Investing.com’s stocks of the week

After the epic flop of the Mayweather-Pacquiao fight in 2015, I have become increasingly suspicious of any big-name events being able to live up to the hype. While I am cautiously optimistic this weekend’s Trump-Xi meeting at the G20 will have some meaningful market impact, it seems just as likely to disappoint than to pleasantly surprise. Neither side seems willing to back down, but we have heard the right things from both US and China about wanting to make a deal. The question is, can both sides find a way to make small concessions while also saving face with their citizens? Pain is being felt around the world with stocks reeling, global sentiment turning sour, and even the Fed possibly rethinking their rate hike pace for 2019. The market will be looking for some sort of hint as to a possible resolution on this trade war, but it is unlikely to deliver a deal this weekend. Progress from Friday and Saturday’s meeting would be positive for overall market sentiment going in to the new year which could have negative implications for the Dollar, Yen, and Swiss Franc. The countdown is on.

Speaking of trade disputes, that new NAFTA/USMCA deal still has not been officially signed yet. Trump, Trudeau, and Nieto are set to have that done at the G20, but Canada and Mexico are hopeful that the US will also drop their steel and aluminum tariffs that the US imposed. Rumour has it that the US is looking to impose quotas in place of tariffs, rather than simply dropping the tariffs. Can’t imagine that will sit well with Canada or Mexico, and it will be interesting to see how this plays out come this weekend’s meeting. Any significant developments (positive or negative) will likely be felt on both USD/CAD and USD/MXN as the first December trading session kicks off in a week’s time. The Loonie is already under serious pressure from the freefall of Canadian Oil prices, so any negative news could see USD/CAD once again test 1.3300 and possibly towards the 2018 high of 1.3386. Canada GDP is out Friday, with 1.8% MoM and 3% Annualized being the numbers to watch. The Bank of Canada forecast 1.8% growth for Q3, so a significant miss could spell trouble for an already hurting Loonie.

Figure 1 - USD/CAD Daily (FX Global)

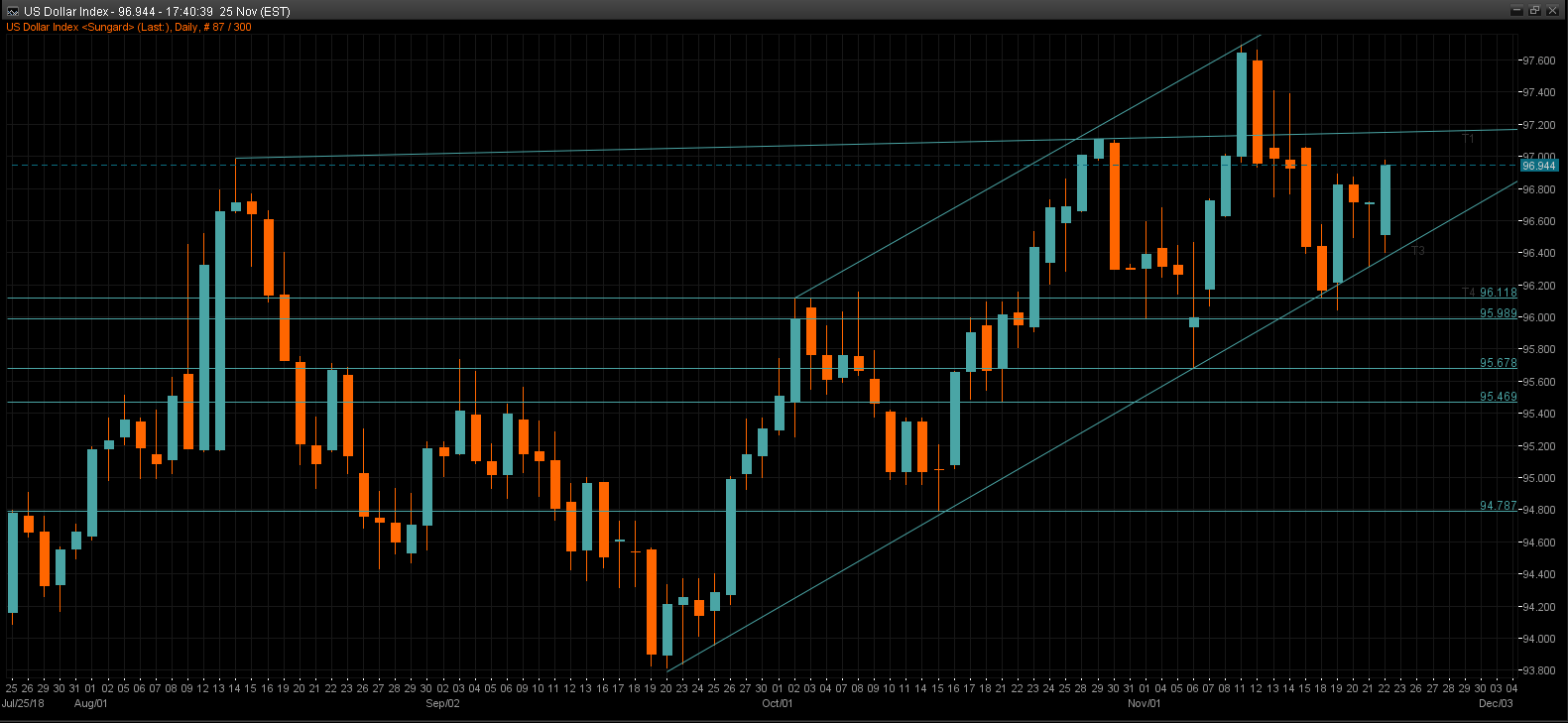

The G20 isn’t the only event in town this week. The market will also be getting a steady dose of the Fed, which suddenly seems to be turning a bit dovish. Several Fed members have struck a cautious tone as of late, but this week the market will get to hear from the one whose opinion has the most sway. Fed Chair Powell speaks at the Economic Club of New York on Wednesday, and any indication of the Fed slowing on its rate hikes would certainly be a big blow to the Dollar. Stocks, however, might get the jolt they need to end 2018 on a high note. Sandwiching Powell’s speech is Vice-Chair Clarida talking Fed data dependence on Tuesday, and FOMC minutes on Thursday. Sprinkle in US PCE, Q3 GDP, Housing Data, and Consumer Confidence, you can bet Dollar traders won’t be bored this week. DXY support held up remarkably well last week, but a few more tests may be in the cards as the week unfolds.

Figure 2 -DXY Daily (NetDania)

Finally, we end off with the ever-entertaining Brexit saga. The EU put its stamp of approval on the deal, but also warned that this is as good as it will get for the UK. If UK parliament rejects the deal, odds of a no-deal Brexit will skyrocket. If that is the case, the Pound will almost certainly implode. December 11 seems to be the date on the table for the UK Parliament vote, meaning the GBP volatility is expected to continue for the next few weeks. The early predictions point to the deal being rejected by Parliament, and that would probably mean Britain would be looking for a new PM soon after. The clock is ticking for Theresa May to sell this Brexit deal to the nay-sayers within her Conservative party, otherwise she will need a lot more help from the opposition to have any hope of pushing this through Parliament.