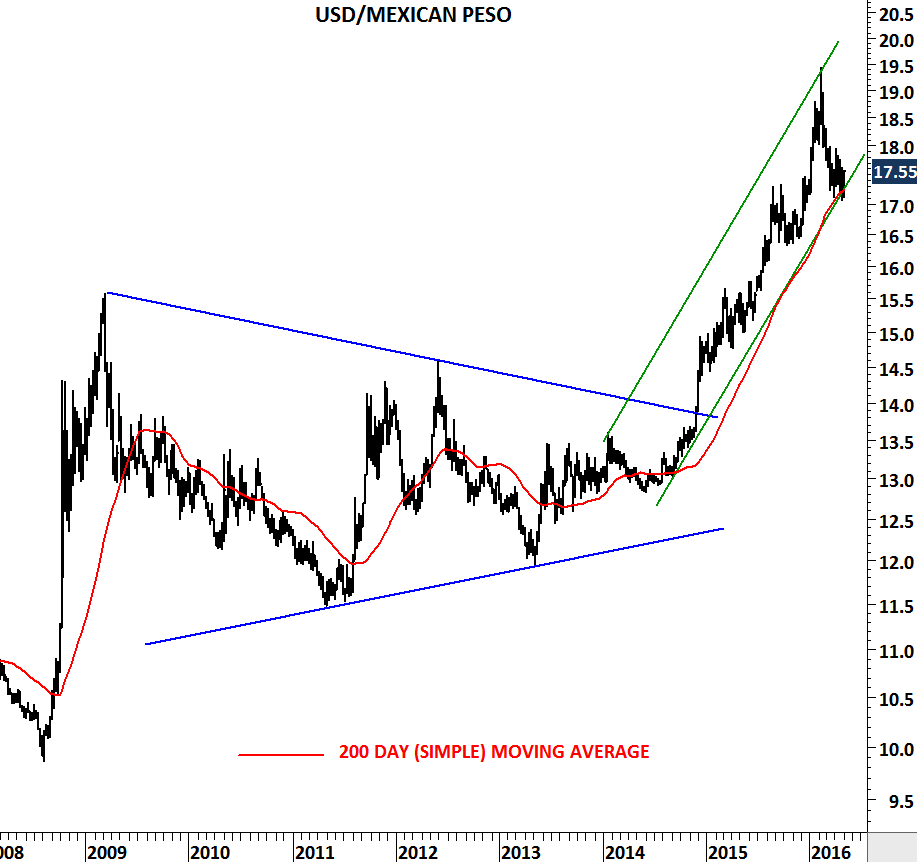

USD/MXN is another emerging market currency that found support at the 200 day moving average. 17 level was not only the long-term average but also the lower boundary of the possible 2 year-long trend channel. If USD/MXN is reversing from these levels, cross rate should rebound towards 19.5 levels in the following weeks.

|

|