- Trump’s tariff strategy paying off.

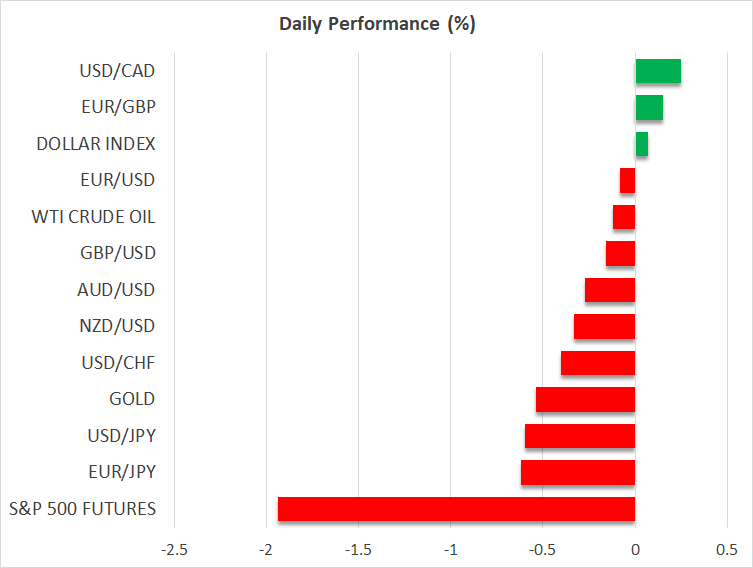

- Dollar rallies but equity indices take a tumble.

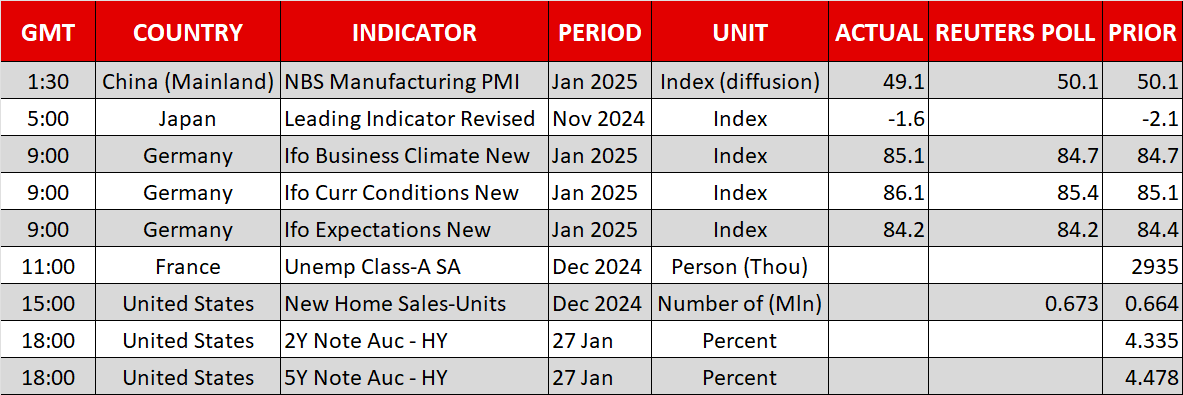

- The busy calendar this week as China celebrates New Year.

- Gold, oil and cryptos experience losses.

Trump’s Tariff Strategy Affects Risk Sentiment

A new week begins with the markets finding themselves jumping from the frying pan into the fire, as President Trump starts to implement his aggressive trade strategy. With reports indicating that he is pushing for the swift imposition of 25% tariffs on both Mexico and Canada on February 1, Colombia almost felt his wrath during the weekend after failing to accept the landing of deportation flights from the US.

The Colombian President quickly changed his stance, offering Trump an easy win, which feeds his belief in trade restrictions as a powerful tool to achieve his targets, potentially making him even more aggressive going forward. As a result, risk appetite took a significant hit, with Western equity indices opening the week in the red following a rather decent performance last week.

Developments on the AI front are also playing a key role, with the Chinese DeepSeek R1 model creating a serious challenge for its US-based AI rivals.

Trump could potentially take advantage of this development to further promote his recent announcement of a $500bn investment in AI and toughen his stance against China.

Dollar Rallies and Gold Suffers

Meanwhile, the US dollar has started the week on the right foot, somewhat reversing last week’s weak performance, especially against the EUR/USD, which benefited from the upside surprises recorded in the Eurozone PMIs. However, the most significant movements are taking place in gold and the cryptocurrency market.

After almost testing the $2,800 level, gold is retreating towards the $2,750 area. Profit-taking sounds reasonable after the strong rally, but the week-long Chinese holiday that will start on Tuesday, January 28 – potentially resulting in Chinese authorities’ absence from the gold market for at least a week - might be also impacting demand for the precious metal.

However, buyers might find this price dip attractive, and the same could also apply to the crypto market. Following a retest of the $110k level, Bitcoin has dropped aggressively below $100k, despite the lack of any meaningful newsflow. Technically, a potential double top is forming, but a move below $91.5k is needed to validate this bearish structure.

Busy Schedule This Week

Amidst these market changes, and with Trump being the most significant risk-dampening factor, this week’s calendar is very busy. Market volatility is expected to remain elevated, as the BoC, ECB and Fed will publish their rate-setting decisions, while Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META), Tesla (NASDAQ:TSLA) and Apple (NASDAQ:AAPL) will report their Q4 earnings.

While both the ECB and the BoC are expected to announce another 25bps rate cut, the focus will be on the Fed and, specifically, on Chairman Powell’s press conference. A balanced rhetoric could pour cold water on rate cut expectations, with the market pricing in the first 25bps cut in June, potentially drawing the ire of President Trump, who is a proponent of lower rates as stated at last week’s WEF in Davos.

Oil Is Under the Weather Again

With the Russian side keeping the door open to a Trump-Putin meeting soon to “solve” the Ukrainian crisis, Trump spoke with Saudi Arabia’s Crown Prince about lower oil prices going forward. As a result, oil prices continued to weaken, dropping below a key 200-day simple moving average. The outlook remains mostly clouded for oil, especially as the latest Chinese Manufacturing PMI survey unexpectedly dipped below 50 again.